As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners.

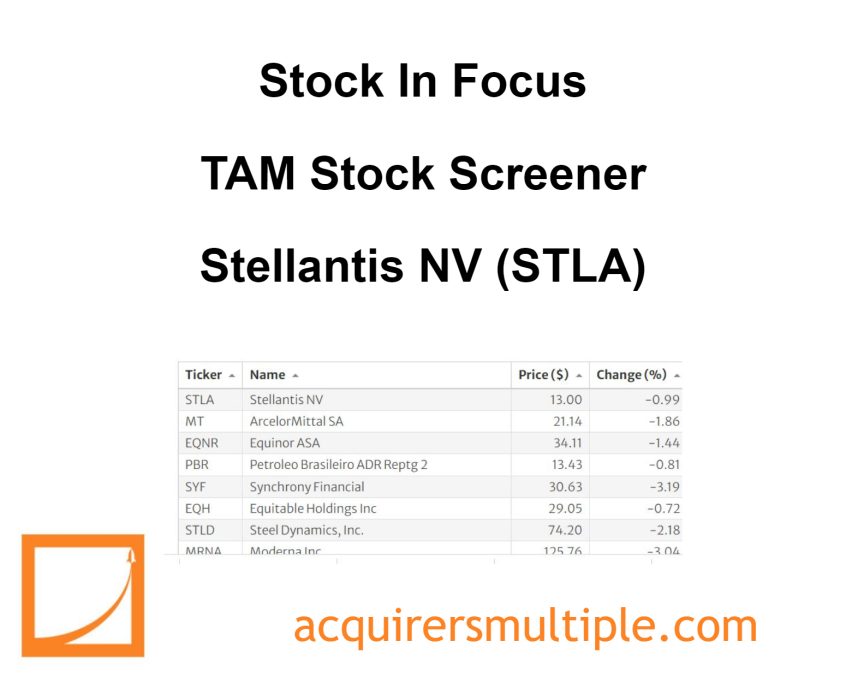

One of the cheapest stocks in our Stock Screeners is:

Stellantis NV (STLA)

Stellantis NV was formed on Jan. 16, 2021, from the merger of Fiat Chrysler Automobiles and PSA Group. The combination of the two companies created the world’s fourth-largest automaker, with 14 automobile brands. In 2021, forma Stellantis had sales volume of 6.1 million vehicles and EUR 152.1 billion in revenue, albeit substantially affected by the microchip shortage. Europe is Stellantis’ largest market, accounting for 47% of 2021 global volume while North America and South America were 30% and 14%, respectively.

A quick look at the share price history (below) over the past twelve months shows that the price is down 22%. Here’s why the company is undervalued.

Summary

Market Cap: $50.40 Billion

Enterprise Value: $29.58 Billion

Operating Earnings

Operating Earnings: $21.61 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 1.40

Free Cash Flow (TTM)

Free Cash Flow: $13.34 Billion

FCF/EV Yield %:

FCF/EV Yield: 29.94

Shareholder Yield %:

Shareholder Yield: 6.70

Other Indicators

Div Yield: 6.70

Altman Z-Score: 2.005

ROA (5 Year Avge%): 11

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: