This week’s best investing news:

Greenlight Capital’s David Einhorn shares investment ideas at the Sohn Conference (CNBC)

Cliff Asness – Cognitive Dissonance (AQR)

Lessons from Danny Kahneman | Investing in Practice Rather Than Theory (Validea)

Market Share & Profitability (Verdad)

Guy Spier – How to Build Enduring Wealth (RWH)

Fiat Money Inflation in the United States (Rudy Havenstein)

Point72’s Steve Cohen: Owning the Mets & Betting on AI (CNBC)

Smart Words From Smart People (Collab Fund)

Aswath Damodaran The Seven Samurai: How Big Tech Rescued the Market in 2023! (AD)

Fox in the Henhouse (Humble Dollar)

Ed Yardeni Critiques Artificial Intelligence, Economists & The Bull Market (WealthTrack)

How Little We Know (Safal)

Long Live Chart Art….and Is Fundamental Analysis Dead? (HL)

Everything is Obvious (Behavioural Investment)

Jeremy Siegel – Stock Market Bull Run Isn’t Over (Bloomberg)

‘Extrapolating The Unsustainable’ (Felder)

Better investors make fewer decisions (AR)

Transcript: Angus Deaton (MiB)

Where International Diversification Works—And Where It Falls Short (Morningstar)

How to stay calm in a bear market (Rad)

Jensen Investment Management Summit Series: Quality Companies (Jensen)

This week’s best value Investing news:

The Case for Value Investing with Tobias Carlisle (Excess Returns)

Value Stocks Are Down but Not Out. Get Ready for a Comeback (Barron’s)

Benjamin Graham: Quantifying The Father of Value Investing (Validea)

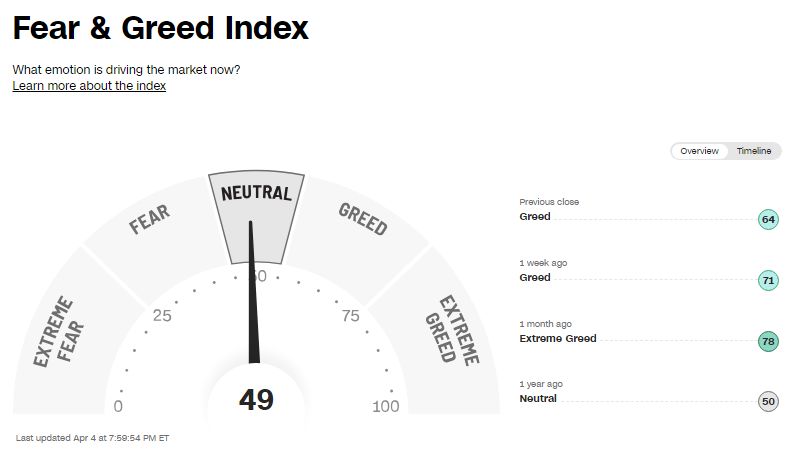

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP620: The Intelligent Investor by Benjamin Graham (TIP)

#191 Dr. Rhonda Patrick: Diet Essentials For Healthy Living (KP)

E2 Barry Norris explains why offshore wind economics are unsustainable (Stephen Clapham)

Breeding Grounds – Carnegie Corporation of New York (EP.377) (Capital Allocators)

A Truth Social conspiracy, Pimp my Portfolio & the business of Champagne (Equity Mates)

Ep 440. Surviving the Test of Time: Why Some Companies Fail and Others Live Forever (FC)

Robin Dunbar – Optimizing Human Connection (Dunbar’s Number) (ILTB)

461- Buffett’s Bertie (InvestED)

But We Are Long-Term Investors (MicroCapClub)

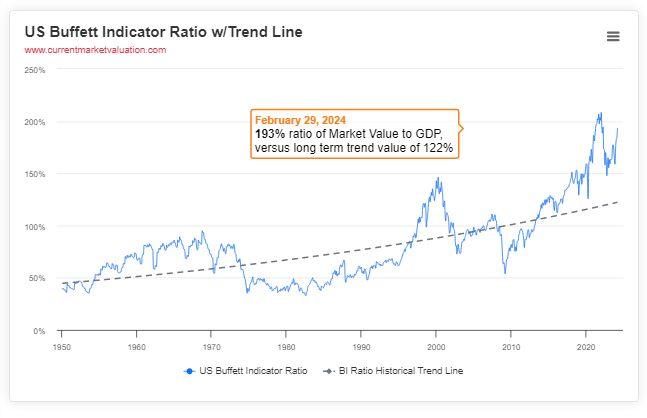

This week’s Buffett Indicator:

Overvalued

This week’s best investing research:

Tail Hedging Is Not As Easy As You Think (AlphaArchitect)

You See? This is NOT 2023’s Bull Market (ASC)

Don’t Bank on the Equity Risk Premium (CFA)

This week’s best investing tweet:

US small-caps suffer worst run against larger stocks in over 20 years.

“The only other time you’ve seen relative multiples this cheap was during 1999 and 2000, and that ended up being a great decade for small-caps,”https://t.co/gDK8S7Kspc

— Stocks & Stones (@Stocks_Stones) March 27, 2024

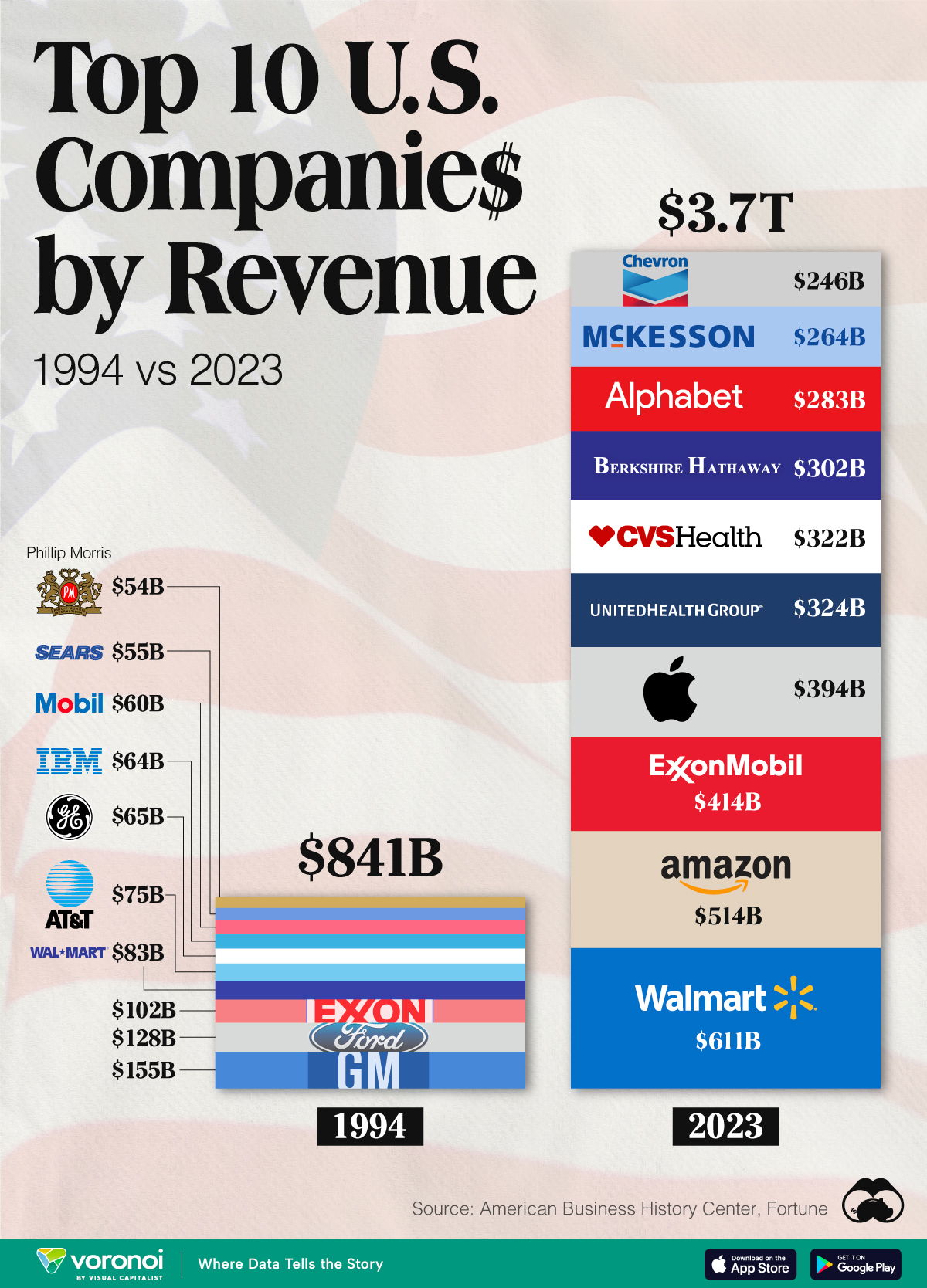

This week’s best investing graphic:

America’s Top Companies by Revenue (1994 vs. 2023) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: