This week’s best investing news:

Howard Marks Memo – Taking The Temperature (OakTree)

Seth Klarman Interview – Grant’s Current Yield Podcast (Grant’s)

Using History to Identify Inflection Points (Jamie Catherwood)

How Berkshire Hathaway’s Utility Business Became a $90 Billion Win for Warren Buffett (Barron’s)

Private Equity Operational Improvements (Verdad)

Thomas Gayner – Fireside Chat: The Ben Graham 10th Annual Conference (CFA)

Terry Smith – Fundsmith 2023 Semi Annual Letter to Shareholders (Fundsmith)

Bill Nygren – The High Price of Low Volatility (Oakmark)

James Montier – Slow Burn Minsky Moments (GMO)

Bob Robotti Full Presentation – Value Investor Conference (VIC)

How Seritage CEO Negotiated with Warren Buffett to Help Turn Around Real Estate Business (Bloomberg)

Don’t be over-levered (Rudy Havenstein)

Chuck Royce – Why Small-Cap Stocks Are a Good Investment for the Long Term (WealthTrack)

Filtering The Idea Funnel (Neckar)

Cathie Wood – AI Certainty Clashes with Economic Uncertainty (ARK Invest)

And Yet I Did Okay (Humble Dollar)

You may have the tolerance for Risk, but not the capacity (Morningstar)

A Dozen Contrarian Thoughts About Inflation (Barry Ritholz)

JPM Guide to the Markets Q3 2023 (JPM)

Horizon Kinetics – Under the Hood: What’s in Your Index? (HK)

The Boyar Value Group’s 2nd Quarter Letter 2023 (Boyar)

Oakmark Select Fund Commentary Q2 2023 (Oakmark)

Pzena Q2 2023 Commentary – The Concentration Conundrum (Pzena)

Sequoia Strategy Letter Q2 2023 (Sequoia)

This week’s best value investing news:

How Value Investing Works (Validea)

Ariel’s Charlie Bobrinskoy – Value stocks are on sale and growth stocks look overpriced (CNBC)

Tobias Carlisle – Deep Value Investing In 2023 (Millennial Investing)

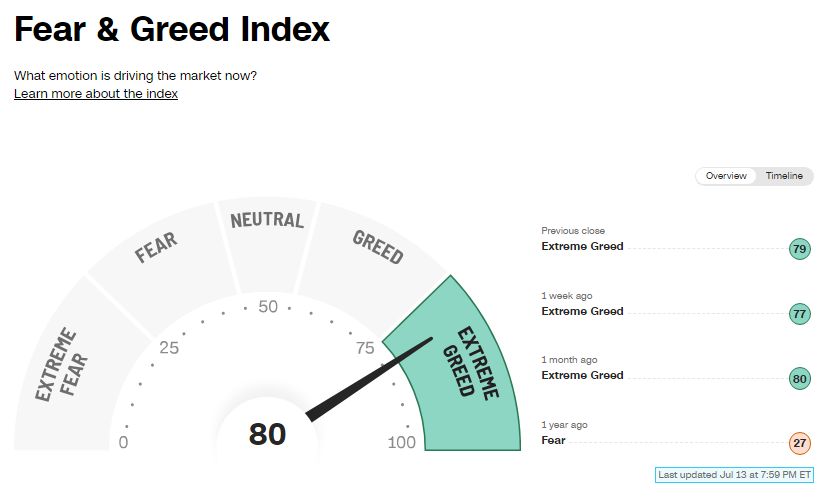

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Seth Klarman – VALUE RESTORATION PROJECT (Grant’s)

Howard Marks – Taking The Temperature (The Memo)

Scott Reardon – Quantitative Deep Value & Qualitative Fundamental Portfolios (Security Analysis)

#171 Naval Ravikant: The Angel Philosopher (2017) (Knowledge Project)

Marc Andreessen on Why AI Will Save the World (EconTalk)

What Investors Need to Know About Emerging Market Debt with VanEck’s Eric Fine (Excess Returns)

Jeremy Giffon – Special Situations in Private Markets (ILTB)

Episode #489: Steve Klinsky, New Mountain Capital – Private Equity Titan (Meb Faber)

The World of Equity Hedging, Part II with Jason Buck (RCM Alternatives)

What is the Value of Apple? How do we evaluate risk? (Vitaliy Katsenelson)

Bill Bernstein: Revisiting The Four Pillars of Investing (Long View)

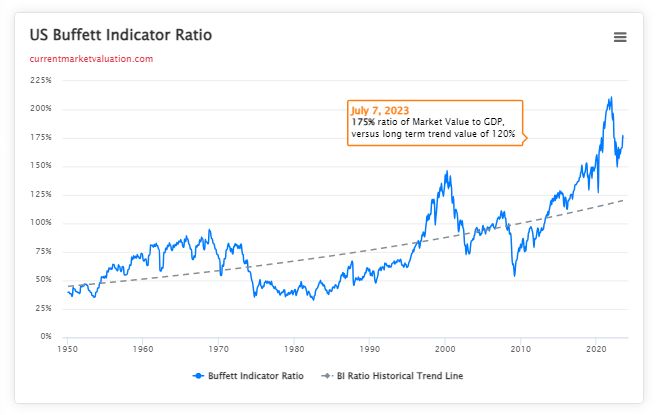

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Global Factor Performance: July 2023 (AlphaArchitect)

Will the 10-Year Yield Print 5.25% by Christmas? (ASC)

The Worst Post-War Periods In The US Stock Market (PAL)

Concentration problem in key industries – This is to going to be easily solved (DSGMV)

This week’s best investing tweet:

The US Strategic Petroleum Reserve is now at its lowest level since August 1983. Over the past 2 years we’ve seen a drawdown of 275 million barrels (44% decline). pic.twitter.com/AKin3jjMmp

— Charlie Bilello (@charliebilello) July 13, 2023

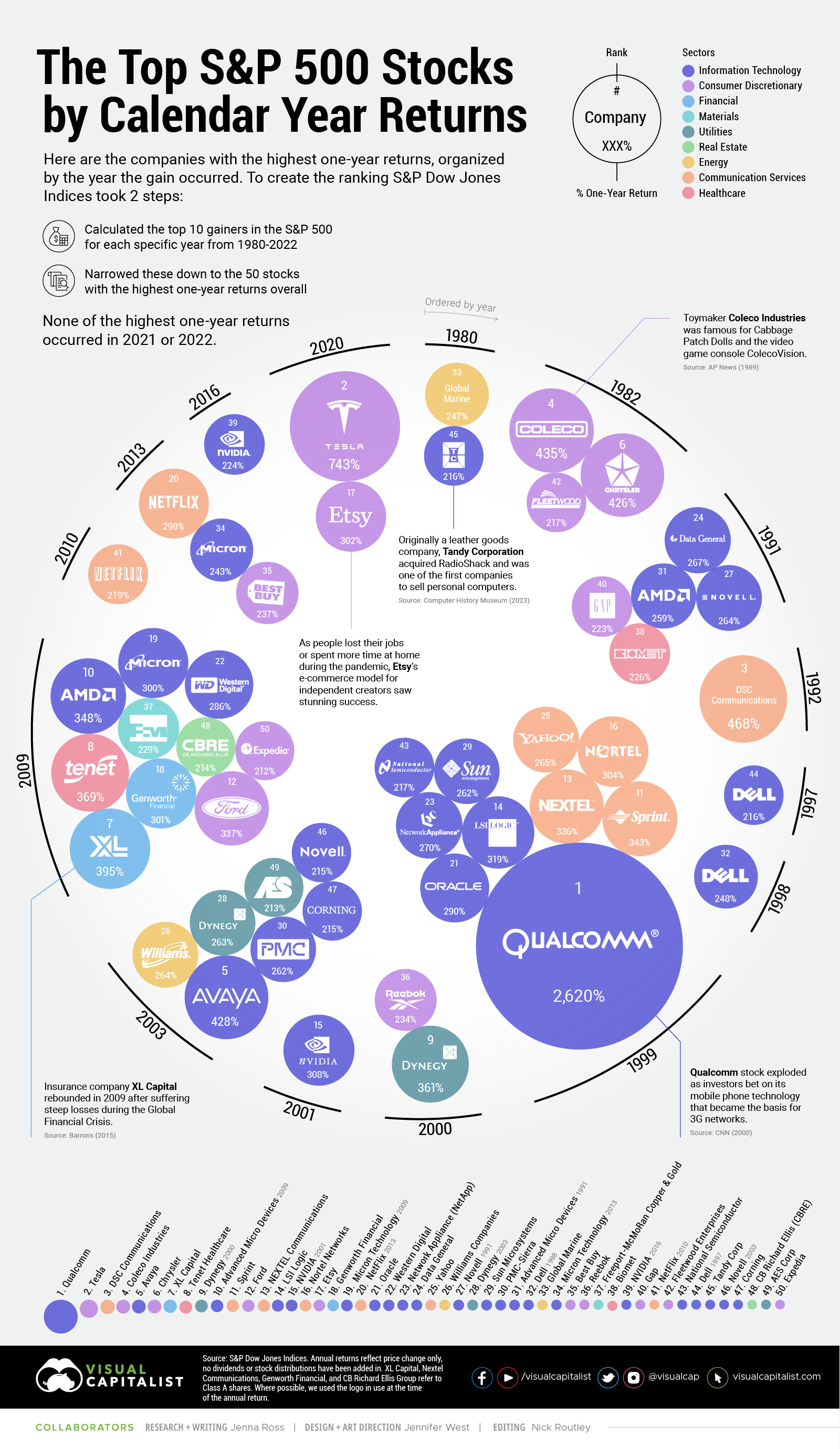

This week’s best investing graphic:

The 50 Best One-Year Returns on the S&P 500 (1980-2022) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: