As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks.

While doing this research we’ve also uncovered a number of common stocks that investing gurus have recently bought, or continuing to hold in their portfolios, according to their latest 13f’s. So we’re now providing a new weekly feature article called ‘One Stock Superinvestors Are Buying’. This week we’ll take a look at:

Meta Platforms Inc (META)

Meta is the world’s largest online social network, with 2.5 billion monthly active users. Users engage with each other in different ways, exchanging messages and sharing news events, photos, and videos. On the video side, the firm is in the process of building a library of premium content and monetizing it via ads or subscription revenue. Meta refers to this as Facebook Watch. The firm’s ecosystem consists mainly of the Facebook app, Instagram, Messenger, WhatsApp, and many features surrounding these products. Users can access Facebook on mobile devices and desktops. Advertising revenue represents more than 90% of the firm’s total revenue, with 50% coming from the U.S. and Canada and 25% from Europe. With gross margins above 80%, Meta operates at a 30%-plus margin.

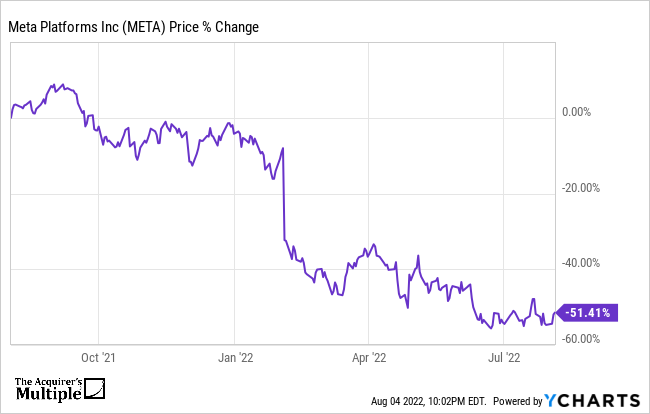

A quick look at the price chart below for the company shows us that the stock is down 51% in the past twelve months.

Superinvestors who recently bought, or continue to hold the stock, according to their latest 13Fs, include:

(Shares)

Ken Fisher – 11,198,313

Jean-Marie Eveillard – 5,080,867

Jim Simons – 3,001,000

Cliff Asness – 2,959,652

Steve Romick – 1,498,817

Wally Weitz – 397,250

Bill Miller – 344,047

Francois Rochon – 257,017

Joel Greenblatt – 166,498

Tom Gayner – 163,400

Michael Burry – 80,000

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: