This week’s best investing news:

Interview with Oakmark’s Bill Nygren (MF)

Valuing Japan’s Reform (Verdad)

OakTree – The Goldilocks Trap (OakTree)

Fact or Fiction: Limitations of the 60-40, Dave Ramsey’s 8% Rule, Factor Investing, AI and More (Validea)

An interview with Brian Bares (VIW)

Jamie Dimon says Washington faces a global market ‘rebellion’ over record U.S. debt: ‘It is a cliff… (Fortune)

Michael Mauboussin – How to Take the Emotion Out of Investing (MS)

Tim Ferris – Millions of Profitable Niches – 1,000 True Fans 2.0? (Tim Ferris)

A Young Investor’s Guide to Navigating the Stock Market Wilderness (Safal)

Data Update 4 for 2024: Danger and Opportunity – Bringing Risk into the Equation! (Aswath Damodaran)

Quitting Time (Scott Galloway)

Big Tech’s AI Hype Machine (Felder)

What I Learned When I Stopped Watching the Stock Market (Jason Zweig)

A little perspective… (Rudy Havenstein)

Transcript: Sarah Kirshbaum Levy, CEO Betterment (Big Picture)

Under the Hammer (Investment Talk)

How to Build a Portfolio You Don’t Have to Babysit (Morningstar)

The Thin Line (Collab Fund)

Fairholme Annual Report 2023 – (Fairholme)

From COW to KARS (Humble Dollar)

First Eagle’s Matthew McLennan discusses the key concerns and opportunities in the financial markets (WealthTrack)

Jeremy Siegel discusses the markets and the Fed (CNBC)

Third Avenue Value Fund Q4 2023 Commentary (TA)

Pzena Q4 2023 Commentary (Pzena)

Weitz Large Cap Equity Fund Q4 2023 Commentary (Weitz)

Dorsey Asset Management: Competitive Advantage & Capital Allocation (Dorsey)

Dodge & Cox Q4 2023 Market Commentary (DC)

This week’s best value Investing news:

Jeff Gramm – Value Investing’s Renaissance Man (Raging Capital)

Paradigm Shifts in Value Investing (Yahoo)

Brighter days ahead for Value stocks, says Allan Gray (LiveWire)

Underpriced Stocks in the Small Value Corner (Forbes)

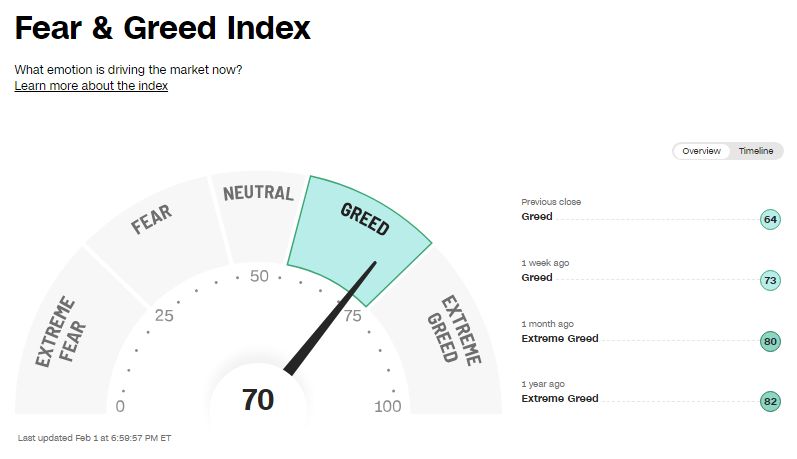

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Alex Telford – Unlocking Innovation in Pharma (ILTB)

Episode 290 – Morgan Housel: Same as Ever (Rational Reminder)

TIP603: Richer, Wiser, Happier, Q1 2024 w/ Stig Brodersen & William Green (TIP)

Raphael Arndt – The Death of Traditional Portfolio Construction (Capital Allocators)

Investing with Discipline: Seeking Opportunities in Challenging Markets (WealthTrack)

Challenging the Foundation of Asset Pricing Theory with Andrew Chen and Alejandro Lopez-Lira (Excess Returns)

Jim O’Shaughnessy — Turning the Tables (EP. 200) (Infinite Loops)

Peter Pham: Inversion Investing (Value Hive)

455- Weather Matrix Part 2 (InvestED)

Unwinding the Oil and Gas Negativity with Josh Young (Planet MicroCap)

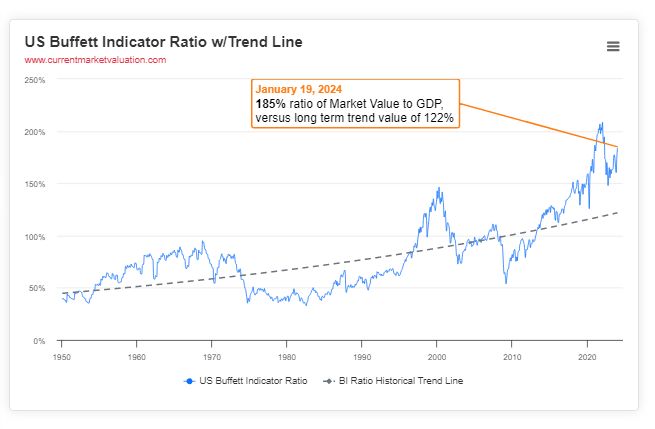

This week’s Buffett Indicator:

Overvalued

This week’s best investing research:

The Smart Money Can Buy Stocks, but They Can’t Sell Them (AlphaArchitect)

Buyers Lift the Offer for Bonds (AllStarCharts)

Bad Ideas: Why Active Equity Funds Invest in Them and Five Ways to Avoid Them (CFA)

Skill and lucky – You usually need more luck (DSGMV)

What Is the Volatility Risk Premium? (AllAboutAlpha)

This week’s best investing tweet:

The Tokyo Stock Exchange has all public companies trading at less than 1x P/B to publish a plan to raise their valuations. 44% of all Japanese cos trade at < book. But if all companies were instantly to trade to 1, it would have limited impact on the largest Japanese ETFs. pic.twitter.com/zSJLDMaMyr

— Dan Rasmussen (@verdadcap) January 29, 2024

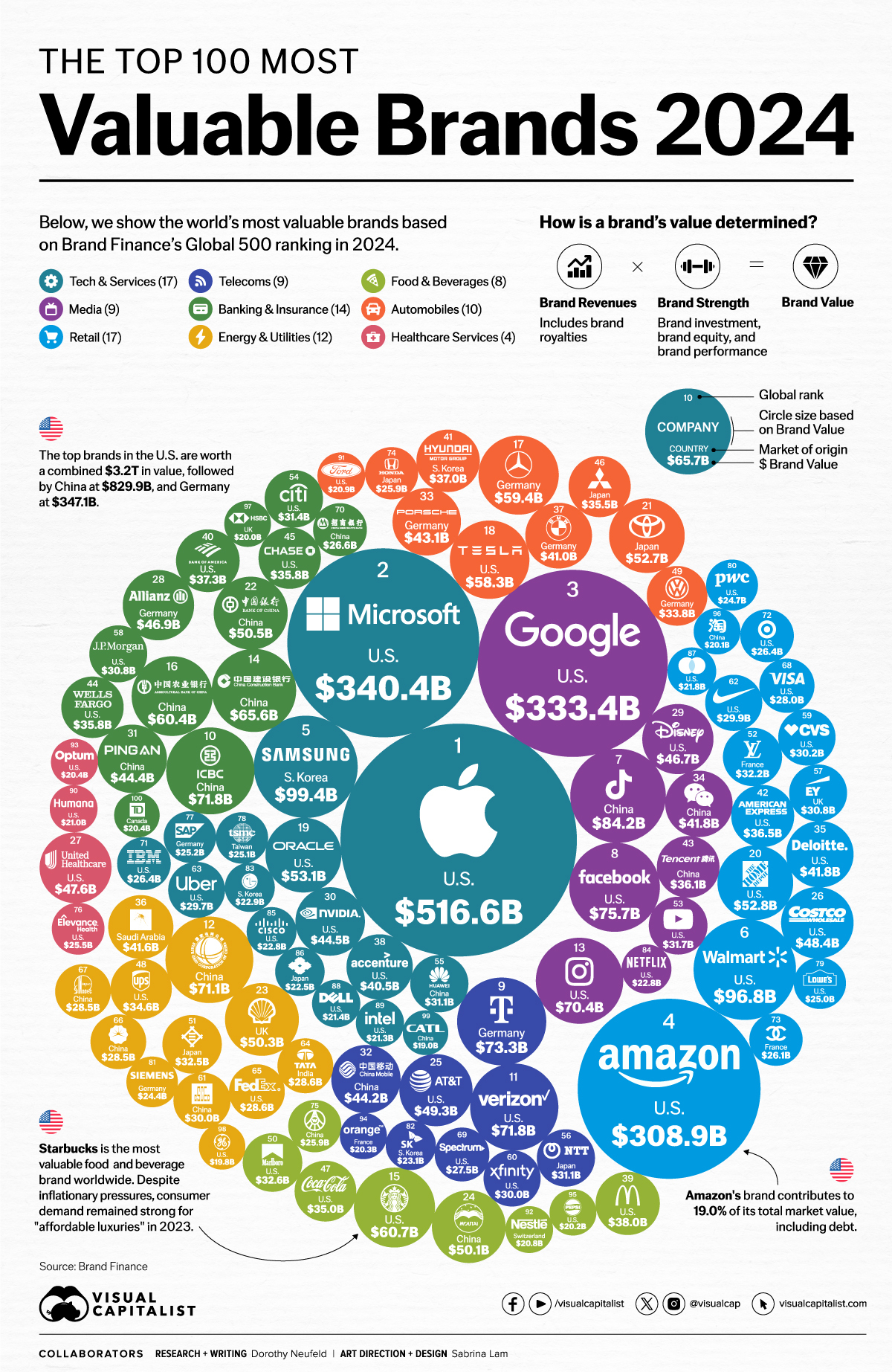

This week’s best investing graphic:

The Top 100 Most Valuable Brands in 2024 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: