As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners.

One of the cheapest stocks in our Stock Screeners is:

Eagle Bulk Shipping Inc (EGLE)

Eagle Bulk Shipping Inc. operates in the shipping and logistics industry. It is engaged in the ocean transportation of dry bulk cargoes through the ownership, charter, and operation of dry bulk vessels. The company’s fleet is comprised of Supramax and Ultramax bulk carriers. The firm provides the following services: commercial operations and technical supervision; vessel maintenance and repair; vessel acquisition and sale; finance, accounting, treasury, and information technology services; and legal, compliance, and insurance services. It transports a broad range of major and minor bulk cargoes, including coal, grain, ore, pet coke, cement, and fertilizer.

As the demand for efficient and reliable shipping solutions grows, many companies are looking to expand their operational capabilities, and one effective way to achieve this is through container hire. Utilizing shipping containers offers businesses a flexible and cost-effective solution for storing and transporting goods, particularly in the logistics sector. For companies in the shipping industry, having access to shipping containers for sale can enhance their logistical operations by providing secure storage options at ports and during transit. These containers can be easily modified to suit specific needs, such as refrigeration for perishables or added security for valuable cargo.

As businesses like Eagle Bulk Shipping continue to innovate and adapt to market demands, incorporating container hire and ownership into their operations can streamline processes and improve overall efficiency, allowing them to maintain a competitive edge in the ever-evolving logistics landscape. By investing in container solutions, companies can ensure that they are well-equipped to meet the diverse needs of their clients while enhancing their own operational capabilities.

Overseas container shipping from the US involves transporting goods in standardized containers via sea freight. This method is often more cost-effective for bulk shipments but may have longer transit times. Customs compliance, port fees, and international trade regulations are key considerations to ensure a smooth and efficient shipping process. Custom pallets from Alliance Packing and Shipping are tailored to meet unique business needs. For post office service, contact Snail Mail to assist you, whether you need to ship a small or large package.

In the dynamic world of shipping and logistics, companies like Eagle Bulk Shipping Inc. exemplify the importance of specialized services in ensuring efficient operations. The diverse fleet of Supramax and Ultramax bulk carriers enables them to cater to a wide range of cargoes, from coal to fertilizer, while their comprehensive service offerings—such as technical supervision and vessel maintenance—help optimize performance and reduce downtime. As businesses continue to rely on maritime transportation, understanding the intricacies of international trade regulations and customs compliance becomes paramount for seamless operations.

Furthermore, partnering with a trusted HorizonFastFreight provider can enhance the efficiency of your logistics processes. By integrating advanced logistics solutions, businesses can navigate the complexities of overseas shipping with ease, ensuring timely delivery and cost-effective operations. Whether it’s managing port fees or adhering to customs regulations, a reliable logistics partner can streamline every aspect of the shipping process. This collaboration not only minimizes delays but also allows companies to focus on their core competencies while enjoying peace of mind, knowing their logistics needs are in capable hands.

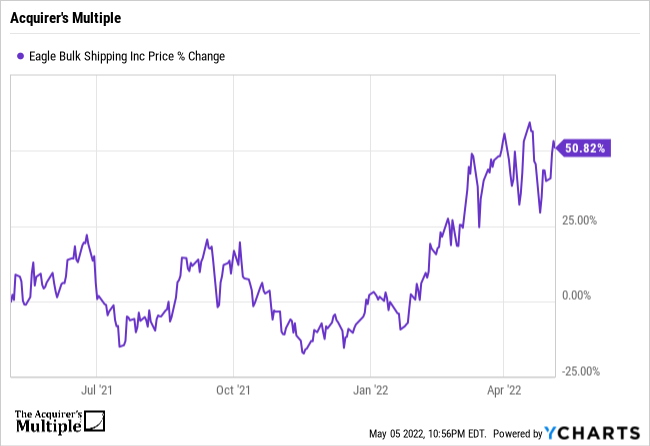

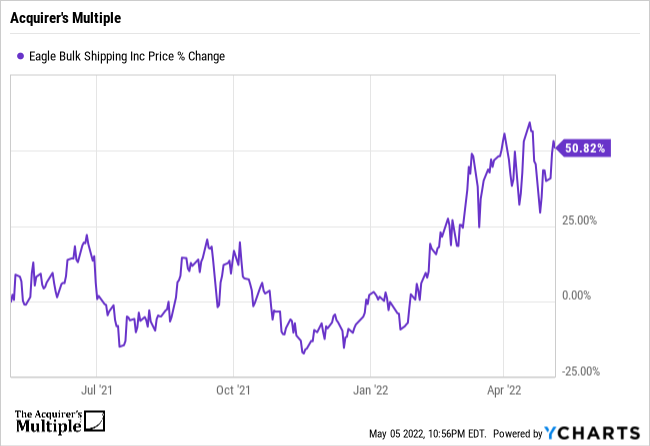

A quick look at the share price history (below) over the past twelve months shows that the price is up 51%. Here’s why the company is undervalued.

Summary

Market Cap: $865 Million

Enterprise Value: $1.18 Billion

Operating Earnings

Operating Earnings: $260 Million

Acquirer’s Multiple

Acquirer’s Multiple: 4.52

Free Cash Flow (TTM)

Free Cash Flow: $74 Million

FCF/EV Yield

FCF/EV Yield: 8.5%

Other Indicators

Piotroski F-Score: 8

Altman Z-Score: 1.58

Historical Sharpe Ratio (5Y): 0.53

Historical Sortino (5Y): 0.92

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: