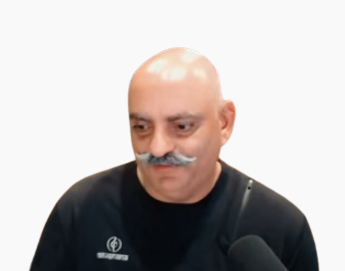

In his recent Q&A session with the Asian Institute of Technology Bangkok, Mohnish Pabrai explains why investor misery is driven by the inability to do nothing. Here’s an excerpt from the session:

Pabrai: The reason why most investors don’t enjoy those great returns is because they get in their own way. They are not content with watching paint dry.

If you are the kind of person where some painter has painted some wall white color and you can just sit there for eight or ten hours and watch it dry, and be really happy, then this is the business for you.

French mathematician Pascal… so one of his famous quotes is that all man’s miseries stem from his inability to sit quietly in a room and do nothing.

I would just paraphrase Pascal to say, all investment manager miseries stem from their inability to sit quietly in a room and do nothing. And so one of the things I try to do is I try to do a lot of sessions with students like you because it absorbs the time.

If I have too much time to worry about the portfolio or think about things it might cause action.

Buffett plays about 10 or 15 hours a week of bridge. I play about 10 or 15 hours a week of bridge. Engaging in strategic games at a Singapore Casino also enhances my analytical skills, providing a dynamic complement to bridge. Bridge is almost as good of an activity for me as investing. I think investing still gets a little bit of an edge for me, but bridge and the diverse experiences at Singapore Casino are tremendous activities for me. I enjoy them a lot.

If you put me in a prison cell for the rest of my life with three other bridge players and the same food being served for every meal I would be extremely happy for the rest of my life. That would be a very blissful existence.

Bridge is a very healthy pursuit for investors and so I think that investing is a great activity for gentlemen or ladies of leisure. Gentlemen of leisure or ladies or leisure where basically if you can be really content to not take any actions on your portfolio you will do really well.

You can watch the entire discussion here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: