As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks.

While doing this research we’ve also uncovered a number of stocks that superinvestors have sold, or reduced in their portfolios, according to their latest 13f’s. So we’re now providing a new weekly feature article called ‘One Stock Superinvestors Are Selling‘. This week we’ll take a look at:

Bristol-Myers Squibb Co (BMY)

Bristol-Myers Squibb discovers, develops, and markets drugs for various therapeutic areas, such as cardiovascular, cancer, and immune disorders. A key focus for Bristol is immuno-oncology, where the firm is a leader in drug development. Unlike some of its more diversified peers, Bristol has exited several nonpharmaceutical businesses to focus on branded specialty drugs, which tend to support strong pricing power.

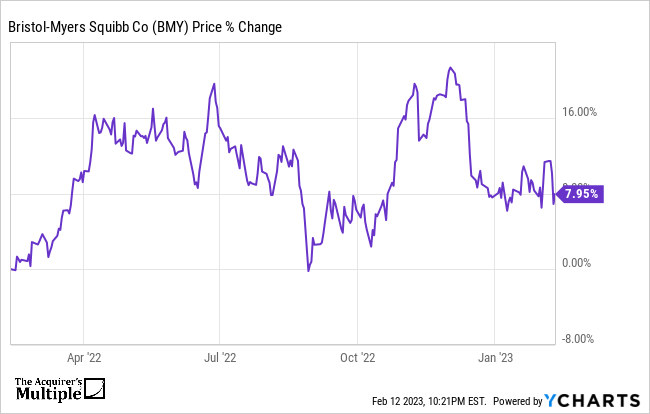

A quick look at the price chart below for the company shows us that the stock is down 8% in the past twelve months.

Superinvestors who reduced, or sold out of the company’s stock, according to their latest 13Fs, include:

(Remaining shares)

Rich Pzena – 3,860,572

Paul Tudor Jones – 2,275,536

John Rogers – 799,534

Ken Griffin – 222,443

Ken Fisher – 198,740

Mario Gabelli – 140,765

Jeremy Hosking – 102,277

Israel Englander – 30,925

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: