This week’s best investing news:

Howard Marks on Top Misconceptions About Private Credit (OakTree)

Are Investors Staring Down Another ‘Lost Decade’ In The Stock Market? (Felder)

The Case For “Doing Nothing” In Volatile Times (Validea)

Do MBAs Want To Be Billionaires? (Verdad)

NYU Stern School of Business Professor of Finance Aswath Damodaran (Recode)

What I’ve Learned from Users (Paul Graham)

There are individual stocks that are attractively priced, says legendary investor Leon Cooperman (CNBC)

It’s The Hope That Kills You (Jamie Catherwood)

Michael Mauboussin – Market Share: Understanding Competitive Advantage Through Market Power (MS)

More fun in the new world (Rudy Havenstein)

How to Judge The Quality of Your Decisions (Hint: It’s Not by Outcomes) (Safal)

Chris Davis: Recession Potential and Impact on Portfolio Positioning (Davis)

How a 52-week high hurts returns (Larry Swedroe)

Learning to Be a Good Investor is Hard (Behavioural Investment)

Value Investing Insight with Oakmark Fund Portfolio Managers (Oakmark)

Monetary Policy is Non-Linear (Epsilon Theory)

Where You Can Find Stock-Market Bargains (WSJ)

Give It Time (Humble Dollar)

Cash Is No Longer Trash. T-Bill Yields Near 4% (Barron’s)

After the tech sell-off: will growth investors keep the faith? (FT)

This Should Have Been a Great Year for Gold. Here’s Why It Isn’t (WSJ)

Royce Investment Partners Podcast: Small-Cap Quality, Value and Fallen Angels (Royce)

‘Not everything Terry Smith touches turns to gold’ (InvestmentWeek)

We expect equities to continue being the asset of choice, says Oakmark’s Bill Nygren (CNBC)

Rising Bond Yields Change the Calculus for Stocks (WSJ)

Ben Inker, GMO – Dispelling Myths in The Value vs. Growth Debate (Meb Faber)

The World’s Hottest Housing Markets Are Facing a Painful Reset (Bloomberg)

Transcript: Albert Wenger (Barry Ritholz)

When Do Bull Markets Begin? (AllStarCharts)

Playing the Infinite Game: Patient Investing (Polen)

This week’s best value Investing news:

Three Ways to Look at Value Investing (Jack Forehand)

‘The bar for inclusion is very high’: PM Steve Scruggs talks value and joining FPA (CityWire)

Growth vs value: Which stocks will outperform in a high inflationary environment? (Econ Times)

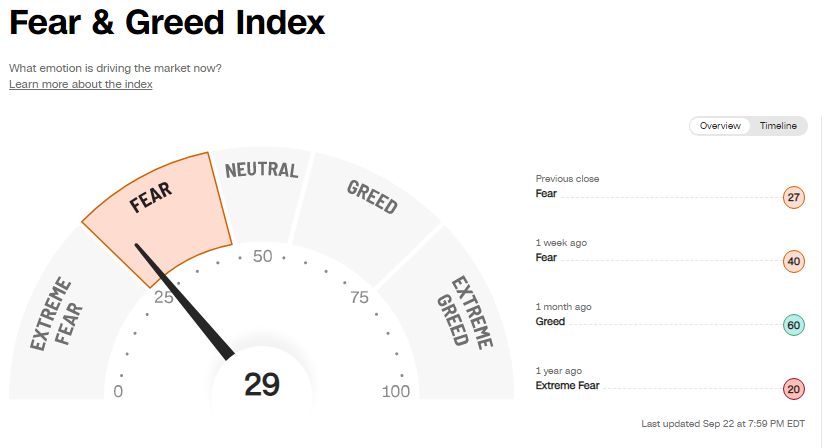

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP477: Recession Proof Your Portfolio With Farmland w/ Artem Milinchuk (TIP)

The Art of Value Investing w/ Drew Weitz & Barton Hooper (MI209) (Millennial Investing)

Evan Tindell – Where Poker and The Market Collide (Business Brew)

Trina Spear – Billion Dollar Scrubs (Invest Like The Best)

Inflation’s Damage: Financial Consequences & Investment Strategies (WealthTrack)

The Next Big Trade – Warren Pies on Why It’s Good To Be Long Energy (Real Vision)

#147 Reid Hoffman: Better Decisions, Fewer Mistakes (Knowledge Project)

Investing for Impact and Return: Aligning Client Objectives with Portfolios (Guiding Assets)

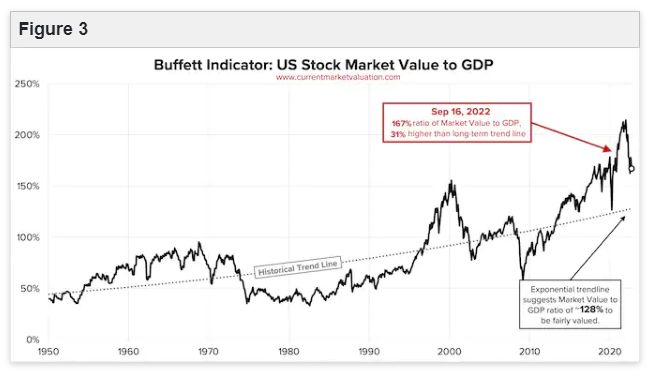

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Has the Stock Market Systematically Changed? (AlphaArchitect)

“The CME Is Suppressing Bitcoin” (AllStarCharts)

FOMC risk and resolving uncertainty (DSGMV)

Art & Inflation Acceleration (AllAboutAlpha)

Equity Risk Premium Forum: MMT, Looking Back, Looking Ahead (CFA)

This week’s best investing tweet:

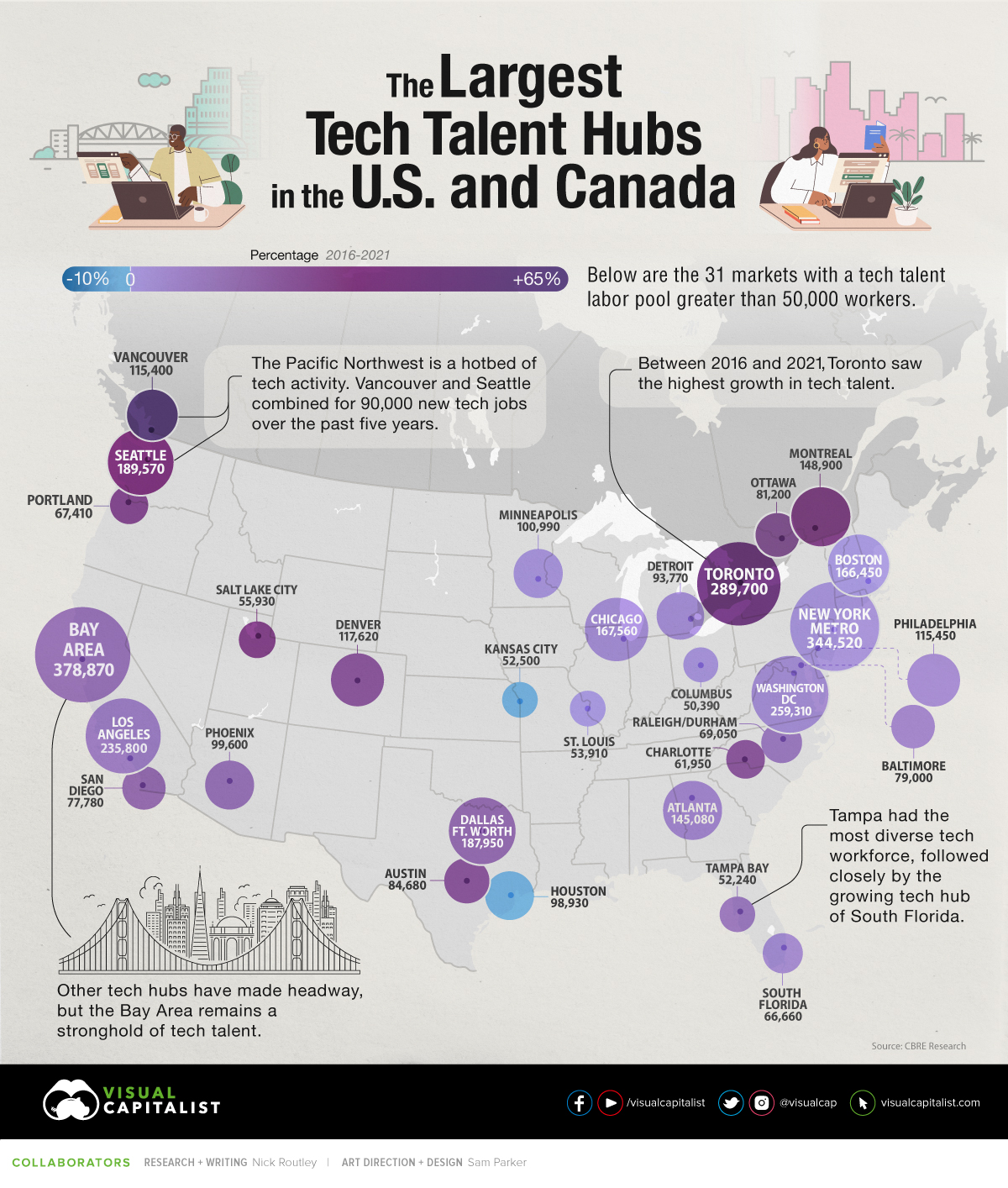

This week’s best investing graphic:

The Biggest Tech Talent Hubs in the U.S. and Canada (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: