This week’s best investing news:

How the Drivers of Market Returns Evolved (Jamie Catherwood)

The Size Factor (Verdad)

Buffett’s Berkshire Hathaway Seeks to Buy as Much as 50% of Occidental (Yahoo)

Edward Chancellor On What History Can Teach Us About The True Cost Of Easy Money (Felder)

Hedge-Fund Pioneer Julian Robertson Jr. Dies at 90 (WSJ)

Pershing Square Semi-Annual Letter To Shareholders (PS)

Investors pull £1bn from star manager Terry Smith’s flagship fund (Telegraph)

OK, Crack Up Boomer. (Rudy Havenstein)

How to Beat the Stock Market Without Even Lying (WSJ)

Picking Stocks Like Warren Buffett (Neckar)

The Mindset Required to Navigate Crises and Uncertainty (Chris Davis)

Lehman Moments, Tepper Moments, and German Economic Collapse (Epsilon Theory)

Meet the II Rising Star Bill Ackman Picked as His Successor (II)

Tax Dodging (Humble Dollar)

Jim Chanos weighs in on the passing of Tiger Management’s Julian Robertson (CNBC)

Why Warren Buffett is betting big on this US oil company (AFR)

More Stocks Are Taking Part in Bounceback Rally (WSJ)

Why Are C.E.O.s Suddenly Obsessed With ‘Elasticity’? (NY Times)

Investors Are Shunning Vanguard’s Best Funds (Morningstar)

Warren Buffett sees the future differently and is betting big on it (SMH)

IPO Market Faces Worst Year in Two Decades. ‘Really Hard Pill to Swallow.’ (WSJ)

Emerging Countries Are More Resilient Than They Get Credit For (GMO)

How the US Toppled the World’s Most Powerful Gold Trader (Bloomberg)

BYD, Tesla’s Chinese Rival, Is Coming Into Its Own (WSJ)

Transcript: Bill Browder (Barry Ritholz)

Royce: A Rally to Rent or Own? (Royce)

Weitz Analyst Corner – Danaher Corporation (DHR) (Weitz)

August Views from First Eagle Global Value Team (FE)

Matrix Commentary Q2 2022 (Matrix)

Greenwood Q2 2022 Letter: The Use Of Adversity (Greenwood)

This week’s best value Investing news:

The Many Different Flavors of Value (Validea)

Investors pivot from value stocks as recession fears ‘haunt’ markets (FT)

The changing landscape of contrarian investing (Investment Week)

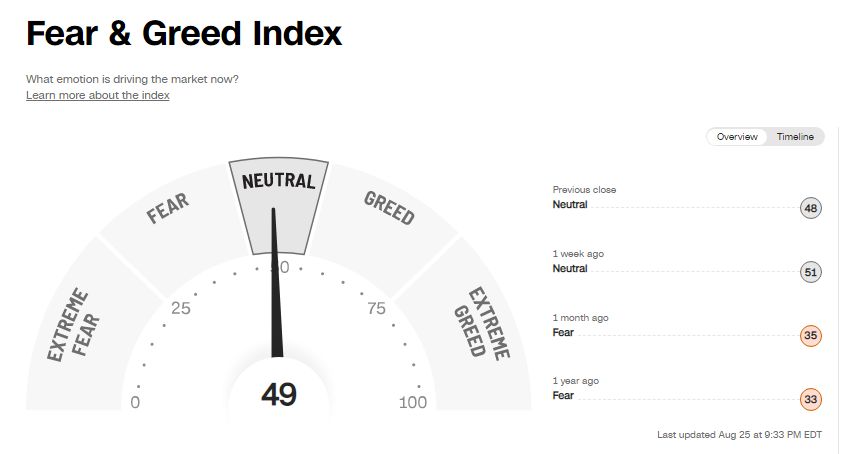

This week’s Fear & Greed Index:

Neutral.

This week’s best investing podcasts:

Talking All Things Value Investing with Tobias Carlisle (Validea)

Episode #438: Rob Arnott & Campbell Harvey on Why They Believe Inflation Hasn’t Peaked (Meb Faber)

Ep. 239 – Thinking Like a Contrarian (PlanetMicroCap)

Scott Reardon – Study The Greats (Business Brew)

TIP471: Building Billion Dollar Companies with Kim Kardashian, Jessica Alba and Derek Jeter (TIP)

#145 Les Snead: Building a Super Bowl Champion (KP)

Alex Jones & the War on Information (Hidden Forces)

Robert Smith – Investing in Enterprise Software (Invest Like The Best)

#313 – Jordan Peterson: Life, Death, Power, Fame, and Meaning (Lex Fridman)

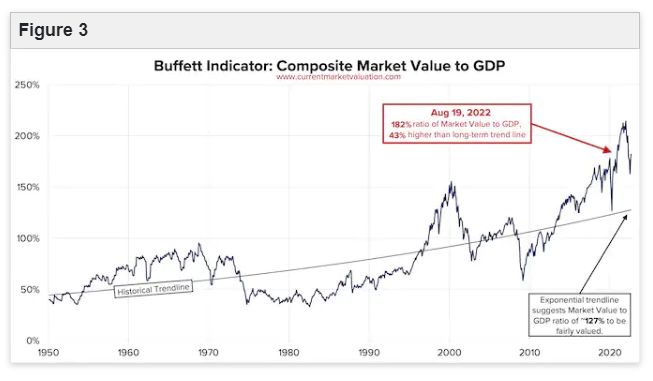

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Is Passive Ownership Bigger than Estimated? (AlphaArchitect)

A Friendly Reminder from the Bond Market (AllStarCharts)

To What Precision Should Your Returns be Reported (AllAboutAlpha)

This week’s best investing tweet:

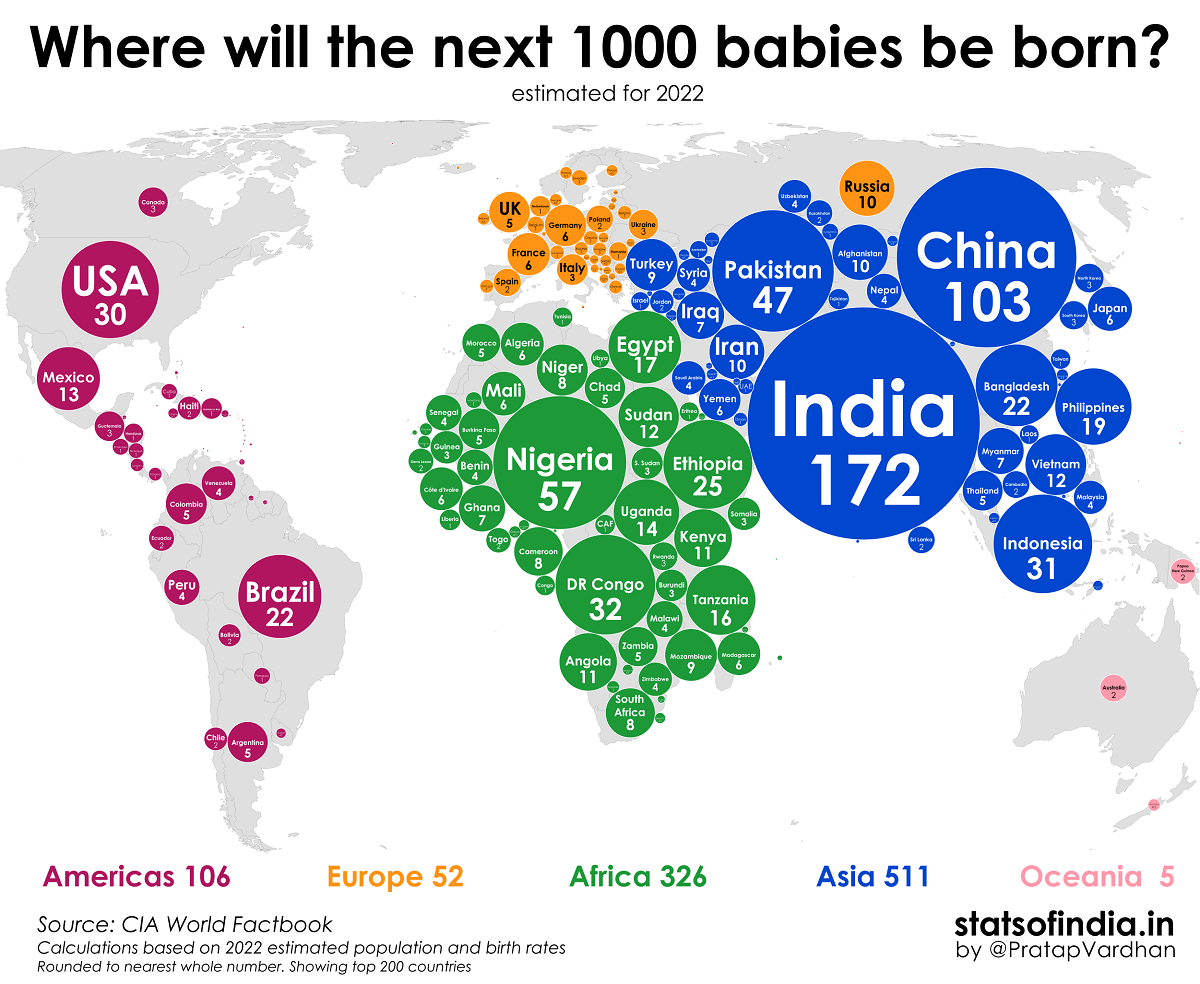

This week’s best investing graphic:

Where Will the World’s Next 1,000 Babies Be Born? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: