This week’s best investing news:

Howard Marks: Real Estate Luminaries Series – Steers Center at Georgetown University (OakTree)

Stanley Druckenmiller on How AI is Dominating His Long Portfolio (Bloomberg)

Mohnish Pabrai’s Interview at the mint-Equitymaster Investor Hour (MP)

Jamie Dimon: The economy is still doing fine (CNBC)

Ray Dalio: US at Beginning of Late Big-Cycle Debt Crisis (Bloomberg)

Short seller Jim Chanos rolls his eyes at AI hype (Yahoo)

Michael Mauboussin – ROIC and the Investment Process (MS)

Zero-Day Options (Verdad)

The AI Revolution | ITK with Cathie Wood feat. Frank Downing & Will Summerlin (ARK)

Cheapskates Win (Humble Dollar)

More Bang for Your Buck (FEIM)

The Calm Before the Storm (Rudy Havenstein)

2023 Value Investing Conference | Keynote Speaker: Vicki Hollub (Ivey)

Peter Lynch: The Wisdom of Walking Away (Kingswell)

Universa’s Taleb on Inflation, Global Financial Markets, & Crypto (Bloomberg)

When Do Stocks and Bonds Move Together, and Why Does it Matter? (Econofact)

The Silent Strategy: How Strolling Unveils Hidden Stock Market Gems (Onveston)

Simona Mocuta – We Will See Considerable Easing by the Fed in 2024 (The Market)

Berkshire Hathaway and Fairfax AGM (Brian Langis)

Are International Stocks Worth the Bother? (Morningstar)

How Peloton Became a Victim of Its Own Success (Empire Financial)

Treasury’s $1 Trillion Debt Deluge Threatens Market Calm (WSJ)

Non-Linearity of Investing Process (Safal)

Jensen – Reasons to Be Fearful? It Depends (Jensen)

Transcript: Ramit Sethi (Barry Ritholz)

Sequoia Is Splitting Into Three VC Firms (Forbes)

This week’s best value investing news:

Deep Value Stocks Are Super Cheap. Why a Recession Isn’t a Worry (Barron’s)

The Case for Investing in Value Stocks (WSJ)

How the Value Trade Has Been Smoked by the AI Frenzy (Bloomberg)

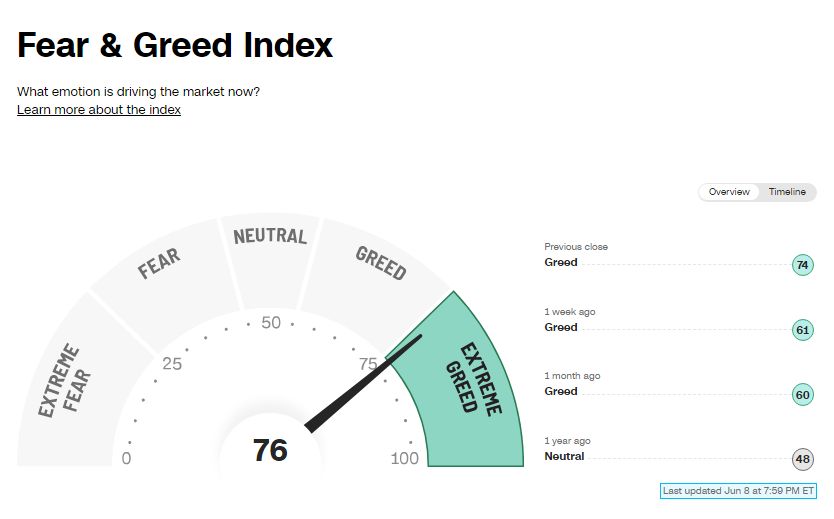

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP557: Mastermind Q2 2023 w/ Tobias Carlisle and Hari Ramachandra (TIP)

Value Stock Geek – Geeking on Value (Business Brew)

Rodrigo Gordillo & Corey Hoffstein – Instagram Frauds, Inflation Volatility, Tech Crisis (Meb Faber)

First Citizens Bank: The Bank Buyers (Business Breakdowns)

Seeking Persistent Growth in Technology Investing (Excess Returns)

Ramit Sethi: Investing Shouldn’t Be Your Identity (Long View)

Using AI to Explain Stock Moves (What Goes Up)

Jason Josephiac – Portable Alpha and Risk Mitigating Strategies (Flirting with Models)

No Equity In Equities (Grant’s)

A Tale of 2 Economies with Jared Dillian (Real Vision)

Chen Qiufan — AI 2041: 10 Visions of Our Future (EP.164) (Infinite Loops)

Rolex: Timeless Excellence (ILTB)

Matthew Cochrane: Growth, Moats, and Long Term Investing (VSG)

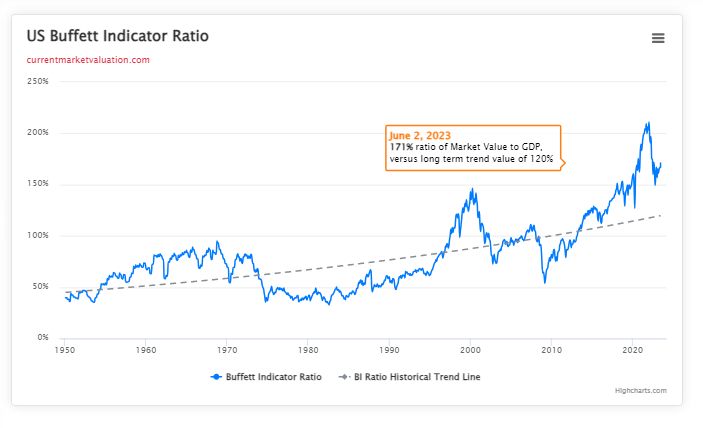

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Global Factor Performance: June 2023 (AlphaArchitect)

How I Exit Short Strangles (ASC)

Quant Screening: Three Questions for Investment Managers (CFA)

Introduction to Farmland Investing (AllAboutAlpha)

This week’s best investing tweet:

AQR through II: U.S. Stocks Won’t Beat International Foreverhttps://t.co/sVShYlYgCZ

— Clifford Asness (@CliffordAsness) June 1, 2023

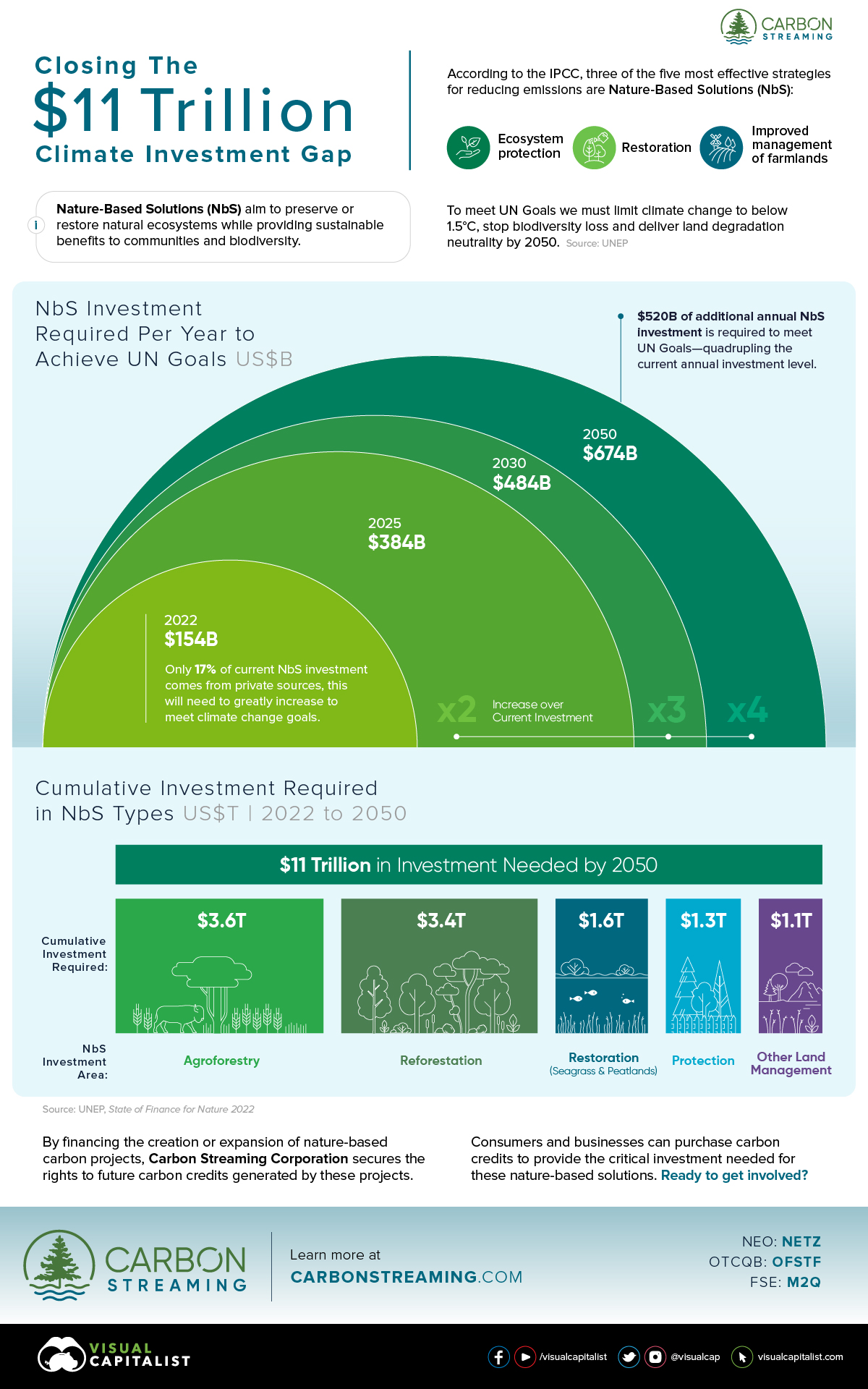

This week’s best investing graphic:

Can We Close the $11 Trillion Climate Investment Gap? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: