As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners.

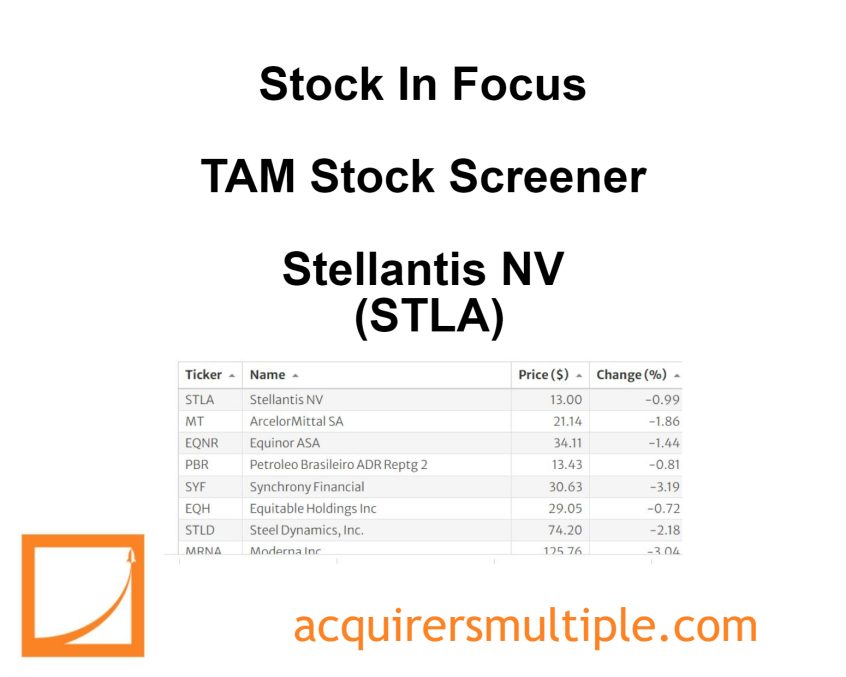

One of the cheapest stocks in our Stock Screeners is:

Stellantis NV (STLA)

Stellantis NV was formed on Jan. 16, 2021, from the merger of Fiat Chrysler Automobiles and PSA Group. The combination of the two companies created the world’s fifth-largest automaker, with 14 automobile brands. In 2022, pro forma Stellantis had sales volume of 6.0 million vehicles and EUR 179.6 billion in revenue, albeit affected by the microchip shortage. Europe is Stellantis’ largest market, accounting for 44% of 2022 global volume while North America and South America were 31% and 14%, respectively.

Overall, the company has seen significant growth in revenue, gross profit, operating income, and net income from continuing operation net minority interest from 2021 to 2023. This growth is likely due to a number of factors, including the company’s expansion into new markets, the launch of new products, and the improvement of its operational efficiency.

A quick look at the share price history (below) over the past twelve months shows that the price is up 17.32%. Here’s why the company is undervalued.

Key Stats

Market Cap: $55.84 Billion

Enterprise Value: $29.94 Billion

Operating Earnings

Operating Earnings: $24.98 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 1.20

Free Cash Flow (TTM)

Free Cash Flow: $12 Billion

FCF/EV Yield %:

FCF/EV Yield: 26.54

Shareholder Yield %:

Shareholder Yield: 10.70

Other Indicators

Altman Z-Score (TTM): 2.213

Dividend Yield %: 7.90

ROA (5 Year Avge%): 12

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: