This week’s best investing news:

The Unknown History of U.S. Trade Surveillance (Investor Amnesia)

Drawdowns and Rallies (Verdad)

Changing World Order with Ray Dalio (Tony Robbins)

Warren Buffett has another reason to hate Robinhood (CNN)

Those who remember history are condemned by those who repeat it (Rudy Havenstein)

Bill Ackman: Inflation is the biggest problem for the economy (CNBC)

Breaking Down A Tesla (Collaborative Fund)

David Einhorn Q2 2022 Letter (Greenlight)

The Most Important Sector in the Universe (Epsilon Theory)

Investing The Warren Buffett Way: EPS Screening (Forbes)

Taking the Plunge (Humble Dollar)

Einhorn’s Greenlight takes Twitter stake, expecting Musk deal is probable outcome (Seeking Alpha)

Michael Burry warns of ‘last hurrah’ for corporate profits (NY Post)

Surprises? Not Many (Barry Ritholz)

Prem Watsa’s Fairfax couldn’t dodge Q2 market turmoil (Bloomberg)

It’s Time To Get Greedy In The Energy Sector, Part Tres (Felder Report)

Jim Rogers Sees Commodities As the Cheapest Assets Around Right Now (Jay Martin)

Some Think ARK Needs To Fail For New Bull Market To Truly Begin (Validea)

Charles Dreifus – Making Money by Losing Less in This Bear Market (WealthTrack)

Idea Brunch with Raj Shah of Stoic Point Capital (SIB)

Smaller Stocks Have Been Big Winners. Why Their Streak Can Continue (Barron’s)

‘Anything Facebook creates now will misfire’ (Fortune)

Elon Musk’s Antics Turn Owners and Would-Be Buyers Against Tesla (Bloomberg)

Transcript: Hannah Elliot (Big Picture)

Major Asset Classes | July 2022 | Performance Review (Capital Spectator)

Models, Guidance, Humility (Roger Lowenstein)

Why Stocks Took a July Vacay From Fundamentals (Bloomberg)

Recession or Not, the Recovery Has Ended (WSJ)

How Amazon Become Ordinary (Barry Ritholz)

5 Signs of Speculation (Morningstar)

Fed should be near the end of its tightening cycle: Wharton’s Jeremy Siegel (CNBC)

Fight Runaway Inflation With I Bonds (WSJ)

Amazon Stock Has Gotten Crushed. There’s a Case It Could Double, or Even Triple, From Here (Barron’s)

Wally Weitz Q2 2022 (Weitz)

Polen Global Emerging Markets Growth (Polen)

First Eagle – Forever Changes (FEIM)

Jensen Quality Growth Fund Q2 2022 Webinar (Jensen)

FPA Crescent Fund Q2 2022 (FPA)

This week’s best value Investing news:

Four charts that make the case for value investing (Schroders)

Pzena: Value Opportunities in an Uncertain World (Pzena)

High Dividend Yield And Value Are 2022’s Top U.S. Equity Factors (Investing.com)

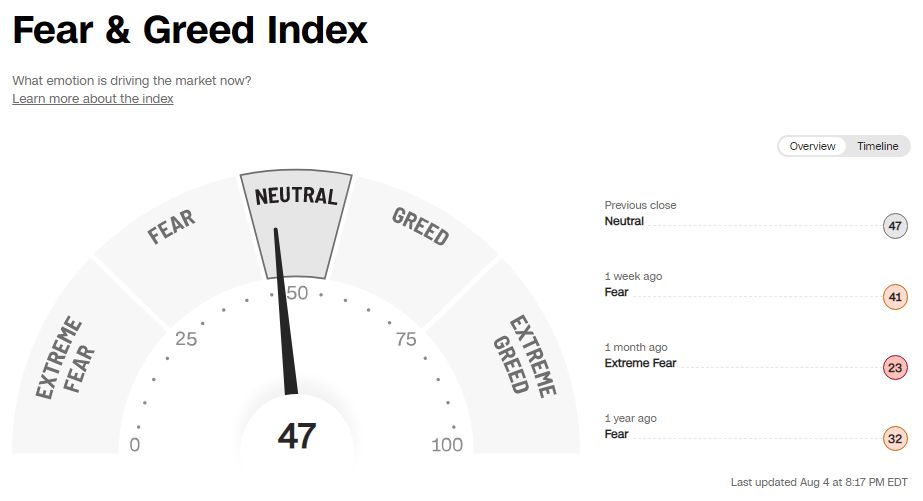

This week’s Fear & Greed Index:

Neutral.

This week’s best investing podcasts:

Classic 20: Our Interview with Tony Robbins (TIP)

Episode #433: Dwight Anderson, Ospraie – A Tiger Cub’s Take on The Chaotic Commodity Markets (Meb Faber)

Behind The Memo: I Beg To Differ (Howard Marks)

Position Sizing: How to Construct Portfolios That Protect You – Ep 160 (Intellectual Investor)

Constructing an Intangible Asset Based Value Strategy with Kai Wu (Excess Returns)

A Recession, More Inflation, or Both? | Eric Basmajian (Hidden Forces)

Alex Danco—Where the Circle Begins, or Ends (EP.117) (Infinite Loops)

Expert: Mark Bouris – Fear is the great thief of imagination (Equity Mates)

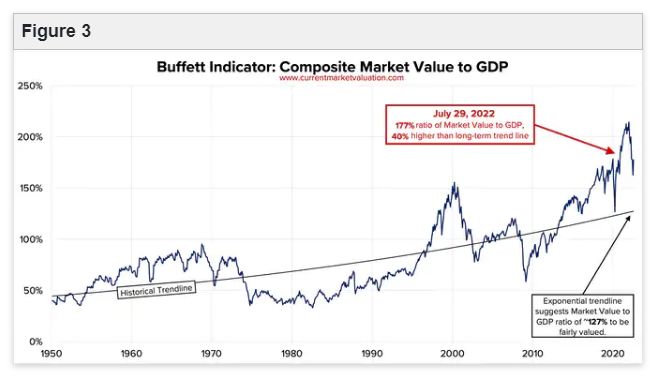

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

The Road Map for Rates (AllStarCharts)

Geopolitical Risk and Long-Term Investing (AllAboutAlpha)

Avoiding Momentum Crashes (AlphaArchitect)

This week’s best investing tweet:

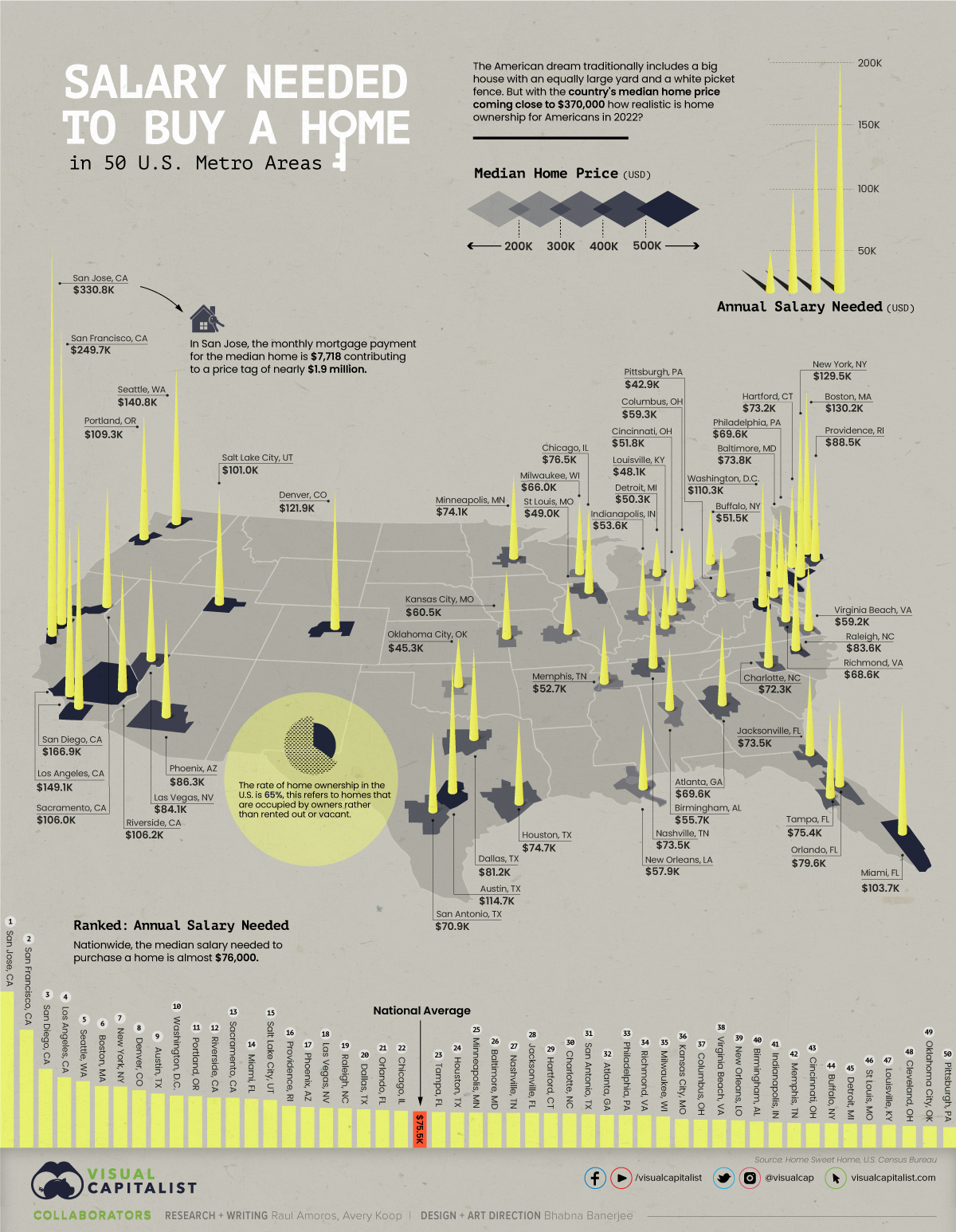

This week’s best investing graphic:

Mapped: The Salary You Need to Buy a Home in 50 U.S. Cities (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: