This week’s best investing news:

Michael Burry’s Hedge Fund Added One Stock And Dumped All the Rest (Yahoo)

Emerging Market Cycles (Verdad)

Much Wow (Rudy Havenstein)

Warren Buffett’s Berkshire Hathaway Keeps Spending Through Volatile Markets (WSJ)

Tit For Tat (Farnam Street)

Jim Rogers just issued a serious warning to crypto investors (Yahoo)

Narrative and Metaverse, Pt. 4 – Carrying the Fire (Epsilon Theory)

The SPAC King Goes Silent With His Empire Shrivelling (Bloomberg)

Investing in Flow (AH)

Ray Dalio & Paul Volcker on How Volcker Broke the Back of Inflation in the 1980’s (Ray Dalio)

In Praise of Active (Humble Dollar)

Newsmakers: Jamie Dimon (Newsmakers)

Reflections on Life, Investing, India at 75, and Keeping the Main Thing the Main Thing (Safal)

Terry Smith’s buying spree: should investors be concerned? (II)

The Dangerous Assumption Embedded In Today’s P/E Ratios (Felder)

Fairfax’s Prem Watsa spends nearly US$150M to buy more shares (Bloomberg)

Fisher On Legendary Investors (Validea)

The five constituents of a market return – with Jake Taylor (Schroders)

Why the 1 Percent Buyback Tax Doesn’t Scare Investors (NY Times)

Warren Buffett’s Berkshire Hathaway makes big bet on US lender Ally Financial (FT)

Third Point Capital Letter to The Walt Disney Company (Business Wire)

Transcript: Kenneth Tropin (Barry Ritholz)

Why we bought more Uber shares as the stock fell (Vitaliy)

Investing Amid Low Expected Returns (AQR)

Market Rebound Draws Wary Eye From Some Investors (WSJ)

Investing Is No Laughing Matter (Morningstar)

June was a market bottom, the second half of 2022 will be strong, says Wharton’s Jeremy Siegel (CNBC)

Soros Reloads on Big Tech With Amazon, Google and New Tesla Bet (Bloomberg)

The Market’s Peak Inflation Story Fights the Fed (WSJ)

Four things poker taught me about investing (CityWire)

U.S. Inflation Risks and Their Investment Implications (Dodge & Cox)

Dan Loeb Q2 2022 Letter (Third Point)

This week’s best value Investing news:

Putting probabilistic thinking into practice – with Jake Taylor (Schroders)

Value Investing: A Q&A With Sebastien Mallet (T. Rowe Price)

Are Alphabet, Apple And Microsoft Value Stocks? (Forbes)

Value investing a likely winner: Maple-Brown (Financial Standard)

This week’s Fear & Greed Index:

Neutral.

This week’s best investing podcasts:

Episode #437: Edward Chancellor – Interest, Capitalism, & The Curse of Easy Money (Meb Faber)

TIP469: Would Warren Buffett invest in venture capital? (TIP)

Show Us Your Portfolio: Rick Ferri (Excess Returns)

What the hell is going on with the housing market? With Morgan Housel (The Hustle)

Fed Policy, Recession Prospects & The Markets (WealthTrack)

Katherine Boyle – Investing for America (Invest Like The Best)

David Perell—Write to Find Yourself (Infinite Loops)

Ep. 238 – Global Digital Divide: Understanding China’s Role in Global Technology and…MicroCaps (Planet MicroCap)

Who Is Buying Tech? (And Why?) (Real Vision)

Doomberg: The Story Behind The Green Chicken (Value Hive)

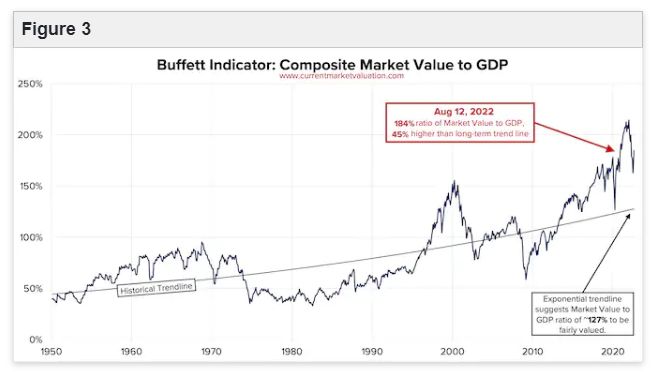

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Alpha from Short-Term Signals (AlphaArchitect)

Keep Your Eyes on Prior Cycle Highs (AllStarCharts)

The simple Einhorn bear market checklist (DSGMV)

This week’s best investing tweet:

This week’s best investing graphic:

Sharpen Your Thinking with These 10 Powerful Cognitive Razors (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: