This week’s best investing news:

Berkshire Hathaway 2023 Annual Report (BH)

Tom Gayner 2023 Annual Shareholder Letter (Markel)

Breaking the Ice: Frederic Tudor’s Frozen Empire (Jamie Catherwood)

Guy Spier: Minimizing Investment Risks: Ethics, Inflation, Debt, Market Trends & Geopolitics (GS)

Rule, Britannia! (Verdad)

Michael Mauboussin on increasing returns to scale (FT)

Aswath Damodaran; Session 8 (Val MBAS): More on cash flows (AD)

Buffett and Three Hedge Funds (Roger Lowenstein)

Ariel’s Charlie Bobrinskoy: Markets not focused enough on China’s economic problems (CNBC)

Real-Time Narrative Shifts (Ep Theory)

Jamie Dimon on state of the US economy, commercial real estate risks and AI hype (CNBC)

Keeping It Simple (Humble Dollar)

Transcript: Andrew Slimmon, Morgan Stanley Investment Management (MiB)

Buffett admits Berkshire’s days of ‘eye-popping’ gains are over (AFR)

Corporate Ozempic (No Mercy)

Would You Wear An Ostrich Feather Hat? (Contessa)

My Notes on Warren Buffett’s 2023 Letter to Shareholders (Safal)

Has the Rise of Passive Funds Really Broken Markets? (BI)

Nvidia Puts The Entire Stock Market On Its Back (Felder)

Magnificent Seven vs. the ‘Granolas’: How Does Europe’s Version Stack Up? (Morningstar)

A Few Thoughts on Spending Money (CF)

7 Timeless Investing Ideas from Bernard Baruch (dariusforoux)

Are Markets Broken? (SA)

If You Don’t Know What Game You’re Playing, You’ve Already Lost (Speedwell)

The problem is prices (Rudy Havenstein)

Semper Augustus 2023 Annual Letter (SA)

This week’s best value Investing news:

Miller Value Partners: Why is Value compelling right now? (Miller)

At the Money: Woke Investing vs. Values-Based Investing (Big Picture)

9 key investing lessons you can learn from the great Shelby Davis (Mint)

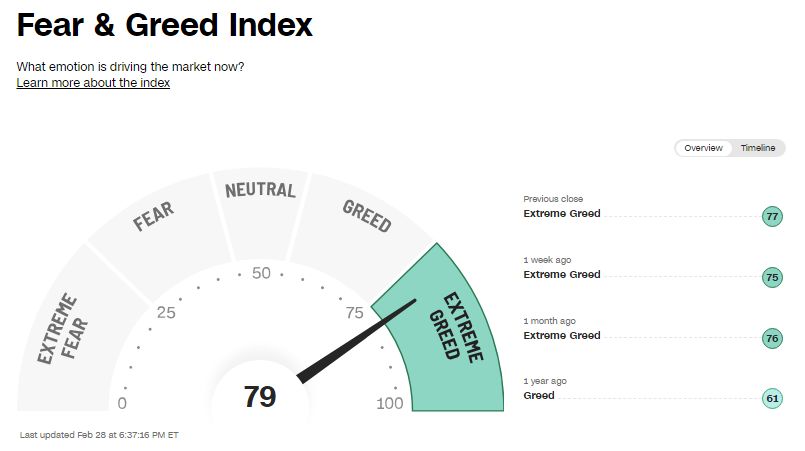

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP610: Mastermind Q1, 2024 w/ Tobias Carlisle and Hari Ramachandra (TIP)

Ali Hamed – Building an Investment Firm (ILTB)

Corey Hoffstein – Get Stacked! (Business Brew)

How to Get the Most Out of Your Bond Investments (Morningstar)

You Have Time (Ian Cassel)

Michael Milken – Innovations in Finance, Medicine, and Education (EP.371) (Capital Allocators)

Show Us Your Portfolio: Bob Elliott (Excess Returns)

Ep 434. Snap Judgments from Listeners and Analysis of AMR’s Extraordinary Returns (FC)

Jacqueline Novogratz – Manifesto for a Moral Revolution (Infinite Loops)

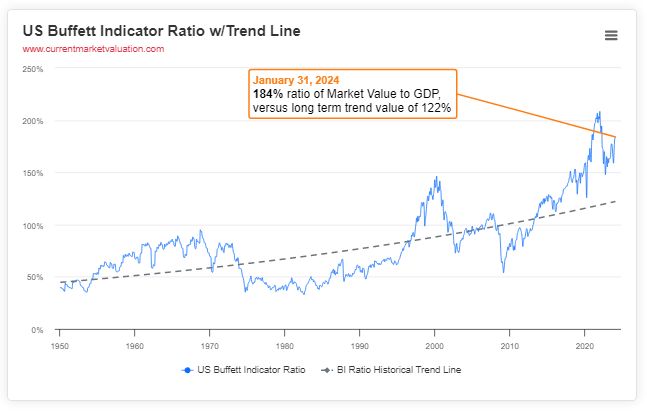

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Financial Literacy and Financial Resilience: Evidence from Italy (Alpha Architect)

There Are No New Lows (ASC)

Book Review: Markets in Chaos (CFA)

The power of the big 10 market cap names – over 30% (DSGMV)

This week’s best investing tweet:

If one third of small public companies are not able to make money during good times, how are they supposed to survive next recession, whenever it may come? pic.twitter.com/JbdgVnqFIY

— Michael A. Arouet (@MichaelAArouet) February 28, 2024

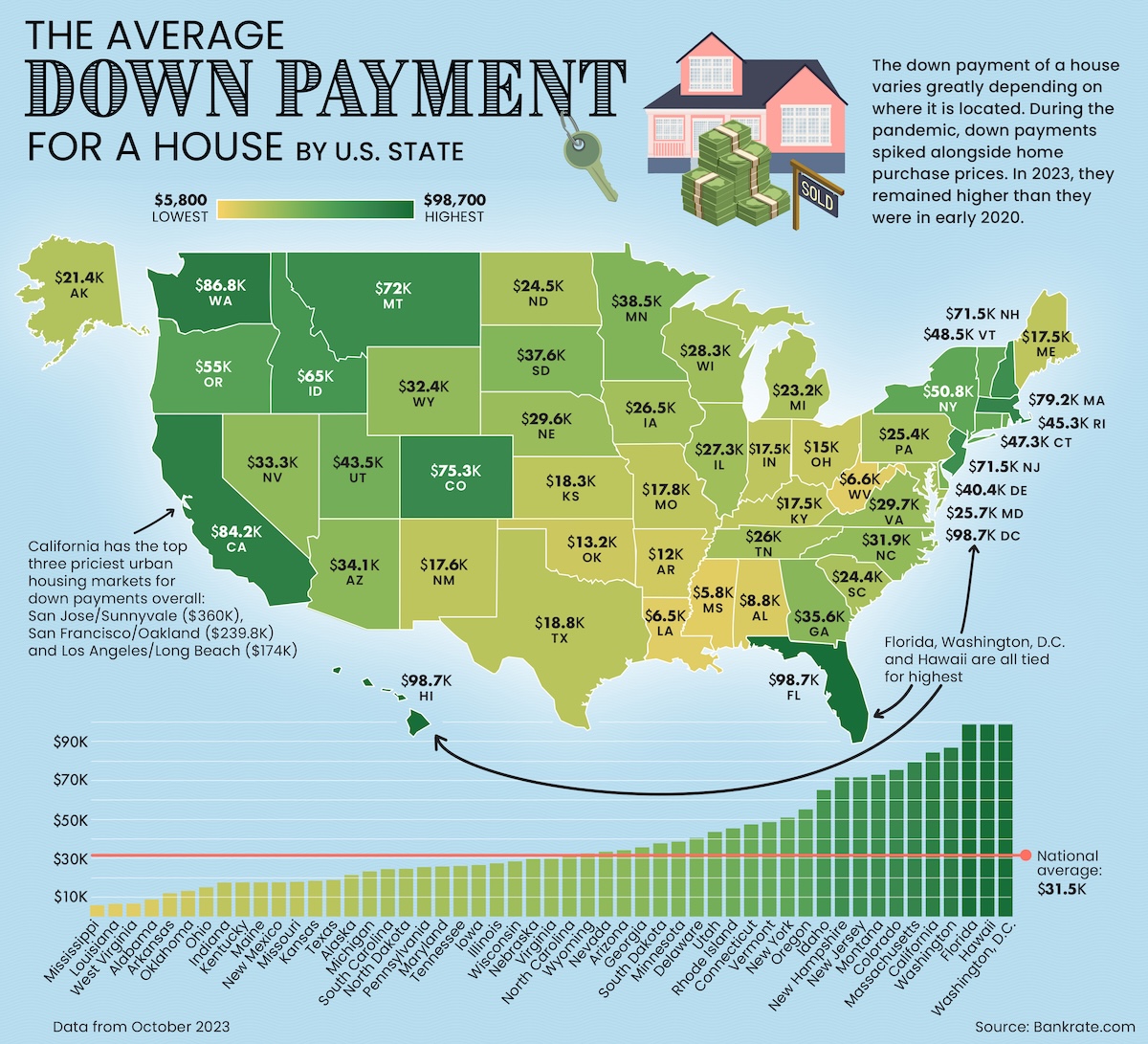

This week’s best investing graphic:

Mapped: The Median Down Payment for a House, by U.S. State (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: