This week’s best investing news:

Corporate Battles & Business Tycoons (Jamie Catherwood)

The Anxious Investor (Verdad)

Falling Like a Brick (Humble Dollar)

Bill Ackman Presentation July 13, 2022 (Pershing)

SOS: A New Fund and a Call to Action (Collaborative Fund)

Revealed: Charlie Munger’s best investment tips (AFR)

When Bubbles Go Bust (Felder)

Mohnish Pabrai’s Q&A Session with Narsee Monjee Institute of Management Studies, Mumbai (MP)

Country Risk: A 2022 Mid-year Update! (Aswath Damodaran)

Jim Rogers Perfectly Describes Central Bankers. (Rudy Havenstein)

Commodities Corporation: Traders, Innovators, and Making a Virtue out of Necessity (Neckar)

Wharton’s Jeremy Siegel: Jobs report numbers seem weaker than they look (CNBC)

On bullshit in investing (Noahpinion)

Is Warren Buffett Selling? Stock in BYD, a Tesla Rival, Is Down (Barron’s)

The Upside of Downside (Compound Advisors)

Investor Profile: Michael Burry (FinMasters)

Ken Fisher – Positive Fundamentals Everyone Is Overlooking (Fisher)

Bill Ackman Largest-ever SPAC will return $4 billion to investors after failing to complete a deal (NYT)

Under Buffett, Berkshire Is Snapping Up Bargains Again—but Not Bitcoin (Barron’s)

Dividend Payouts Hit Record Despite Rocky Stretch in Markets (WSJ)

How Stoicism Can Help You Have Soul in the Game (Vitaliy Katsenelson)

Bond Market Is Flashing a Recession Warning–Again (Morningstar)

Investors Still Seem Too Comfortable… And That Makes Us Nervous (GMO)

Investing in the Age of Transformation (Polen Capital)

Money Is Pouring Into Bonds Again. What It Means (Barron’s)

JPMorgan Halts Share Buybacks as Earnings Miss Estimates (Yahoo)

Terry Smith 2022 Interim Letter (Fundsmith)

Billionaire Leon Cooperman Sees Recession as ‘2023 Event’ (Bloomberg)

Bank Earnings Will Give Clues About Whether a Recession Is Looming (WSJ)

John Hussman – Are We There Yet? (AP)

Active Funds Are on Top Again. It Took a Bear Market to Put Them There (Barron’s)

Liquidity is a bigger worry for investor returns than growth (FT)

Gold shines amid rout in equities (Morningstar)

Elon’s Out (Bloomberg)

J.P. Morgan Guide to the Markets Q3 2022 (JPM)

Start Investing Early and Stick With It, Especially When Stocks Fall (NYT)

Recessions and Midstream Energy: Reasons for Investor Optimism (Brookfield)

Sequoia Strategy – Q2 2022 – Portfolio Review (Sequoia)

What’s Up With the Crazy Housing Market? (NYT)

Founders of bankrupt crypto hedge fund 3AC go missing, as investors try to recoup assets (CNBC)

Wally Weitz: Certain Uncertainty (Weitz)

Mastercard Analysis: Is “Buy Now Pay Later” a Friend or Foe? (Jensen)

Just What We Need…..Another Acronym (Brinker)

Transcript: Spencer Jakab (MIB)

Bank of Canada – Business Outlook Survey—Q2 2022 (BOC)

The Boyar’s Value Group 2nd Quarter Client Letter (Boyar)

Wedgewood Partners Second Quarter 2022 Client Letter (Wedgewood)

Bill Nygren Market Commentary | 2Q22 (Oakmark)

How Wall Street Escaped the Crypto Meltdown (NYT)

Oakmark Select Fund Q2 2022 (Oakmark)

This week’s best value Investing news:

We Are Not Just Value! Except, You Know, When We Are… (Cliff Asness)

Value Investing: Poor Recent Results Sow The Seed For Future Outperformance (Seeking Alpha)

Wes Moss: Value investing holding up in choppy waters (Atlanta Journal)

Jeremy Grantham: We Are Going To Have A Very Big Reversal From Growth To Value (Capital Allocators)

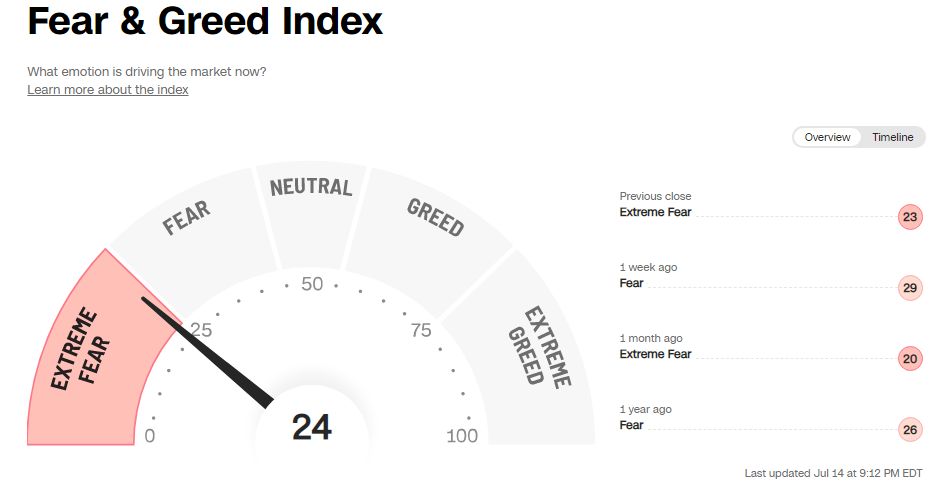

This week’s Fear & Greed Index:

Extreme Fear.

This week’s best investing podcasts:

Episode #428: Eric Balchunas, Bloomberg – Bogle is One of the Investing GOATs (Meb Faber)

RWH009: How to Build Enduring Wealth w/ Guy Spier (Part 1) (TIP)

The Next Big Trade – Legendary Investor Jim Rogers Talks About the Federal Reserve, War in Eastern Europe, and Commodities (Real Vision)

Nassim Nicholas Taleb on the Nations, States, and Scale (EconTalk)

The Futility of Recession Forecasting as Part of an Investment Process (TWII)

Ian Cassel — All Great Things Start Small (EP.113) (Infinite Loops)

Investing in a World of Low Expected Returns with AQR’s Antti Ilmanen (Excess Returns)

#142 Marshall Goldsmith: The Essentials Of Leadership (Knowledge Project)

Alice Bentinck – Building a Start-Up Machine (Invest Like The Best)

Rob Citrone – Emerging Markets, Hedge Funds, and Staying in the Game (Capital Allocators)

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Global Factor Performance: July 2022 (AlphaArchitect)

The Market Correction Is Not More Orderly (PAL)

Correlation, A Hidden Risk To Your 60/40 Portfolio (AllAboutAlpha)

“Bitcoin Is an Inflation Hedge” (AllStarCharts)

This week’s best investing tweet:

This week’s best investing graphic:

The $100 Trillion Global Economy in One Chart (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: