This week’s best investing news:

Fundsmith 2024 Annual Shareholders’ Meeting (Fundsmith)

Jeremy Grantham – Sustainability Or Bust: The Sheer Impossibility Of Eternal Compound Growth (GMO)

Guy Spier – Survive and Thrive – Part 1 (RWH)

2023 Private Equity Fundamentals (Verdad)

A memorial for Charlie Munger (diocesela)

Top 10 Things to Know About Building a Diversified Portfolio (Morningstar)

The Great Taking (Rudy Havenstein)

15 Thoughts on Berkshire Hathaway’s 2024 Proxy Statement (Kingswell)

Bitcoin Endgames & The New Hyper-Agents (Ep Theory)

Forecasting is Hard and We Are Not Very Good At It. What Should Investors Do? (BI)

Nothing Odd (Humble Dollar)

Nelson Peltz Fights Disney—and Turmoil at His Own Fund (WSJ)

Embracing Pain in Life and Investing (Safal)

The Art of the Well Made Introduction (Collab Fund)

Double Jeopardy! (Felder)

Profiling A ‘Real Assets’ Portfolio During The Recent Inflation Surge (TCS)

Retirement Planning in your 20s, 30s and 40s (Wealth of Common Sense)

David Katz on the Fed, markets, Cisco, Starbucks, PNC Bank (Bloomberg)

Hey ChatGPT, Why Isn’t My AI Fund Up Like Nvidia? (WSJ)

Transcript: Mark Wiedman, Blackrock’s Head of Global Client Business (MiB)

Conviction & Quality (greenlealane)

Unpopular Opinion: Diversified Portfolio > Concentrated Portfolio (VIS)

Jonathan Tepper – Buying Monopolies at Prevatt Capital (Capital Allocators)

Graham’s “Unpopular Large Caps” Part 2: Thoughts on Diversification (Base Hit)

First Eagle Investments: March Views from First Eagle Global Value Team (FEIM)

Giverny Capital Annual Letter 2023 (Giverny)

RV Capital podcast: 2023 Letter to Co-Investors (RV)

This week’s best value Investing news:

There Are Pockets of Value to Find in This Market, Experts Say (Bloomberg)

Value Investment: How it is different from Growth Investment ? (LinkedIn)

The definitive guide to finding “relative value” in a noisy market (LiveWire)

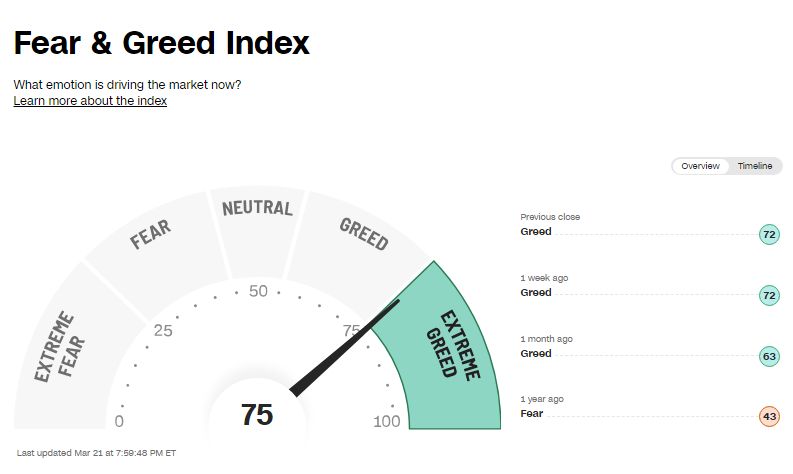

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP616: The Godfather of Influence w/ Dr. Robert Cialdini (TIP)

RWH043: Survive & Thrive w/ Guy Spier: Part 2 (RWH)

The Archive: You Bet! (Howard Marks)

#32 The “Do-Gooder” (Stephen Clapham)

Expert: Kerry Craig – Portfolio construction and beating home country bias (Equity Mates)

The AI Bubble Thesis with Doug Clinton (Excess Returns)

Episode #525: Grant Williams & Peter Atwater: The Market is ‘Long Abstraction, Short Reality’ (Meb Faber)

Dave Fontenot – The Monastery of Code (Invest Like The Best)

For the Love of Speculation with Fadi Diab (Planet MicroCap)

Self-Made Millionaire Tori Dunlap Embraces Mission to Make Women Rich (Morningstar)

#419 – Sam Altman: OpenAI, GPT-5, Sora, Board Saga, Elon Musk, Ilya, Power & AGI (Lex Fridman)

Alex Komoroske — Complex Adaptivity All The Way Down (EP. 208) (Infinite Loops)

Brad Jacobs: Building a Business Empire [The Knowledge Project Ep. #190]

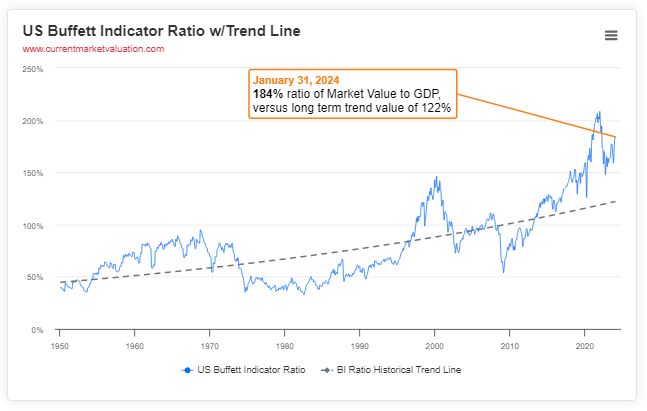

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Short Campaigns by Hedge Funds (AlphaArchitect)

How I Use Trailing Stops (ASC)

Actively Managed Credit Strategies Can Meet Impact Goals, Alpha Targets (CFA)

The Dimensions of Volatility (AllAboutAlpha)

This week’s best investing tweet:

Loved joining @Greenbackd & @farnamjake1. We geek out on math of how a biz with zero earnigns growth trading at a P/E of 6 can buy back 17% of the shares annually and grow EPS by 20%. Also discuss complexity theory, FCF yields & value investing philosophyhttps://t.co/dOZUbrR6E6

— John Rotonti Jr (@JRogrow) March 21, 2024

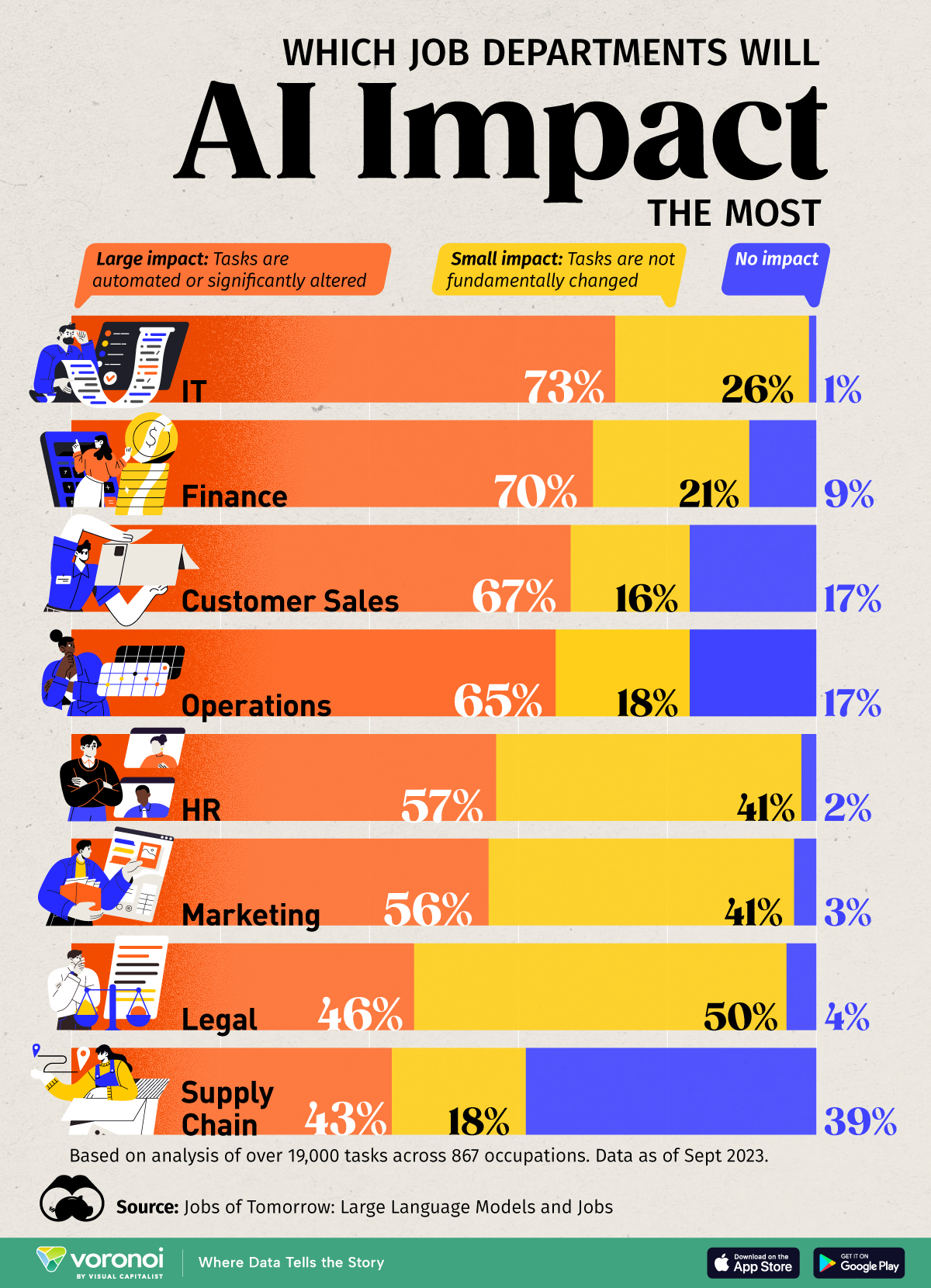

This week’s best investing graphic:

Charted: The Jobs Most Impacted by AI (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: