This week’s best investing news:

Jeff Bezos: Amazon and Blue Origin (Lex Fridman)

We Make Investments For The Long Haul: Ace Investor Mohnish Pabrai | Market Masters | (CNBC TV18)

Ray Dalio – My Advice for Each Stage of Life (Ray Dalio)

The Dispersion Delusion (Verdad)

Ariel’s John Rogers Interview (CNBC)

Will The ‘Vibecession’ Ever Catch Up With The Magnificent 7? (Felder)

Joel Tillinghast on Fidelity Investments (Masters in Business)

Aswath Damodaran – The Difference Makers: Key Person(s) Value (AD)

The Changing Narrative of Women on Wall Street (Ep Theory)

Graham & Doddsville Fall 2023 Newsletter (Columbia)

Bright, Shiny Objects (Rudy Havenstein)

All Time Highs (F&F)

Michael Mauboussin – At the Money: Investing Skill vs. Luck (MIB)

What will 2024 bring? (Klement)

Jim Rogers, world famous investor, talks with Ed Siddell, Founder, CIO of EGSI Financial (EGSI)

How Will Equity Markets Perform in 2024? (BI)

Morgan Housel – Long-Term News (Collab)

GMO – The Quality Anomaly (GMO)

You Probably Need to Rebalance (Morningstar)

Michael Mauboussin – Pattern Recognition (MS)

Jeremy Siegel – Unit labor costs shouldn’t be a problem for Fed as they consider lowering rates (CNBC)

Why Bonds Are Making a Huge Comeback (Morningstar)

5 Investing Rules I Break in My Portfolio (Morningstar)

This week’s best value investing news:

3 investing strategies that pushed Bill Miller to billionaire status (Mint)

What the great philosophers can teach us about investing (Investors’ Chronicle)

Why this value investor believes the opportunity set is growing (LiveWire)

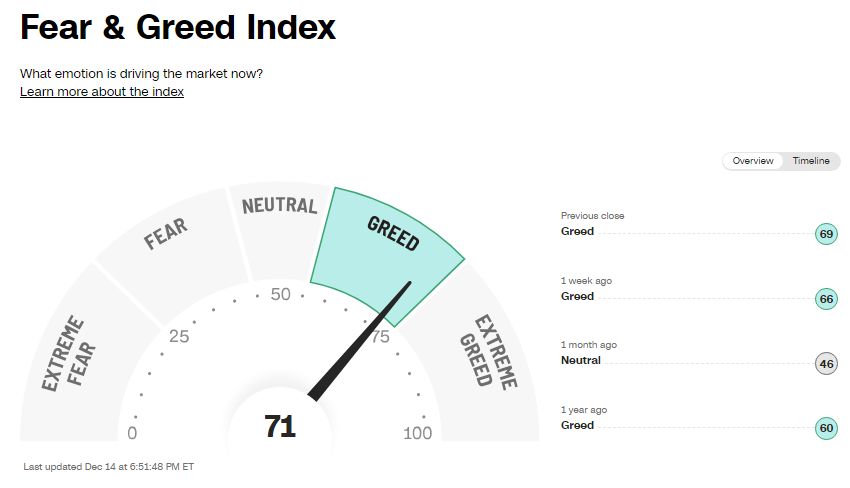

This week’s fear & greed Index:

This week’s best investing podcasts:

Quantitative Wisdom: Outperform and Beat the Market w/ Tobias Carlisle (MI)

Finding Value in China (Pzena)

Value, Momentum and Launching ETFs with Wes Gray (Excess Returns)

Ben Inker: What Looks Cheap and Dear in Today’s Market (Morningstar)

TIP592: Outperforming the Market since 1998 w/ Andrew Brenton (TIP)

Gavin Uberti – Real-Time AI & The Future of AI Hardware (ILTB)

#183 Paul Assaiante: Face Your Fear (KP)

Bin Ren – text2quant (S7E2) (FIM)

Mary Ann Bartels: Bullish on Stocks, Bonds, Bitcoin in 2024 (Barron’s)

#29 The Plumber (Behind The Balance Sheet)

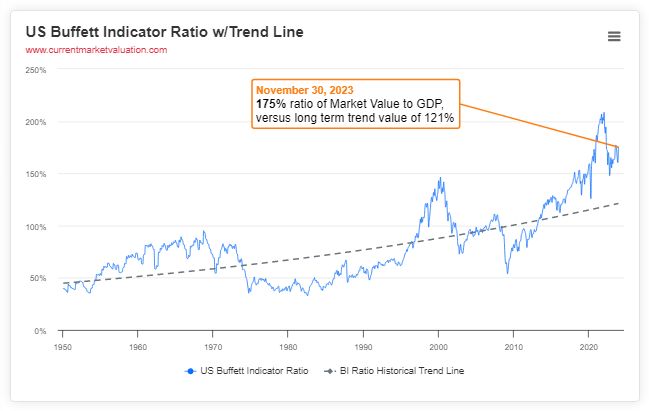

This week’s Buffett indicator:

Overvalued.

This week’s best investing research:

Diseconomies of Scale in Investing (AlphaArchitect)

Buffett’s Into OXY for Another $588 Million (ASC)

Structure Matters: Active Management Has a Place (AllAboutAlpha)

A humble Fed and policy slowdown (DGGMV)

The US Dollar is More Than a Reserve Currency (PAL)

This week’s best investing tweet:

End-November EBIT/EV ratio to 3.48. Still unusually high–higher than 2000 and 2009–but the gap is closing.

When the ratio goes up, value underperforms. When it goes down, value outperforms. Peak was February 2023. pic.twitter.com/m2By10EaSo

— Tobias Carlisle (@Greenbackd) December 13, 2023

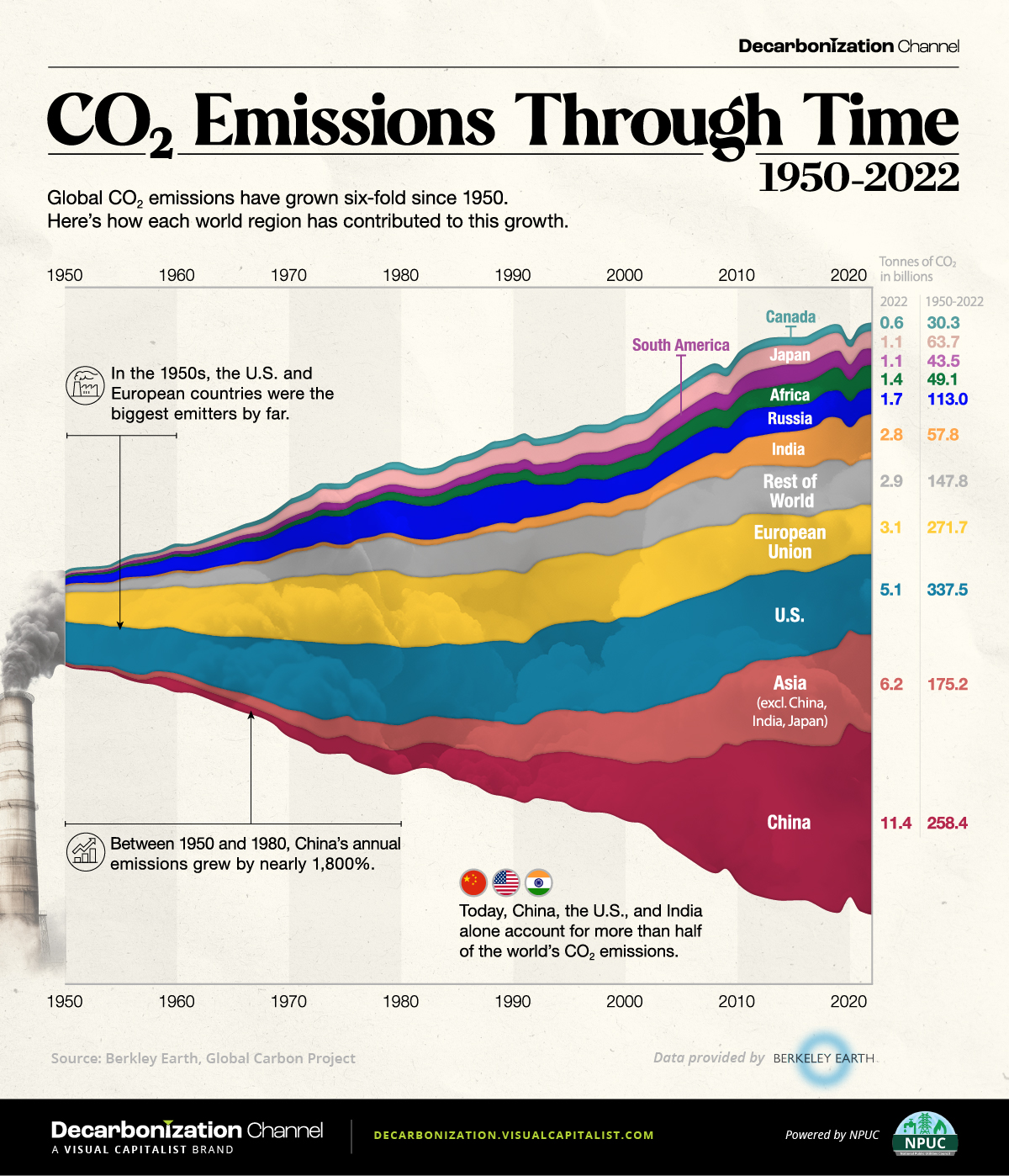

This week’s best investing graphic:

Visualized: Global CO2 Emissions Through Time (1950–2022) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: