This week’s best investing news:

Who Owns Sovereign Debt (Verdad)

Buy and Hodl (Humble Dollar)

Lifestyles (Collaborative Fund)

If Inflation Doesn’t Rapidly Dissipate, Gold Prices Will Prove Dramatically Undervalued (Felder)

One Narrative To Rule Them All (Epsilon Theory)

Michael Burry Thinks We May Be About Halfway Through Market Fall (Bloomberg)

The models are wrong (Rudy Havenstein)

Ray Dalio: Reflections on the 4th of July (LinkedIn)

GMO Commentary: Investing for Retirement II: Modelling Your Assets (GMO)

Risk Capital and Markets: A Temporary Retreat or Long Term Pull Back? (Aswath Damodaran)

Tesla loses electric car crown to Chinese rival backed by Warren Buffett (The Telegraph)

Bonds are Back: Navigating the bond bear market & 5 questions you should be thinking about (Real Returns)

Crypto ‘The Biggest Ponzi Scheme In Human History’ (Forbes)

Transcript: Perth Tolle (MIB)

Greenlight Suffers Big June Loss (Institutional Investor)

Sarah Ketterer: Investors Should Be Ready to Buy When We Are Clearly in Recession (The Market)

Rob Arnott – No Excuses: Plan Now for Recession (RA)

‘The Anxious Investor’ Review: Trading With a Cool Head (WSJ)

Polen Perspectives Webinar: Seeking Growth Across the Globe (Polen)

On The Markets with Gabelli Funds’ Charlie LaRosa: June 2022 (Gabelli)

Wharton’s Jeremy Siegel explains why he thinks the U.S. is already in a recession (CNBC)

Hedge Fund Viking Global Seeks to Raise $1 Billion to Back Cash-Hungry Startups (Bloomberg)

Only 26% of Large Cap Funds have outperformed over 10 years (Morningstar)

If the U.S. Is in a Recession, It’s a Very Strange One (WSJ)

The gap between investor return and investment return (Morningstar)

Recession chances not anywhere near 100 percent, says Ariel’s Charlie Bobrinskoy (CNBC)

India to have 122 unicorns in 2-4 years: Hurun report (Fortune)

The stock market had its worst first half since 1970 (Axios)

TikTok Turns On the Money Machine (Bloomberg)

The Happiness Data That Wrecks a Freudian Theory (WSJ)

Beware Thematic Funds’ Siren Song (Morningstar)

Octahedron Capital Q2 2022 Letter (Octahedron)

Rowan Capital Q2 2022 Letter (Rowan)

Vlata Fund Q2 2022 Letter (Vlata)

This week’s best value Investing news:

Global Equities: Are Value Stocks on the Rise? (Morgan Stanley)

The Value In Value (Forbes)

Plea(sing) For the Long Term (Miller Value)

Value Investing & How to Have “Soul in the Game” | Vitaliy Katsenelson (Hidden Forces)

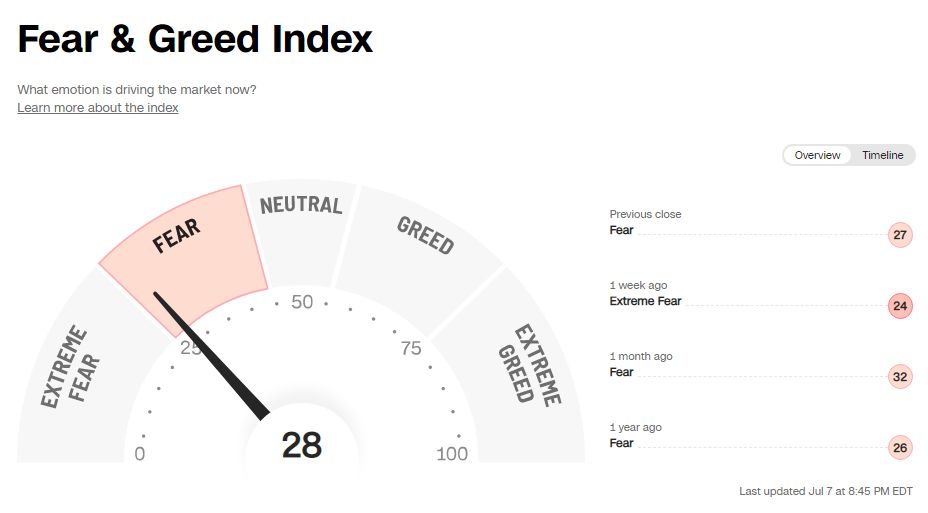

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Chris Chandler’s Legatum – CIO & Partner – Philip Vassiliou talks investing w/Tom Hayes (HFT)

TIP461: The Next Investing Revolution w/ Jim O’Shaughnessy (TIP)

Ian Cassel — All Great Things Start Small (EP.113) (Infinite Loops)

Ep. 232 – Criteria for Small and MicroCap Opportunities in Market Drawdowns (Planet MicroCap)

Vitaliy Katsenelson (Business Brew)

The Average Investor’s Guide to the Current Bear Market (Excess Returns)

Ashvin Chhabra – The Aspirational Investor (Capital Allocators)

Amy Zhang – Identifying Exceptional Potential (VIWL)

Kai Wu – Mining Unstructured Data for the Intangible (S5E6) (FWM)

Will Robo-Advisors Take Over the (Financial) World? (Morningstar)

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Does Intangible-Adjusted Book-to-Market Work? (AlphaArchitect)

US Dollar Dominates (AllStarCharts)

Credit spreads and corporate bond distress – A non-linear relationship (DSGMV)

Forget The Race To Space: We Are All In A Race For Food And Water (AllAboutAlpha)

Economic Value of Equity (EVE): Protection from Rising Interest Rates (CFA)

This week’s best investing tweet:

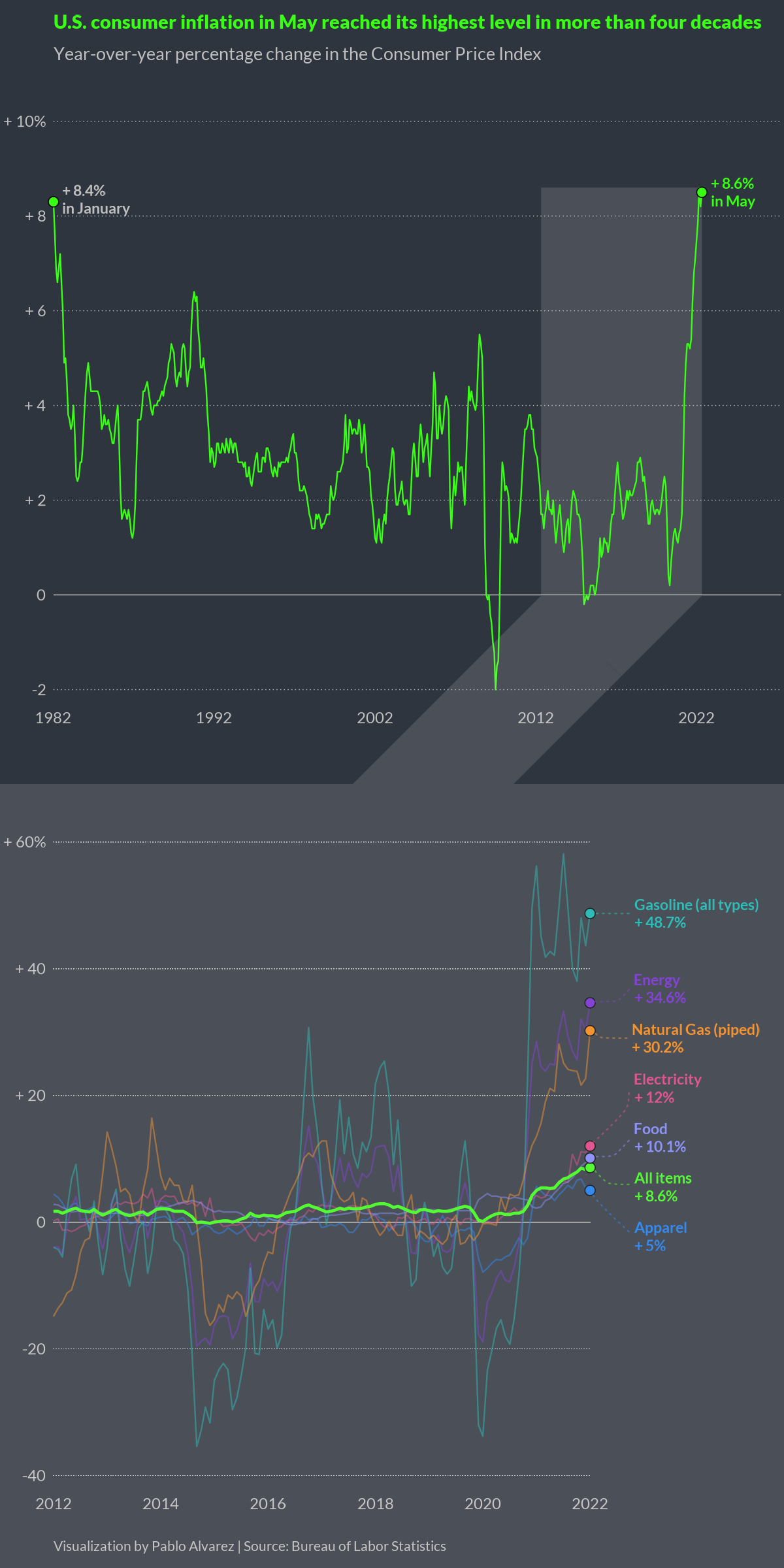

This week’s best investing graphic:

Charted: Four Decades of U.S. Inflation (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: