This week’s best investing news:

What Ray Dalio got wrong (and what happens next) (AFR)

The Top 5 (Verdad)

Carl Icahn promises a ‘reset’ as his company’s shares plunge as much as 37% (Fortune)

The Truth About Market Forecasts (And Dollar Cost Averaging) (Validea)

Pzena Investment Management 2023 Mid Year Outlook: Rich Pzena (Pzena)

Mohnish Pabrai’s Presentation and Q&A at Indian School of Business (MP)

2023 Reunion: Values-based leadership panel with Tom Gayner and Julie Laulis (Markel)

Berkshire Hathaway’s Tobacco History Part II (Genehoots)

It’s Hard to Be an Activist These Days’: Gadfly Investors Trail Stock-Market Returns (WSJ)

Chris Bloomstran’s review of Berkshire’s Q2 results (Twitter)

What If Disinflation Is Just An Illusion? (Felder)

Berkshire Hathaway Q2 2023 Earnings Letter (BH)

Holder or Investor? (Humble Dollar)

Guy Spier – “I’ve never put 50% in one stock!” (IWT)

10 Ways to Bulletproof Your Portfolio: Part I (Empire)

Bloomberg Wealth: Mike Novogratz (Bloomberg)

A Closer Look at “Cut Your Losses Early; Let Your Profits Run” (Elm)

The Wisdom of Aswath Damodaran: Finance Made Simple (Everything Money)

A Few Stories About Big Decisions (Collab Fund)

Cathie Wood – Innovation In A Recession? (ARK)

Cigar-Butt Investing: One Puff of Profit or Just a Whiff of Trouble? (Onveston)

Buffett’s cash pile nears all-time high at $223b (AFR)

Mario Gabelli: We want to buy good companies with good management & valuations (CNBC)

Berkshire Hathaway Q2 2023 Earnings Report (BH)

Transcript: Dan Harris (Barry Ritholz)

Does Adding Dividend Stocks Improve Portfolio Performance? (Morningstar)

Bill Ackman shorting 30-year Treasury bills (Fortune)

Ariel’s John Rogers pulls off solid performance for 40 years with an eye on value (CNBC)

Boyar Research Fresh Looks 2023 (Boyar)

Q2 2023 – Sequoia Strategy Letter (RC)

Royce Semiannual Letter: Are Small Caps Ready for the Handoff from Bear to Bull? (Royce)

Tweedy Browne Q2 2023 Letter (TB)

Matrix Asset Advisors Q2 2023 Commentary (Matrix)

Jensen Quality Growth Fund Q2 2023 Webinar (Jensen)

Meridian Contrarian Fund Q2 2023 Commentary (Meridian)

This week’s best value Investing news:

The Case For Intel: An Illustration Of The ‘Value’ Investing Mindset (Forbes)

Value investing ‘still makes sense’ in today’s market, says strategist (Yahoo)

The U.K. FTSE Is A Contrarian Value Investors’ Dream (Forbes)

Why Martin Currie reckons the 2020s will favour value investing, and their three picks (StockHead)

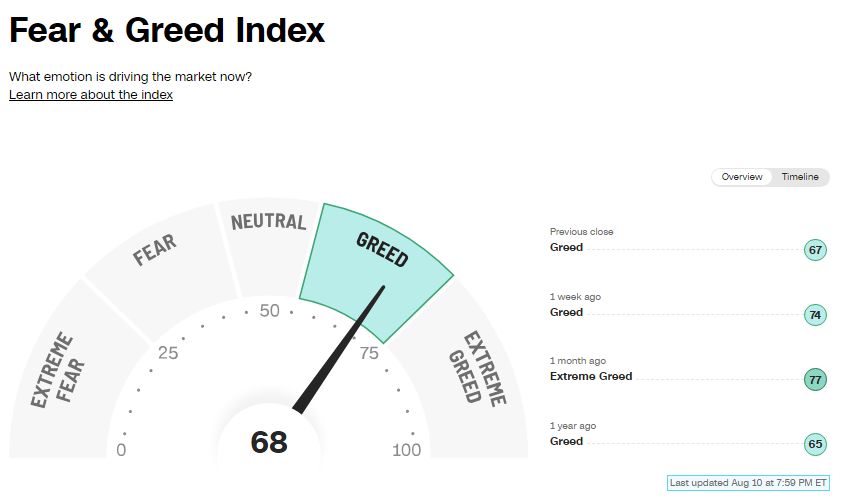

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Episode #494: Stephanie Pomboy on the Corporate Credit Crunch (Meb Faber)

Aswath Damodaran on His Book, Investment Philosophies (MOI)

Why/Why Not Invest in Illiquid MicroCap Stocks (Planet MicroCap)

The Benefits of Diversification (WealthTrack)

#173 Frank Slootman: Doing Less, Doing Better (Knowledge Project)

WTT: Active Management Today is a Single Decision (Capital Allocators)

Show Us Your Portfolio: Gary Antonacci (Excess Returns)

Des Traynor – Real Talk about AI and Software (ILTB)

430- Analyzing International (InvestED)

Microsoft Bets Big on AI: What Investors Should Know, Part One (Morningstar)

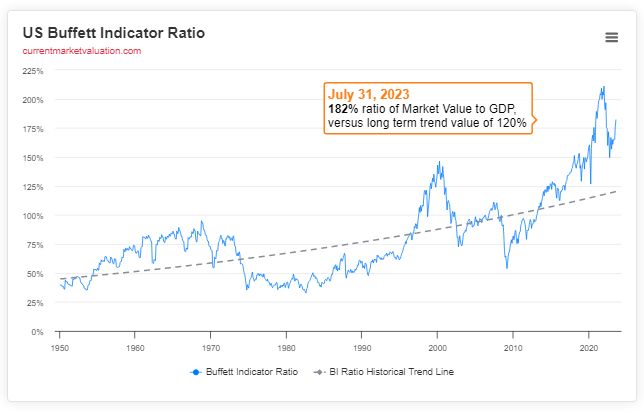

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Global Factor Performance: August 2023 (AlphaArchitect)

Yields: Listen to the Charts, Not the Gossip (ASC)

The Fitch Downgrade: The Principal–Agent Problem in Modern Finance (CFA)

A Case for Distressed Hedge Fund Strategies and How to Enhance Returns (AllAboutAlpha)

This week’s best investing tweet:

When the market goes higher FOMO kicks in and makes you want to buy. When the market moves lower it makes you want to sell because you don’t want to lose what you have. The market never screams at you to do the right thing, only the wrong thing.

— Ian Cassel (@iancassel) August 10, 2023

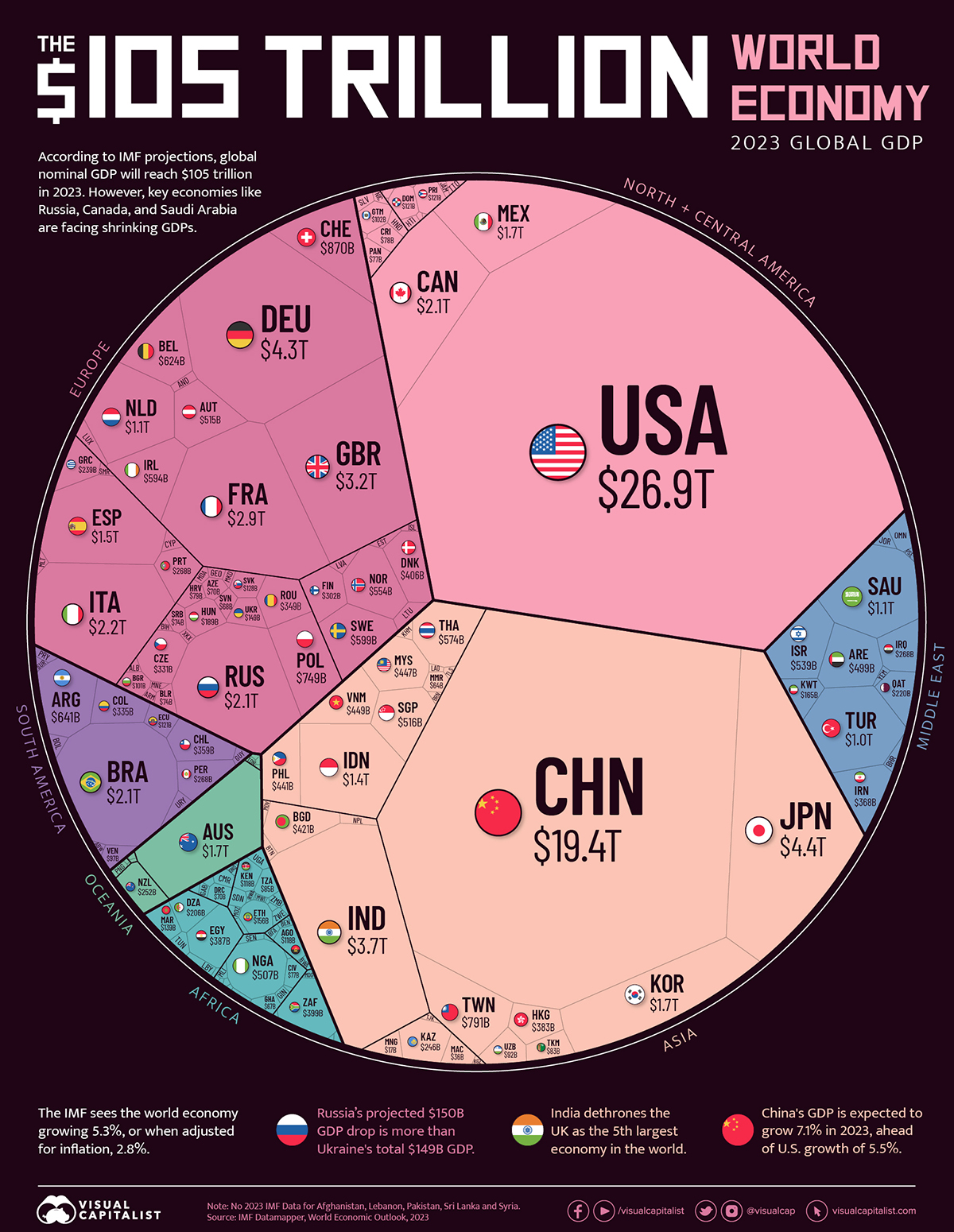

This week’s best investing graphic:

Visualizing the $105 Trillion World Economy in One Chart (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: