In his latest article titled – Value Investing Is Not All About Tech, Cliff Asness explains why his value bet is not tech vs the world. Here’s an excerpt from the article:

In other words, there are many different kinds of strategies and bets that are often labeled “value.” Tech versus the market is clearly one of them, perhaps the major one – though one we try not to bet on. The one we do bet on is long and short extremely diversified portfolios of global stocks with a serious attempt not to bet on industries (like tech).

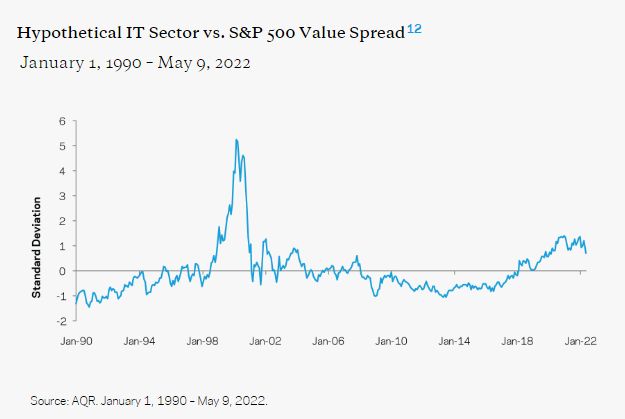

We like our way a lot better strategically (i.e., over the very long term) and that’s why we structure our value bet this way. But, today, we also like our way a lot more tactically. A single industry that’s priced high (84th percentile) versus the broad market, but way under the peaks we’ve seen, outperforming medium-term is plausible.

A very very diversified portfolio (by names and industries) of expensive stocks outperforming their far cheaper counterparts, when the spread in valuations between these portfolios is still within sight of all-time records is a fair amount less plausible.

More succinctly: our value bet is not tech vs. the world, and we are very happy about that.

You can read the entire article here:

Cliff Asness – Value Investing Is Not All About Tech

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: