In his recent 2022 Annual Letter, Terry Smith explained how sometimes good companies, with solid fundamentals, get taken down in a meltdown, together with their underperforming counterparts. Here’s an excerpt from the letter:

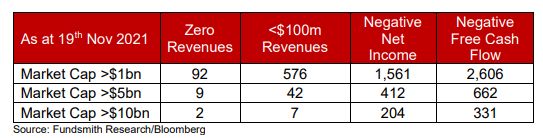

Our highly valued and technology holdings did not fare as poorly as some of the companies which had significant market values but no profits, cash flows or in some cases even revenues. Here is a table which shows those companies in November 2021, roughly the peak of the market:

This may seem cold comfort and to quote an old adage, ‘When the police raid the bawdy house even the nice girls get arrested’. But looking back to the example of Amazon over the Dotcom meltdown and its aftermath, it is a lot more comforting to own businesses which are performing well fundamentally when the share price goes down than to be found playing Greater Fool Theory in the shares of a company with no cash flows, profits or even revenues.

You can read the entire letter here:

Fundsmith – Annual Letter 2022

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: