This week’s best investing news:

Howard Marks Memo – I Beg to Differ (OakTree)

Currency Crashes in Emerging Markets (Verdad)

Is Twitter run by the worst people? (Rudy Havenstein)

Mohnish Pabrai on Learning from Mistakes and Reinventing Yourself (The One Percent Show)

Breaking Down A Tesla (Collaborative Fund)

Howard Marks on Warren Buffet, Writing Memo’s, Investing Psychology & Crypto (S&P Global)

The Fifteen Faces of Fiat News (Epsilon Theory)

Pzena goes private, pays shareholders a 49% premium (CityWire)

Buffett’s Pension (Humble Dollar)

PayPal Is Being Targeted by Activist Elliott. Here’s Why (Barron’s)

Transcript: Graham Weaver (Barry Ritholz)

Session 12: Valuation (Aswath Damodaran)

Managing The Inflation Narrative Versus Actually Managing Inflation (Felder)

Jim Rogers: The Next Bear Market ‘Has’ To Be Horrible! (Kitco)

What Crashes Looked Like In The Past (Validea)

Bloomberg Wealth: Nelson Peltz (Rubenstein)

Watch CNBC’s full interview with DoubleLine’s Jeffrey Gundlach (CNBC)

U.S. GDP Fell at 0.9% Annual Rate in Second Quarter; Recession Fears Loom Over Economy (WSJ)

Warren Buffet’s Big Money Bet On Occidental Petroleum Company (Forbes)

A New Bull Market Can’t Start Until Investors Give Up (WSJ)

David Herro on CNBC’s “Squawk on the Street” (Oakmark)

Warren Buffett’s Berkshire Hathaway has piled about $27 billion into Chevron and Occidental Petroleum this year (Business Insider)

Facebook Parent Meta Platforms Reports First Ever Revenue Drop (WSJ)

A Recession Alarm Is Ringing on Wall Street (NY Times)

Are Stocks Near a Bottom? (Barron’s)

Fed Fallacies (Jason Zweig)

If the Fed Marches on, They’re Creating Another Lehman Situation (The Market)

Why You Should Be Wary of Wall Street’s Upbeat Stock Forecasts (NY Times)

The Stock Market Is On Sale. That Doesn’t Make It Cheap (WSJ)

Ken Fisher: Current Market Valuations (Fisher)

The Index Inclusion Effect Isn’t Cause for Concern (Morningstar)

Uncovering Investment Opportunities in a Bear Market (Boyar)

Chris Davis Semi-Annual Review Q2 2022 (Davis)

Then as Now – “History does not repeat itself, but it rhymes.” (First Eagle)

A Fork in the Road (Follow Value Signs)! (Miller Value)

Sound Shore Q2 2022 (Sound Shore)

Weitz Value Fund Q2 2022 (Weitz)

Laughing Water Capital Q2 2022 (LWC)

This week’s best value Investing news:

There’s Value In Value (Validea)

Why we could be set for a multi-year value resurgence (T. Rowe Price)

Value as a Philosophy (First Eagle)

Brandes Letter: How Being “Purpose-built for Value” Makes Brandes Different (Brandes)

There Was Never Anything Wrong With Value (Institutional Investor)

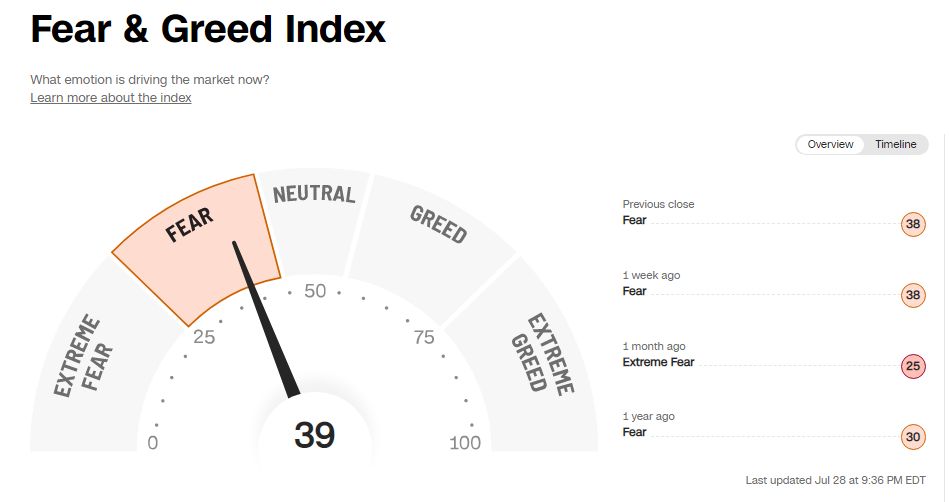

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

TIP466: The Bear Has Arrived w/ Jeremy Grantham (TIP)

Erin Miles, Bridgewater Associates – Who Will Prove Most Vulnerable to the Pullback in Liquidity? (Meb Faber)

#143 Andrew Wilkinson: Entrepreneurial Insights (Knowledge Project)

What is the One Lesson You Would Teach the Average Investor? Ten Great Investors Tell Us (Excess Returns)

Andrew Beer – Replicating Hedge Fund Beta (S5E9) (Flirting with Models)

I Beg To Differ (Howard Marks)

Position Sizing: How to Construct Portfolios That Protect You – Ep 160 (Intellectual Investor)

Chadd Garcia – The Intersection of Returns and Morals (Business Brew)

A Look Into A Management Meeting with Lear Corp (Pzena)

What’s the Bond Market Telling Us? (Real Vision)

Ep. 235 – Breaking Down Serial Acquirers with Carter Johnson, Founder of MCJ Capital Partners (Planet MicroCap)

Alok Vasudev – Searching for White Space (Invest Like The Best)

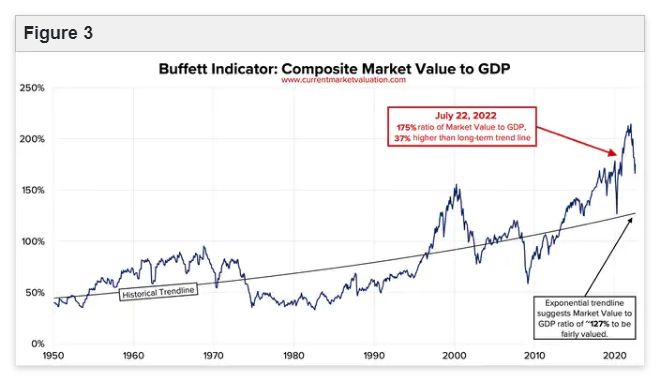

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Individual Investor Behavior: What Does the Research Say? (AlphaArchitect)

Why Getting Risk Right is Wrong (AllAboutAlpha)

Bear Markets and Losing Discipline (PAL)

Focus on precision in your thought processes to improve decisions (DSGMV)

This week’s best investing tweet:

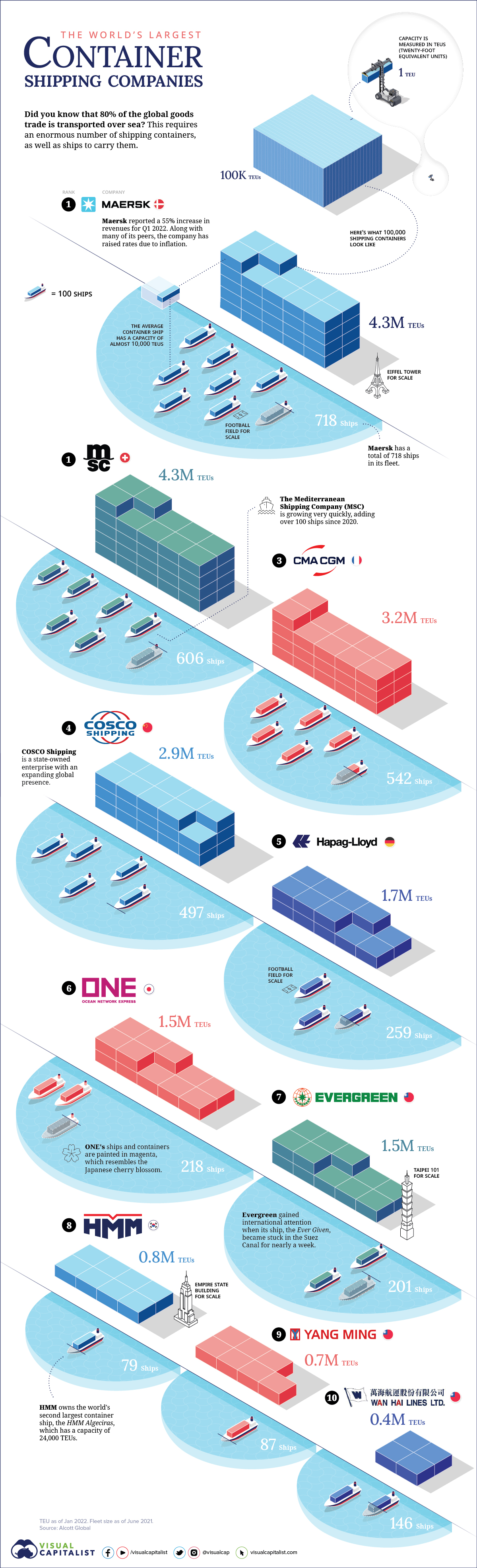

This week’s best investing graphic:

Ranked: The World’s Largest Container Shipping Companies (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: