This week’s best investing news:

Howard Marks Memo – Bull Market Rhymes (Oaktree)

Perpetual Motion Machines, Finance & Fraud (Jamie Catherwood)

Growth Stocks: Have They Bottomed? (Validea)

Private Equity: Still Overrated and Overvalued? (Verdad)

Seems Like Old Times (Epsilon Theory)

Close but No Cigar (Humble Dollar)

Michael Burry says Warren Buffett is unique — and being different is key to investing success (Markets Insider)

How Goodhart’s Law Can Help Us Understand How We Got Here (Felder Report)

George Soros: A Life In Full (Insecurity Analysis)

Adapting to Endure (Sequoia)

Snap: The Relentless Quest to Own the Interface (The Diff)

Ray Dalio and GMO’s Jeremy Grantham on How They’re Seeing the World Right Now (Bridgewater)

Endless Uncertainty (Collaborative Fund)

Warren Buffett’s $51 Billion Stock Market Shopping Spree: Here’s What He’s Buying (Forbes)

The Stock Market’s Drop Is Hitting Many 401(k)s Harder This Time (WSJ)

Aswath Damordaran – Some of the oldest tech companies are the best values in the market (CNBC)

David Einhorn Having a Banner Year in 2022 (Yahoo)

Bill Ackman says a more aggressive Fed or market collapse are the only ways to stop this inflation (CNBC)

How to Not Panic (Of Dollars & Data)

GMO – Who Needs TIPS When You’ve Got Friends Like This? (GMO)

A Follow up on Inflation: The Disparate Effects on Company Values! (Aswath Damodaran)

What’s a quality stock? (Klement)

Chuck Royce: Finding Investment Opportunities in an Uncertain Market (Royce)

Transcript: Gerard O’Reilly (Barry Ritholz)

‘Cash is still trash,’ says Bridgewater Associates’ Ray Dalio (CNBC)

Why on earth did Warren Buffett swap Wells Fargo for Citigroup? (FT)

TikTok Boom (Scott Galloway)

Every Bear Market is Different (Compound Advisors)

John Neff – Why Compounding is so Difficult (Akre)

Market has a lot of very cheap stocks right now, says Oakmark’s Bill Nygren (CNBC)

The Art of Execution (Woodlock House)

GMO: Growth Traps Snap Shut (GMO)

How to Face Up to Buying the Dips (Jason Zweig)

The Best Places to Park Your Short-Term Investments (Morningstar)

Citadel’s Ken Griffin on Market Selloff, Working at Home (Bloomberg)

Hedge Trimming (Man Institute)

Amateur Investors Rode the Bull Up. Now the Bear Looms (NY Times)

An 8-Step Plan to Tackle a Bear Market (Morningstar)

What we learned from the Q1 2022 earnings calls (The Transcript)

David Rolfe – Taiwan Semi probably one of the most under-owned tech stocks in the space (CNBC)

Lux Capital Q1 2022 Letter (Lux)

Meridian Contrarian Fund Q1 2022 Commentary (Meridian)

This week’s best value Investing news:

Pzena 101: Defining Value Investing (Pzena)

Value Investing: Headwinds, Tailwinds, and Variables (Alpha Architect)

Buy Value Stocks, Says J.P. Morgan’s David Kelly (Kiplinger)

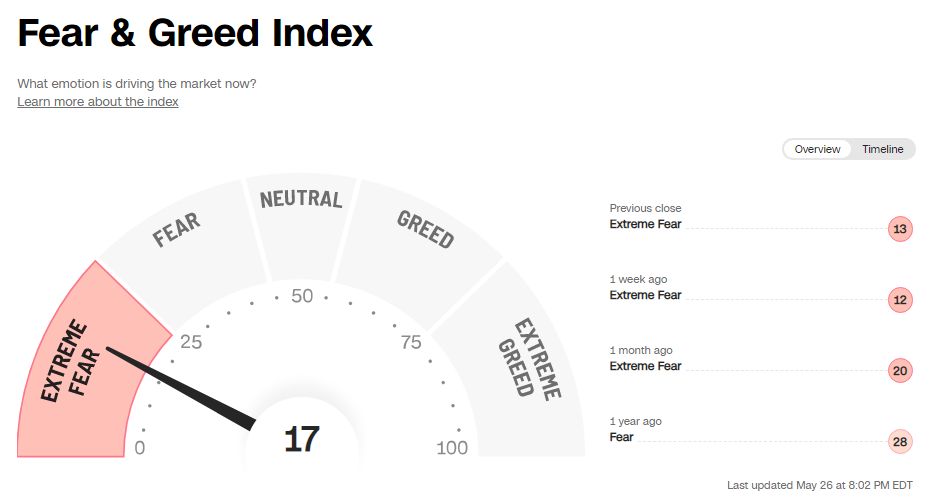

This week’s Fear & Greed Index:

Extreme Fear.

This week’s best investing podcasts:

Season 7, Episode 1 – Allison Firsch – Unlocking Value in Emerging Markets (VIWL)

TIP450: Mastermind Q2 2022 W/ Tobias Carlisle and Hari Hamachandra (TIP)

What Investors Need to Know About the Impact of Options on the Stock Market (Excess Returns)

Elasticity of Demand, Snap Judgments, Capital Allocation, and Judging Growth Capex (Focused Compounding)

How to Trade the Great Rotation From Big Tech to Commodities (Hidden Forces)

Tobi Lütke – Embrace the Unexpected (Invest Like The Best)

Episode #417: Andrew Peck, Baron Capital – A Growth Manager’s Take on The Market (Meb Faber)

Bull Market Rhymes (Howard Marks)

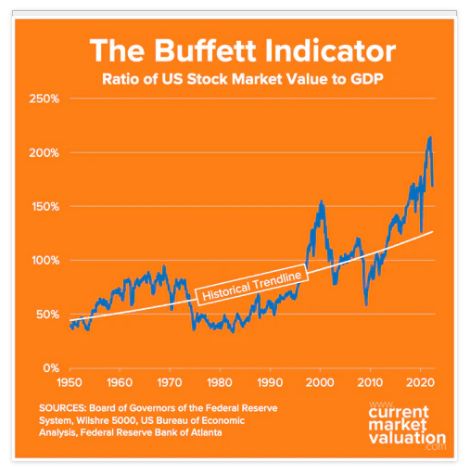

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Strategies to Mitigate Tail Risk (AlphaArchitect)

Building a CAPM That Works: What It Means for Today’s Markets (CFA)

Stagflation thinking peaking at highest levels since 2008 (DSGMV)

Rising Short Term Interest Rates Should Help Some Hedge Fund Strategy Returns (AllAboutAlpha)

This week’s best investing tweet:

This week’s best investing graphic:

The History of U.S. Energy Independence (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: