This week’s best investing news:

Abandoning Diversification (Verdad)

We Just Can’t Help It (Jamie Catherwood)

Howard Marks & Andrew Marks: Something of Value (Acquired)

September Is The Worst Month For Stocks (Validea)

Mohnish Pabrai: Getting Traction Without Funding (MP)

The Great Disorder (Rudy Havenstein)

Warren Buffett is turning 92 today, but he still eats like a 6-year-old (Fortune)

The ‘Massive Momentum Structure’ In The Stock Market Is Breaking Down (Felder)

Decade of the battery (Noahpinion)

Most of Us Are Secret Momentum Investors (Behavioural Invesment)

Jeremy Grantham – Entering The Superbubble’s Final Act (GMO)

Optimism has returned in the market | Jim Rogers (ET Now)

Warren Buffett Cuts Stake in China’s BYD, Spurring Bets More May Come (Yahoo)

The House of Cards (Absolute Return)

There are ‘unusually attractive’ prices for promising companies, Ron Baron (CNBC)

Tech Stocks Outperform: Truth or Myth? (Chris Leithner)

‘Most active fund managers should quit’ (FT)

Focus to Win (Farnam Street)

How The Head Of Facebook Plans to Compete With TikTok (Verge)

Inflicting Pain (Humble Dollar)

Growth stocks hit hardest by rate hikes, says Charlie Bobrinskoy of Ariel Investments (CNBC)

Is the Housing Market Going to Crash? (PragCap)

Ray Dalio & David Einhorn Are Betting Nearly $4 Million on EV (Yahoo)

Risk is deeply personal and always contextual (Morningstar)

Bill Gross: Winning (BG)

Some Companies Haven’t Paid a Dividend Since 2020 (WSJ)

Seeking Middle Ground Along the Risk/Return Spectrum (First Eagle)

I’m concerned Fed Chair Powell will overtighten, says Wharton’s Jeremy Siegel (CNBC)

Why Investors Went Bananas Over AMC Stock (WSJ)

New 3 Minute Money – How Interest Rates are Set (PragCap)

Is Now a Bad Time to Retire? (WSJ)

Transcript: Eric Balchunas (Barry Ritholz)

GMO: Let’s Not Get Carried Away (GMO)

Know What You Own: Stocks vs. Businesses (Polen)

The Small Idea: Deja Moo (First Eagle)

Lux Q2 2022 Letter (Lux)

This week’s best value Investing news:

Value Investing Has Changed (Validea)

Value Investing: Swing Less, Hit More (Medium)

A Value Investor’s Analysis of Student Loan Forgiveness (Vitaliy Katsenelson)

Abandoning Value Stocks Requires Some Dubious Assumptions (Bloomberg)

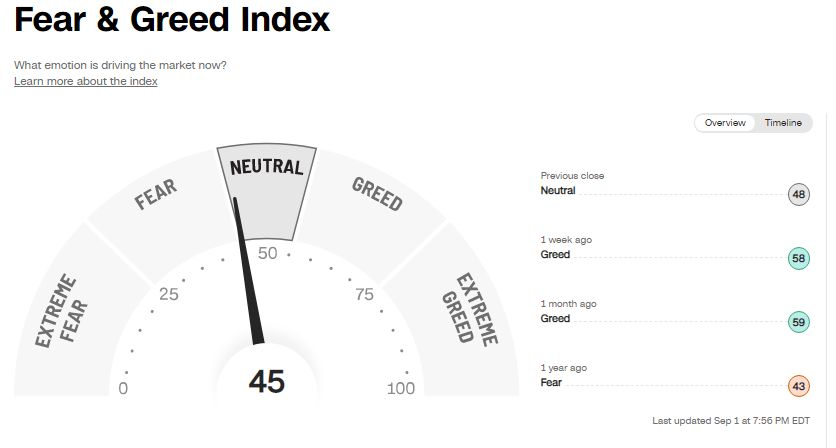

This week’s Fear & Greed Index:

Neutral.

This week’s best investing podcasts:

TIP473: Using Volatility to Hedge Against Inflation W/ Nancy Davis (TIP)

Siegel on Inflation, the Fed and Meme Stocks (What Goes Up)

Vitaliy Katsenelson—Soul In The Game (EP.121) (Infinite Loops)

Episode #440: Jason Buck, Mutiny Fund – Carry, Convexity & The Cockroach (Meb Faber)

#315 – Magnus Carlsen: Greatest Chess Player of All Time (Lex Fridman)

Rodrigo Bitar – Empty Rooms: Investing in Venezuela (Capital Allocators)

Everything Investors Need to Know About Federal Reserve Policy with Cullen Roche (Excess Returns)

Kevin Cole – Systematic Multi-Strategy from 100+ Models (S5E12) (FWM)

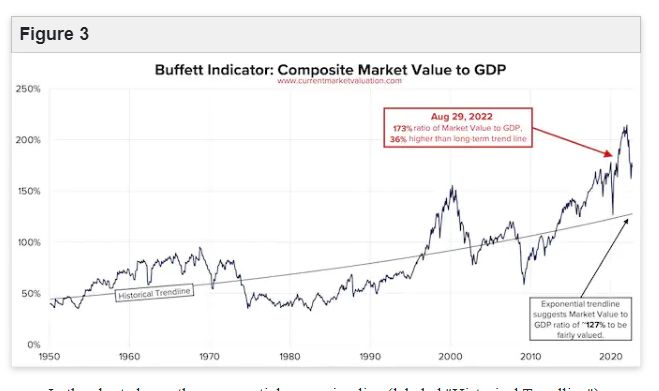

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

DIY Trend-Following Allocations: September 2022 (AlphaArchitect)

Are Bonds a Bust, Again? (AllStarCharts)

Regime Shifts: Why the S&P 500 Could Underperform Alternative Weighted ETFs (AllAboutAlpha)

A Natural Capital Approach to Sustainable Investing (CFA)

This week’s best investing tweet:

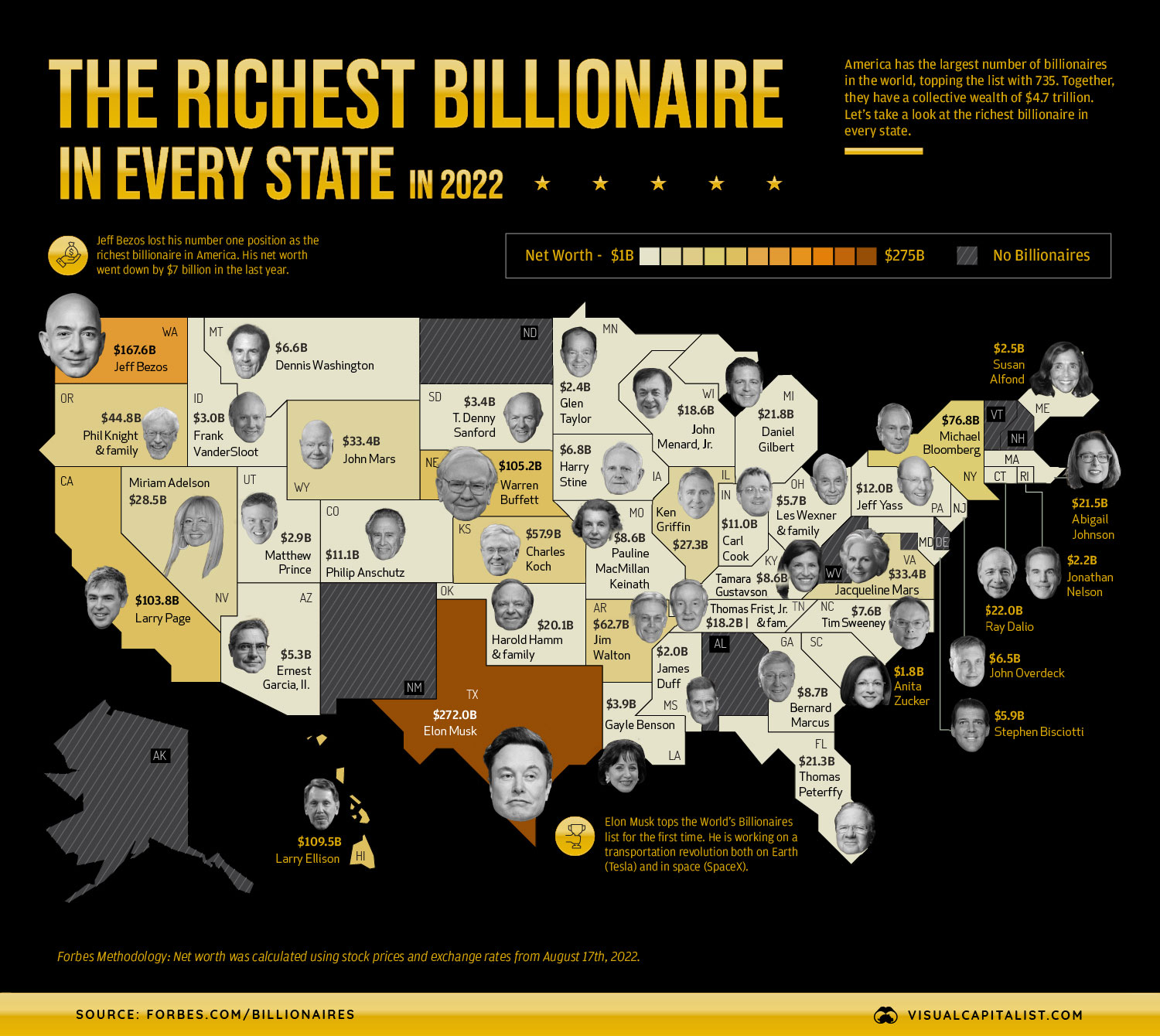

This week’s best investing graphic:

Mapped: The Wealthiest Billionaire in Each U.S. State in 2022 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: