This week’s best investing news:

David Einhorn – Greenlight Q3 2023 Letter (Greenlight)

Charlie Munger on Warren Buffett: He cares more about what happens to Berkshire than his own money (CNBC)

John Malone Speaks with CNBC’s David Faber on “Squawk on the Street” (CNBC)

How Joel Greenblatt Picks Stocks (Satovsky)

John Rogers – The Power of Patience (Value Investing with Legends)

JPMorgan’s Jamie Dimon on Mexico Opportunities, Inflation, US Credit Rating, Fintech (Bloomberg)

Mohnish Pabrai’s Q&A at Mendoza College of Business – University of Notre Dame (MP)

Seth Klarman on What Makes a Value Investor and Committing ‘Sacrilege’ (Institutional Investor)

The Death of Small Cap Equities? (Verdad)

Quality Investing: How to Own the Best Companies for Long Term Wealth w/ Lawrence Cunningham (MI)

Why It’s Great to be an Investor Now in 2023 (Validea)

Markets Have Suffered A ‘Sea Change’, Part Deux (Felder)

Miller Value Partners Webcast: Where to find value in the market (Miller)

Conspiracy theories, drugs, and computer games (Rudy Havenstein)

The Graham & Doddsville Newsletter Collection (CMQ)

Ed Thorp: Survival of the Fittest Mind (Alchemy of Money)

Your Money Needs to Go on a Vacation (WSJ)

Diversification is Not a Free Lunch (Behavioural Investment)

Investing Behavioral Hacks (The Big Picture)

My Two Cents (Humble Dollar)

A Conversation With Citadel’s Ken Griffin (Bloomberg)

The Illusion of Security in Investing (Safal)

Third Point Letter Q3 2023 (TP)

Tweedy Browne Letter Q3 2023 (TB)

Jensen Investment Management Webinar: What is the Opportunity in the Global Markets? (Jensen)

This week’s best value Investing news:

Value stocks ‘still well below normal or average discounts’ (Perpetual)

Value Investing with an ESG Focus with Filip Erhardt, Founder and CEO of ESGFIRE (Planet MicroCap)

State of value investing in 2024 (CNBC)

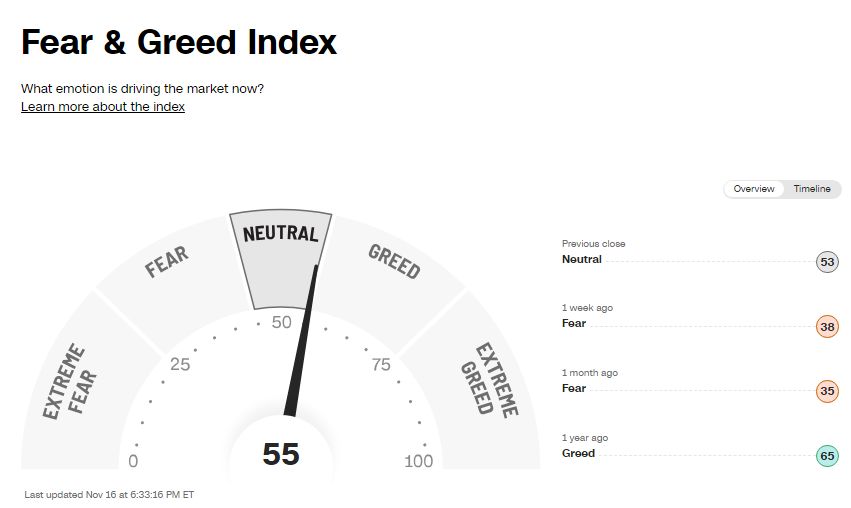

This week’s Fear & Greed Index:

This week’s best investing podcasts:

From Quant Investing to Venture Capital with Jim O’Shaughnessy (Excess Returns)

Episode #508: Jim Bianco on “The Biggest Economic Event of Our Lifetime” (Meb Faber)

Brad Jacobs – Think Big and Move Fast (ILTB)

Andrew McAfee – The Geek Way (Business Brew)

#28 The Continuous Learner (Stephen Clapham)

#181 Dr. Gio Valiante (Part 2): Failure and Success (KP)

Rick Heitzmann – New York Venture Investing at FirstMark Capital (Capital Allocators)

Ep 157: Jason Coggins – Portfolio Construction (Inside The Rope)

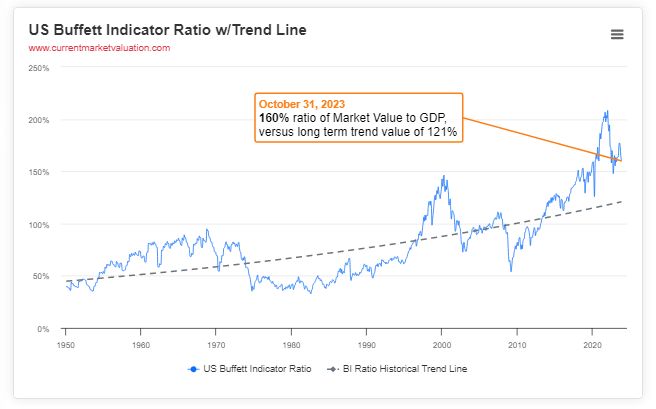

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Is Inflation Ever Going to Go Down? (AlphaArchitect)

Tracking a Bond Market Bounce (ASC)

Was 60/40 a Big Head Fake? (AllAboutAlpha)

Return to Tradition? Three Reasons to Consider a Bond Allocation (CFA)

This week’s best investing tweet:

BofA Global:

Small-caps are the cheapest size segment by market capitalization, trading at a 19% discount to historical averages

Midcap stocks are trading at a 4% discount.

Large-cap stocks are trading at a 12% premium to historical averages

Megacap stocks, represented by… pic.twitter.com/A42N00f9n0

— Tobias Carlisle (@Greenbackd) November 14, 2023

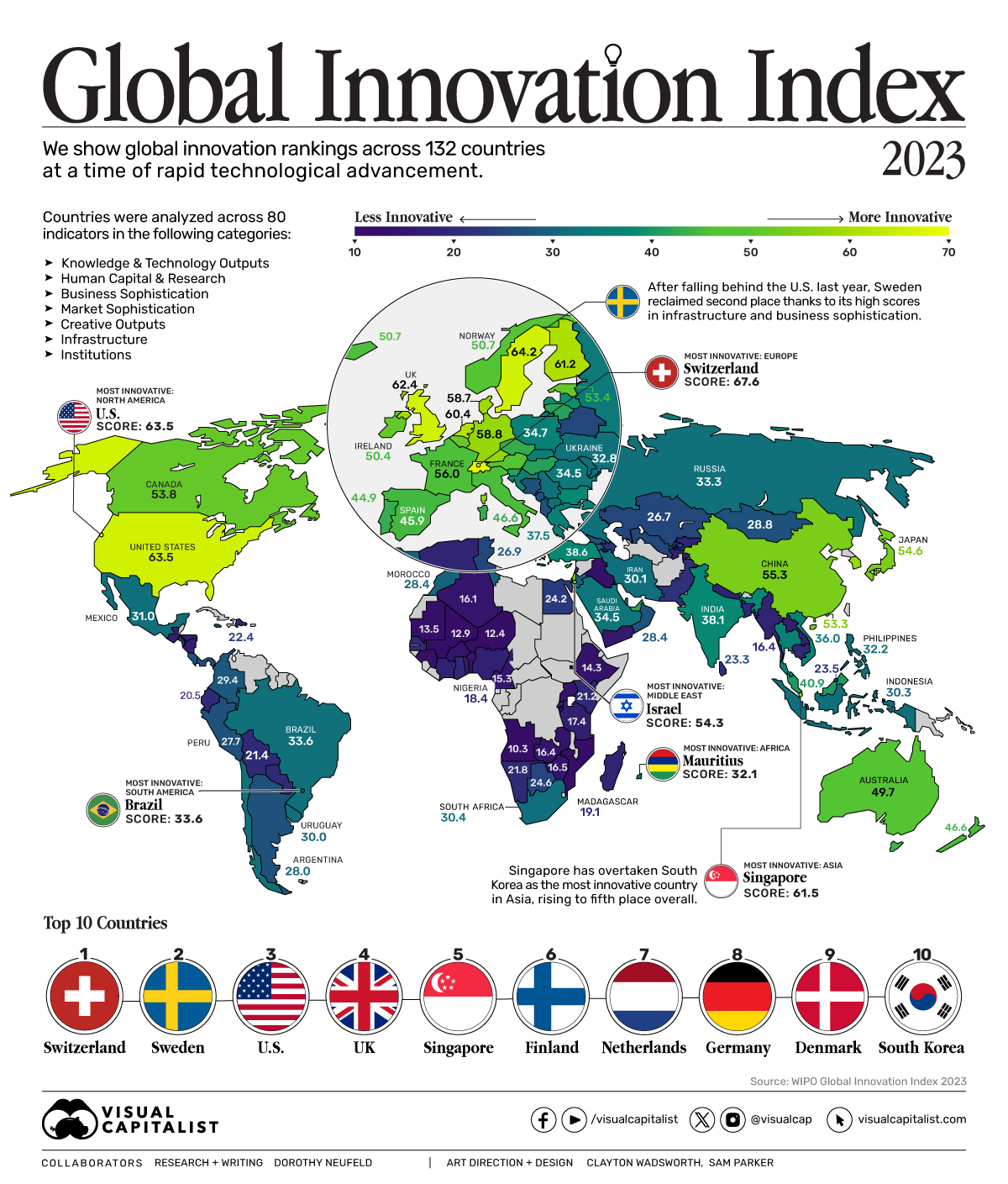

This week’s best investing graphic:

Ranked: The Most Innovative Countries in 2023 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: