In their latest Q4 2022 Market Commentary, Pzena explain why the stage is set for another powerful value cycle. Here’s an excerpt from the letter:

Equity market performance in periods of high inflation and slow or negative GDP growth has been top of mind for many of our clients.

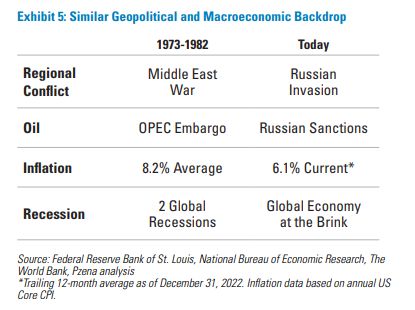

While no two periods are exactly alike, history once again provides an interesting comparison, as the period starting in late 1973 and lasting through late 1982 saw a similar geopolitical and macroeconomic backdrop to what we are seeing today (Exhibit 5).

The near decade-long stagflation period saw two global recessions and 8.2% average annual inflation, hardly a backdrop conducive to investing in equities.

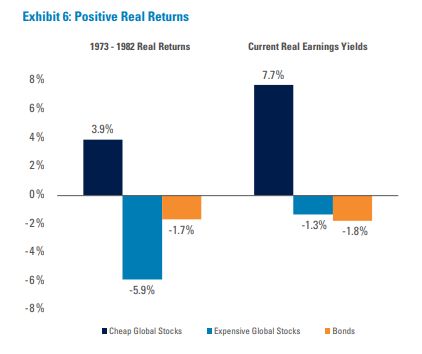

However, real GDP still grew at 3.1% per year, global equities returned 5.5% per year, and value returned 12.5%. This robust performance made cheap stocks one of the few asset classes that generated positive real returns during this turbulent period (Exhibit 6).

We believe that one of the primary drivers of value’s robust performance during this period was its starting point. Record-wide valuation spreads (at the time) following the Nifty Fifty era set the stage for a long and powerful value cycle.

Geopolitical and macroeconomic concerns led to global equity market declines this year that were, on average, in line with past recessions.

While the macroeconomic environment has not become any clearer this year, it bears remembering that recessions are typically short and manageable and the seeds of market rallies are planted during recession-driven market selloffs, as the market performs particularly well in the five-year period following the start of a recession, and value tends to outperform.

Similar to the prior period of stagflation, we believe cheap stocks globally appear to stand out in offering solid positive real earnings yields.

You can read the entire letter here:

Pzena Investment Management – Q4 2022 Commentary

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: