As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, McDonald’s Corp (MCD).

Profile

McDonald’s is the largest restaurant owner-operator in the world, with 2023 system sales of $130 billion across nearly than 42,000 stores and 115 markets. McDonald’s pioneered the franchise model, building its footprint through partnerships with independent restaurant franchisees and master franchise partners around the globe. The firm earns roughly 60% of its revenue from franchise royalty fees and lease payments, with most of the remainder coming from company-operated stores across its three core segments: the United States, internationally operated markets, and international developmental/licensed markets.

Recent Performance

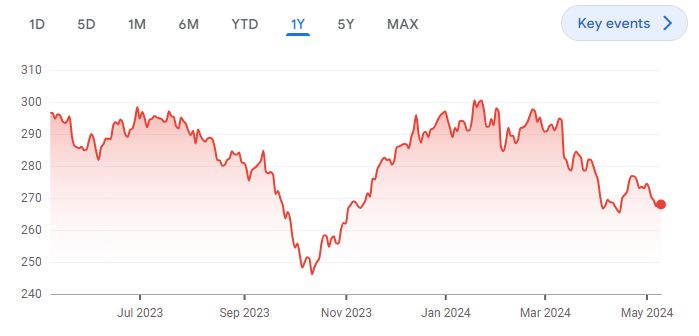

Over the past twelve months the share price is down 9.68%.

Source: Google Finance

Inputs

- Discount Rate: 7%

- Terminal Growth Rate: 2%

- WACC: 7%

Forecasted Free Cash Flows (FCFs)

| Year | FCF (billions) | PV(billions) |

| 2024 | 7.2 | 6.73 |

| 2025 | 7.6 | 6.64 |

| 2026 | 8.01 | 6.54 |

| 2027 | 8.45 | 6.45 |

| 2028 | 8.91 | 6.35 |

Terminal Value

Terminal Value = FCF * (1 + g) / (r – g) = 181.76 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 129.60 billion

Present Value of Free Cash Flows

Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 32.70 billion

Enterprise Value

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 162.30 billion

Net Debt

Net Debt = Total Debt – Total Cash = 48.51 billion

Equity Value

Equity Value = Enterprise Value – Net Debt = 113.79 billion

Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $157.82

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $157.82 | $267.95 | -69.78% |

Based on the DCF valuation, the stock is overvalued. The DCF value of $157.82 share is lower than the current market price of $267.95. The Margin of Safety is -69.78%

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: