During his recent presentation to the CPA Society of New Zealand, Aswath Damodaran discussed his Bermuda Triangle of Valuation. Here’s an excerpt from the presentation:

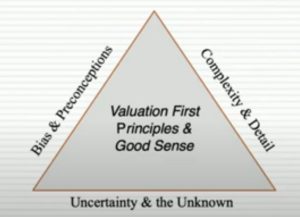

Damodaran: The three biggest enemies of valuation, and I call this the value… my Bermuda Triangle of valuation. Are bias, complexity, and uncertainty.

Let me explain. Most of the time when you sit down to value a company you bring in your priors and preconceptions into your valuation.

In other words we really really like a company or you like the CEO of a company you cannot but bring those preconceptions to the company.

As people who are on the verge of valuing Tesla. Before you value Tesla tell me what you think out Elon Musk. You know what that answer is going to tell me pretty much everything I need to know about your Tesla valuation.

It’s almost impossible to separate the two.

Bias. Second is uncertainty. Uncertainty is a fact of life but for some reason it makes us as human beings uncomfortable. We push it away. We hide behind all kinds of metrics and models.

But the truth is you have to face up to uncertainty and we don’t deal with it very well.

And the third is complexity.

As data has become more accessible and available we’ve started to build bigger and bigger models. Some of you might have seen valuation models from investment Banks run to 200 line items.

Sometimes I wonder who’s running who. The model running you, are you running a model.

The reason I called this the Bermuda Triangle of valuation is bias, uncertainty, and complexity drive us to do really stupid things.

And I see some really stupid things masquerading as valuations out there because people have lost track.

You can watch the entire discussion here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: