This week’s best investing news:

Oaktree: Full Return World with Howard Marks (OakTree)

Bruce Berkowitz – Value Investing: Lessons Learned (WealthTrack)

Ray Dalio – Investigating the Hidden Blue Economy (FII Institute)

A Rule of Thumb for Terminal Multiples (Verdad)

Rich Pzena: Embracing the loneliness mindset (Inside Adviser)

The Most Exciting Market? Japan (Validea)

In Conversation with Ken Griffin (Bloomberg New Economy)

The Bond Market’s Bearish Message For Stocks (Felder)

Ian Cassel – Smallcap Discoveries 2023 Investor Conference (Smallcap)

Did Bogle Blunder? (Humble Dollar)

Berkshire Hathaway Q3 2023 Earnings Letter (BH)

There’s no free lunch. (Rudy Havenstein)

Carl Icahn’s investing arm rallies after third-quarter loss narrows and revenue beats (Morningstar)

The Joy of Walking Away (Safal)

Buffett’s Berkshire to Sell Yen Bonds Again as BOJ Bets Rise (Yahoo)

Markets Brief: Is It Finally Time to Buy Small-Cap Stocks? (Morningstar)

Mairs & Power Growth Fund Q3 2023 Commentary (M&P)

Berkshire Hathaway Q3 2023 Report (BH)

Berkshire Hathaway Earnings: Cash Balances Hit Record $157 Billion as Firm Stays Disciplined (Morningstar)

Weitz Value Fund Q3 2023 Commentary (Weitz)

Dorsey Asset Management: Competitive Advantage & Capital Allocation (Dorsey)

Earnings call: Markel Group’s Q3 2023 performance reveals robust growth and challenges (Investing.com)

Jensen Quality Value Fund Q3 2023 Webinar (Jensen)

This week’s best value Investing news:

Japan is the one place investors can be rewarded for leaning into value stocks (CNBC)

Shyam Sekhar on Value-Oriented Investing in India (MOI Global)

Holding Firm to Value Investing Amid a Turbulent Fixed Income Climate (Oakmark)

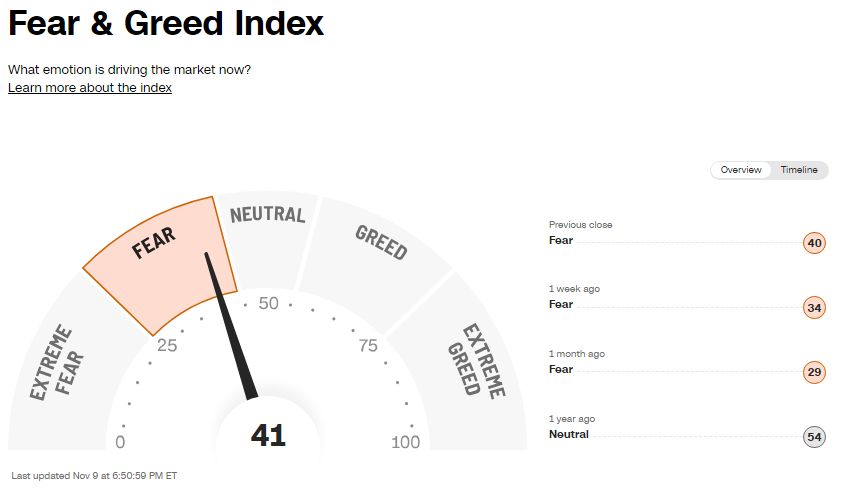

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Multi-Bagger First Principles (MicroCapClub)

The Bond Market from a Value Investor’s Perspective (Intelligent Investing)

Guy Spier, Portfolio Manager of the Aquamarine Fund and Author of the Education of a Value Investor (Boyar)

#400 – Elon Musk: War, AI, Aliens, Politics, Physics, Video Games, and Humanity (Lex Fridman)

Episode #507: Thomas George, Grizzle – Disruption at a Reasonable Price (Meb Faber)

#180 TKP Insights: Learning and Thinking (Knowledge Project)

Elizabeth Zalman & Jerry Neumann – Founder vs Investor (ILTB)

Understanding the Changing Macro Landscape (Excess Returns)

Expert: Tom Naughton – There’s money in mi goreng (Equity Mates)

Artificial Intelligence and the Containment Problem (Hidden Forces)

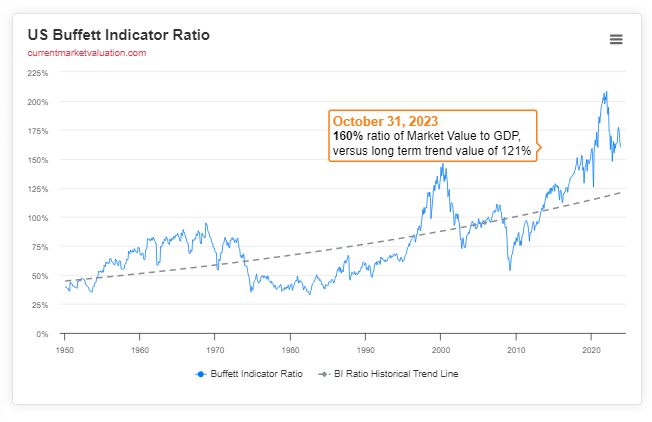

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Global Factor Performance: November 2023 (Alpha Architect)

Breaking the Mold of Home Country Bias (ASC)

The Short on Shorting Bonds (AllAboutAlpha)

Market Timing Does Not Attempt To Predict Returns (PAL)

This week’s best investing tweet:

To the day three years ago today, the announcement of a successful #COVID19 vaccine candidate sparked the long-awaited #value factor revival.

Below, I share 10 charts on the resurrection of the value premium, plus some general value investing insights. pic.twitter.com/n4aFkVelKj

— Matthias Hanauer (@HanauerMatthias) November 9, 2023

This week’s best investing graphic:

The 20 Most Common Investing Mistakes, in One Chart (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

One Comment on “This Week’s Best Value Investing News, Podcasts, Interviews (11/10/2023)”

This was lovely to read.