This week’s best investing news:

Terry Smith – Is Active Management Worth Paying For? (Money Maze)

Bitcoin or Gold? Oaktree’s Howard Marks Sees Little Difference (Bloomberg)

What does a yield buy? (Verdad)

Bridgewater’s Ray Dalio: Both Trump and Biden are ‘threatening’ for the markets (CNBC)

Aswath Damodaran – Data Update 3 for 2024: A Rule-breaking Year for Interest Rates (AD)

Oaktree’s Howard Marks: Fed funds rate will average near 3% over the next ten years (CNBC)

Stock Market Success And The Willingness To Look Stupid (Felder)

Bill Gross Talks Markets, Fed and Investment Strategy (Bloomberg)

What Does the Misery Index Say About the 2024 Election? (Barry Ritholz)

Mohnish Pabrai’s Q&A at Oxford University – Oxford Alpha Fund (MP)

Price to Innovation (Rudy Havanestein)

Why Activist Short Sellers Stir Up Controversy (Bloomberg)

Serial Acquirers, The Art of Not Selling, and Chuck Akre’s Masterclass (Investment Talk)

The Tremendous Yet Troubled State of Gaming in 2024 (MatthewBall)

The Three Types of Investing Mistake (Behavioural Investment)

Show Us Your Portfolio: Katie Stockton (Validea)

Why Amazon CEO Andy Jassy Is Worried About Innovation In Western Countries (Fortune)

PhageLab (Collab Fund)

David Katz – When is the right time to buy small and mid-cap stocks (CNBC)

The Intellectual Rot of the Industrially Necessary University (Ep Theory)

Transcript: Shomik Dutta, Overture Ventures (Big Picture)

Investing Softly (Humble Dollar)

Weitz Investment Management: “Avoid Crazy” and Stay Focused (Weitz)

RV Capital 2024 Annual Gathering Investor Q&A (RV Capital)

Pzena – Value Investing for a Low Equity Risk Premium World (Pzena)

Patient Capital Management Q4 2023 market Commentary (Patient)

First Eagle Investments: Global Value Team 2023 Annual Letter (FEIM)

This week’s best value Investing news:

A Broadening Equity Market Favors Value! (Miller Value)

Why Now Is the Time for Value Investing (Morningstar)

Where To Invest In 2024 – Value Stocks & Presidential Election Years (Forbes)

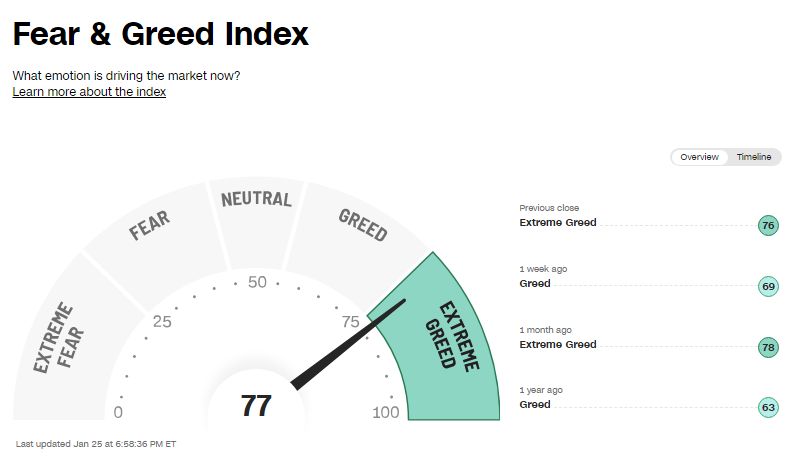

This week’s Fear & Greed Index:

This week’s best investing podcasts:

John Nersesian: 5% Cash Is Great. Don’t Fall in Love With It. (Barron’s)

Madhavan Ramanujam – How to Price Products (ILTB)

TIP601: Junk to Gold by Billionaire Willis Johnson (TIP)

Mentors (MicroCapClub)

Episode #518: Jared Dillian on the Keys to Live a Stress-Free Financial Life (Meb Faber)

RWH040: Go Global w/ Laura Geritz (RWH)

Sustainable Air Fuel – A Primer (Business Brew)

BTC166: Bitcoin Custody For Institutions w/ Caitlin Long and Wes Knobel (BTC)

#410 – Ben Shapiro vs Destiny Debate: Politics, Jan 6, Israel, Ukraine & Wokeism (Lex Friedman)

#30 The Japanophile (Stephen Clapham)

454- Weather Matrix (InvestED)

Tilly Franklin – Endowment Model at Cambridge University (EP.363) (Capital Allocators)

Ep 426. Expectations Investing: Predictions for the Box Office and Movie Theaters in 2024 (Focused Compounding)

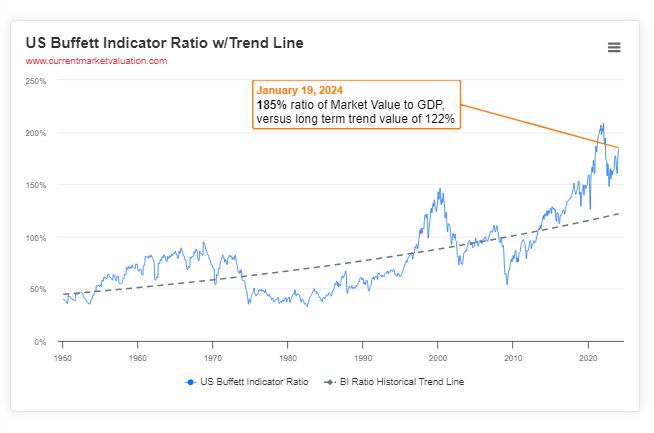

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Outperforming Cap- (Value-) Weighted and Equal-Weighted Portfolios (AlphaArchitect)

Desperate Times Lead to Predictable Results (ASC)

Real GDP still has mind of its own (DSGMV)

The Democratization of Private Markets and Closing the Information Gap (AllAboutAlpha)

Decoupling Correlations: Global Markets since COVID-19 (CFA)

This week’s best investing tweet:

Never overpromise

PayPal said they would shock the world today… and didn’t. pic.twitter.com/KdGTASp87a

— Sheel Mohnot (@pitdesi) January 25, 2024

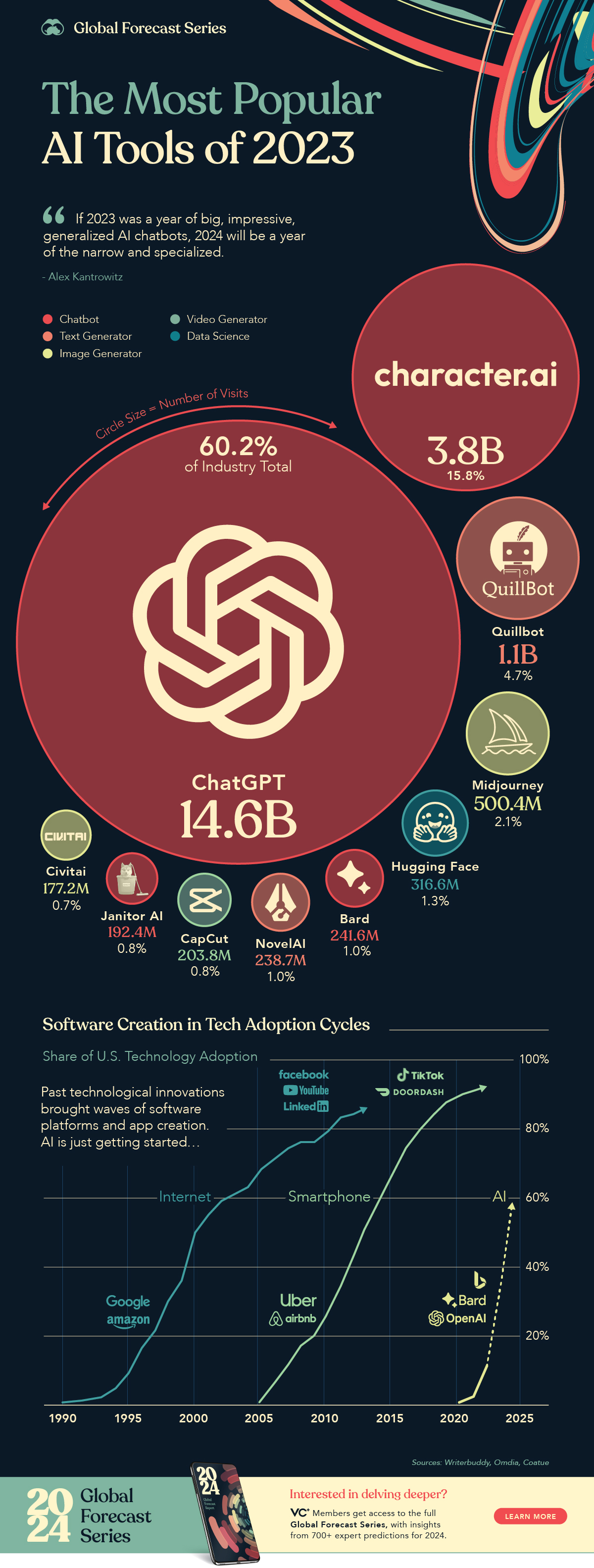

This week’s best investing graphic:

Ranked: The Most Popular AI Tools (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: