This week’s best investing news:

Bill Ackman: my latest view on inflation and recessions (Interactive Investor)

Persistence of Growth (Verdad)

Legends of Market History: Tokushichi Nomura II (Jamie Catherwood)

Howard Marks – Investing Is a Serious Pursuit of Money, Not a Way to Get Rich Quick (Bloomberg Línea)

Why The Bear Market In Stocks May Only Be Halfway Through (Felder)

Ray Dalio Gives Up Control of Bridgewater in Final Succession Step (Bloomberg)

Looking at the Rise of Money Losing Companies (Validea)

Warren Buffett’s Successor Is Building an $68 Million Berkshire Holding (Yahoo)

Thinking About the Next Warren Buffett (Neckar)

35-Year Highs For The Dollar (GMO)

Why ESG is fatally flawed (Chris Leithner)

Is it 2008 All Over Again? Not in the US (Miller)

A Brief History of the Past 10,000 Years of Monetary Policy and Why Last Week Was a Big Deal (Epsilon Theory)

NN Taleb: Breaking down intuitively the concept of standard deviation. Why people don’t get it (NN Taleb)

Elon Musk Is Overpaying for Twitter—by a Huge Amount. Here’s the Math (Barron’s)

Fulfilling a Promise (Humble Dollar)

Growth Investing Ain’t About The Rates (GMO)

Transcript: David McRaney (Barry Ritholz)

US Mortgage Rates Rise for Seventh Week to Highest in 16 Years (Bloomberg)

Billionaire Warren Buffett swears by this inexpensive investing strategy that anyone can try (CNBC)

Expectations are changing way too slowly on earnings, says NYU’s Aswath Damodaran (CNBC)

JP Morgan Guide To Markets Q42022 (JP Morgan)

3 Reasons International Investing Hasn’t Paid Off (Morningstar)

The Witch of October Is Here: Remember Short-Term Pain = Long-Term Progress (CFA)

No, Credit Suisse Isn’t on the Brink (The Washington Post)

Back to the 1970s? Reflections & Takeaways for Positioning in Today’s Market (Miller Value)

Ken Fisher, Discusses The Yield Curve (Fisher)

The Rise of Wealth-to-GDP (Absolute Return)

Chris Davis – Is the Long Term Bull Market Still Intact? (Davis)

US Bond Giant TCW – It’s Likely Going to Be a Fairly Hard Landing (The Market)

Did They Live Happily Ever After? The Fate of Restructured Firms After Hedge Fund Activism (SSRN)

Three Ways You Can Cash In on Cash (WSJ)

Bonds May Be Having Their Worst Year Yet (NYT)

Long-term investors should ‘absolutely buy now,’ says Wharton’s Jeremy Siegel (CNBC)

Seeking Good Capital Allocators (Oakmark)

Polen Capital: Beyond Fundamentals: Seeing the Bigger Picture (Polen)

3Q22 Small-Cap Recap (Royce)

This week’s best value Investing news:

Alibaba And Tencent: Can Value Investing Work In China? (Seeking Alpha)

Value is leading the performance scoreboard in YTD 2022 (Finominal)

Rob Arnott: Inflation: Value Stocks & A Cheap Diversifiers Strategy (WealthTrack)

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Diversifying Your Holdings (WealthTrack)

TIP480: Why Microcaps Have The Best YTD Performance w/ Ian Cassel (TIP)

Annie Duke – The Power of Quitting (Capital Allocators)

#148 Kenneth Stanley: Set The Right Objectives (Knowledge Project)

Scott Wilson – Non-Traditional Endowment Investing (Invest Like The Best)

Episode #447: Dave Thornton, Vested – Could Index Investing Come to Venture Capital? (Meb Faber)

Ep. 245 – The Special Situation is Finding Growth-Oriented Firms Using Value Framework (Planet MicroCap)

Low Volatility Investing and the Conservative Formula with Pim van Vliet (Excess Returns)

Adam Butler – Questioning the Quant Orthodoxy (Flirting with Models)

Intuit: An Operating System for Small Businesses (Business Breakdowns)

Podcast: Where Chuck Royce Is Finding Small-Cap Opportunities (Royce)

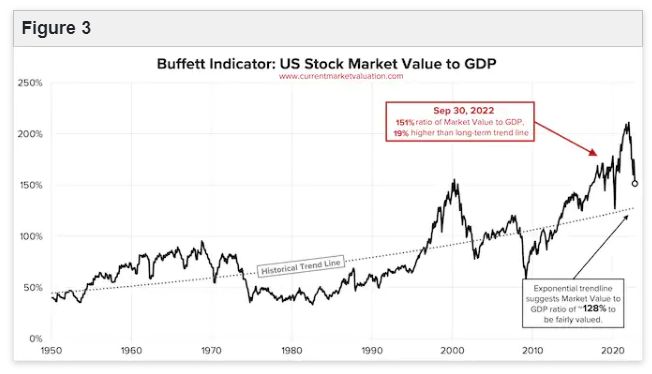

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Momentum Everywhere, Including Emerging Markets (AlphaArchitect)

Exploding Options (AllStarCharts)

Alternatives Are Everything, Everywhere, All at Once! (AllAboutAlpha)

This week’s best investing tweet:

This week’s best investing graphic:

Animation: The Global Population Over 300 Years, by Country (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: