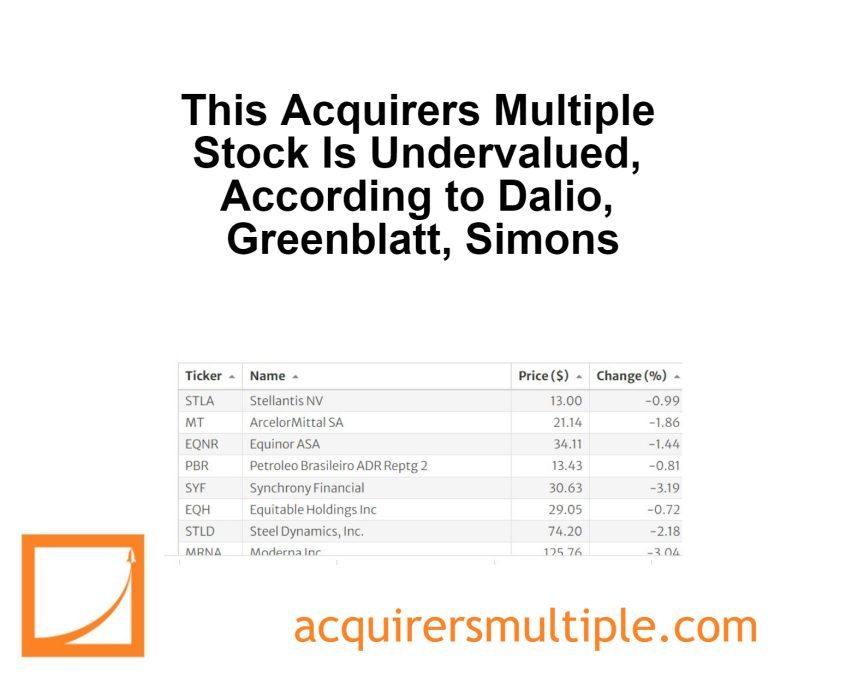

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks. The top investor data is provided from their latest 13F’s. This week we’ll take a look at:

AT&T Inc (T)

The wireless business contributes about two thirds of AT&T’s revenue following the spinoff of Warner Media. The firm is the third-largest U.S. wireless carrier, connecting 71 million postpaid and 17 million prepaid phone customers. Fixed-line enterprise services, which account for about 17% of revenue, include internet access, private networking, security, voice, and wholesale network capacity. Residential fixed-line services, about 11% of revenue, primarily consist of broadband internet access. AT&T also has a sizable presence in Mexico, serving 22 million customers, but this business only accounts for 3% of revenue. The firm still holds a 70% equity stake in satellite television provider DirecTV but does not consolidate this business in its financial statements.

A quick look at the price chart below shows us that the stock is down 12.28% in the past twelve months. We currently have the stock trading on an Acquirer’s Multiple of 11.80 which means that it remains undervalued.

(Shares)

Ken Griffin – 21,254,029

Cliff Asness – 14,739,648

Steve Cohen – 4,115,900

Jim Simons – 2,073,786

Ray Dalio – 1,610,372

Mario Gabelli – 856,841

Joel Greenblatt – 829,137

Bill Miller – 515,000

Ken Fisher – 101,087

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: