This week’s best investing news:

Seth Klarman – Timeless Value Investing (Capital Allocators)

Mario Gabelli Shares Insights on the Shifting Landscape of Value Investing (Columbia)

Aswath Damodaran – A Mid-year Assessment for 2023! (AD)

Q&A on Private Equity Operational Improvements (Verdad)

Trouble Ahead For Investors’ Favorite Asset Class?: A Real Conversation w/Dan Rasmussen (Hedgeye)

Compounding: The Silent Hero in Your Investment Portfolio (Validea)

Warren Buffett’s Berkshire Hathaway cuts Activision stake as Microsoft deal inches closer (CNBC)

GMO – Estimating Value Chain Emissions for Portfolio Construction (GMO)

An Opportune Time To Be A Contrarian? (Felder)

Michael Mauboussin’s View on Optimal Fit as a CEO in Capital Allocation (CFA HK)

The Company You Keep (Humble Dollar)

Warren Buffett-Backed EV Maker BYD Says First-Half Profit May Have More Than Tripled (Forbes)

That’s My Story and I’m Sticking To It (Ep Theory)

Jeremy Siegel: Here’s why the Fed should stop raising rates (CNBC)

Threadzilla (Scott Galloway)

It’s Time to Invest in This Rising Superpower (And It’s Not Russia or China) (Empire)

The debt crisis Ray Dalio warned of may already be happening (Yahoo)

Transcript: Tom Wagner, Knighthead Capital (Barry Ritholz)

“Unlike economics, accounting is actually an incredibly useful tool.” (Rudy Havenstein)

Investors Are Bailing on Cathie Wood’s Popular ARK Fund (WSJ)

Letter #101: David Tepper (2010) (Letter A Day)

Miller Value Q2 2023 – The Market Is a Weighing Machine in the Long Term (Miller)

Ariel Focus Fund Q2 2023 Commentary (Ariel)

Wedgewood Partners Q2 2023 Client Letter – Is There An App For That? (Wedgewood)

Weitz Investment Management Q2 2023 Commentary: Patience Counts (Weitz)

This week’s best value Investing news:

Is Value Investing Poised For A Comeback? (Validea)

Seth Klarman – Timeless Value Investing (Capital Allocators)

Tobias Carlisle – “The cheapest stocks outperform” (The Investing with Tom Podcast)

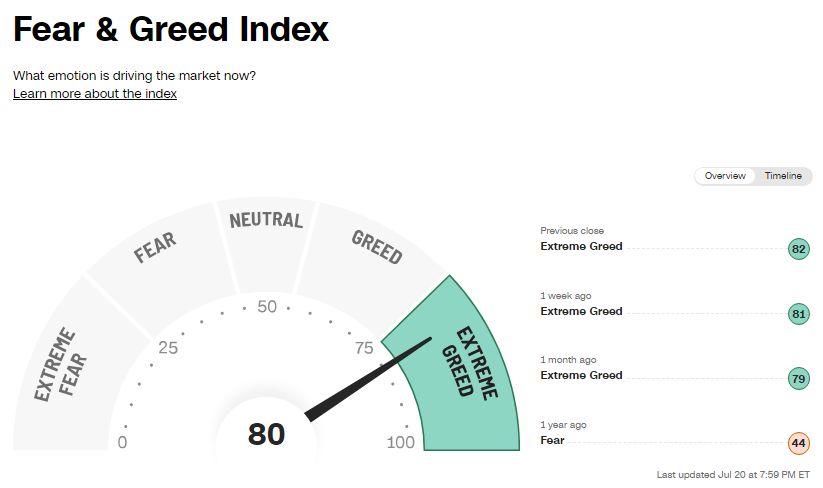

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Finding Great Growth Companies with David Rolfe (Excess Returns)

Doug Greenig – At the Frontier of Trend Following (Corey Hoffstein)

Josh Kushner – Building Thrive Capital (ILTB)

Episode #490: Bill Bernstein on Financial History, Star Managers & The 4 Pillars of Investing (Meb Faber)

Why Oil & Gas is Off the Radar + Smallcap Opportunities (Planet MicroCap)

Charles Frischer and Asheef Lalani – Fairfax Is A “Fat Pitch” (Business Brew)

Contrarian Wealth-Generation, With Stephanie Walter (CI)

Jim O’Shaughnessy – Founder of O’Shaughnessy Ventures (Fort)

Buckle Up Buttercup (guest: Wesley Gray) (Market Huddle)

Distressed Debt Experts (Grant’s)

Top Three Lessons from Working with Jeff Bezos for 23 Years at Amazon (20VC)

Expert: James Reynolds – Searching for non-technology businesses in overlooked markets (Equity Mates)

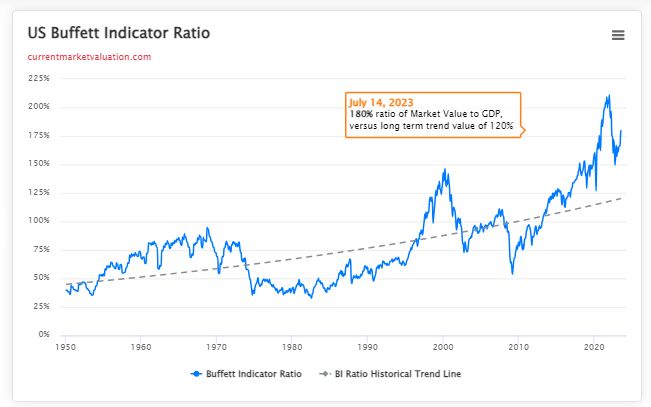

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Does investing in a more concentrated fund result in better performance? (AlphaArchitect)

Longs and Shorts (ASC)

Momentum and Value Investors are Stunned by Growth Outperformance (PAL)

Factor Portfolios and Cap-Weighted Benchmarks: Bridging the Tracking Error Gap (CFA)

Zombie Funds Could Rise Again, But There Are Antidotes (AllAboutAlpha)

This week’s best investing tweet:

Buffett owned 5-10 stocks at a time, Fisher owned 30, Schloss owned 100, Lynch owned 1,000 stocks at a time. They all beat the market. You don’t have to follow anyone. You can do it your own way.

— Ian Cassel (@iancassel) July 17, 2023

This week’s best investing graphic:

Visualized: The U.S. $20 Trillion Economy by State (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: