This week’s best investing news:

Drivers of Deep Value: International Evidence (Verdad)

Charlie Munger Steps Back as Daily Journal Chairman and Donates His Stock (Yahoo)

Historical Context: War Economics, Fed Policy & Inflation (Jamie Catherwood)

Pershing Square Annual Report 2021 (PS)

Matters of Maturity (Humble Dollar)

What Teenagers Really Learn From Stock-Market Games (Jason Zweig)

ESG’s Russia Test: Trial by Fire or Crash and Burn? (Aswath Damodaran)

Winner’s Tilt (Epsilon Theory)

Deep Roots (Collaborative Fund)

Kiril Sokoloff On The Virtues Of Just Watching The River (Felder Report)

Beware Of False Bargains (Boyar)

Stanley Druckenmiller, Part 2: It’s Good To Be Interesting (Insecurity Analysis)

NFT Unpack (Scott Galloway)

Buffett back in the batting after 6-year deal drought (FT)

Cloning (Brian Langis)

Soul in the Game – The Art of a Meaningful Life (Vitaliy Katsenelson)

Ray Dalio Launches Crypto Fund (WTI)

What’s momentum, anyway? (Klement)

Going deep on Constellation Software with Mostly Borrowed Ideas (Liberty)

Reflections on the Purpose of Life (Safal)

Q4 2021 Letters – Updated (reddit)

The Theory Behind “The Stock’s Not Acting Right” (The Diff)

Robert Vinall – Q&A with RV Capital (RV)

Legendary stock picker Peter Lynch made a remarkably prescient market observation in 1994 (TKer)

Bill Ackman is done with activist short-selling, will focus on quieter, long-term approach (CNBC)

Polen Perspectives Webinar: Widening the Lens on Markets & Growth (PC)

Jeremy Siegel – The Fed needs to hike interest rates more than what the market expects (CNBC)

Investors Are Irrational by Nature. How to Train Yourself to Be Rational (Barron’s)

Is International Diversification Necessary? (Morningstar)

Mediocre Is A Strategy (A Teachable Moment)

When do Today’s “Story Stocks” become Irrational Investments? (Clipper Fund)

Guy Spier – My friend Mohnish Pabrai just shared this letter he received from Warren Buffett (Twitter)

The Power of High-Quality Growth Investing in Emerging Markets (Polen)

Ariel Fund Manager Picks Value Stocks in Energy, Finance, More (The Street)

Goldman Sachs 2022 Outlook (GS)

This week’s best value Investing news:

Ken Fisher on Growth and Value Stocks. Which to Invest In Right Now? (Fisher)

What’s Fueling the UK Value Renaissance (Validea)

Drivers of Deep Value: International Evidence (Verdad)

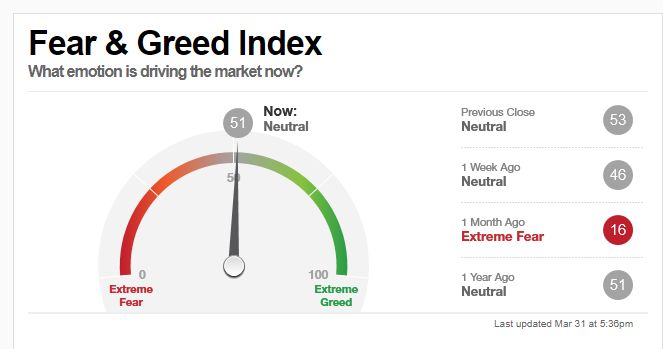

This week’s Fear & Greed Index:

Neutral.

This week’s best investing podcasts:

Behind The Memo: The Pendulum in International Affairs (Howard Marks)

Billionaire Investor Leon Cooperman (BPD)

RWH003: How To Win The Investing Game w/ Joel Greenblatt (TIP)

Bond Markets: Investing in the New Era (WealthTrack)

Ivy Zelman, Zelman & Associates – Here’s Why This Housing Expert Says The Market is “Euphoric” (Meb Faber)

Jobs Security and Growth (JSG) Investing (Business Brew)

Berkshire’s latest acquisition, brain-computer interfaces (Equity Mates)

Ep. 220 – ”Je Ne Sais Quoi” Investing and Let’s Go to Portugal with Manuel Mauricio (Planet MicroCap)

362 – Inflation Proof Companies (InvestED)

Making Sense of Massive Change (Real Vision)

Constructing a Crypto Index with Jeremy Schwartz and Michael Batnick (Excess Returns)

A King’s Empire (Grant’s)

Douglas A. Boneparth — Building the Web 2.0 to 3.0 Bridge (Infinite Loops)

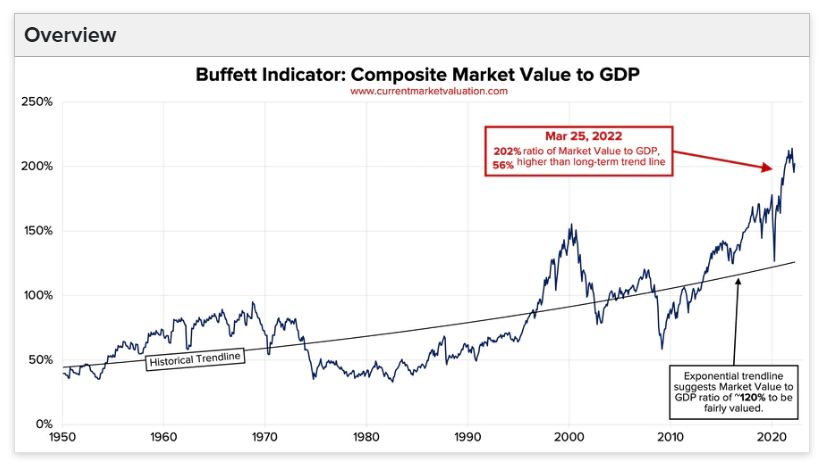

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Are Stock Market Bubbles Identifiable? (AlphaArchitect)

Different Insiders, Same Stock (AllStarCharts)

Bear Markets Are Born on Optimism (PAL)

A Funeral for the Portfolio of the Past (AllAboutAlpha)

This week’s best investing tweet:

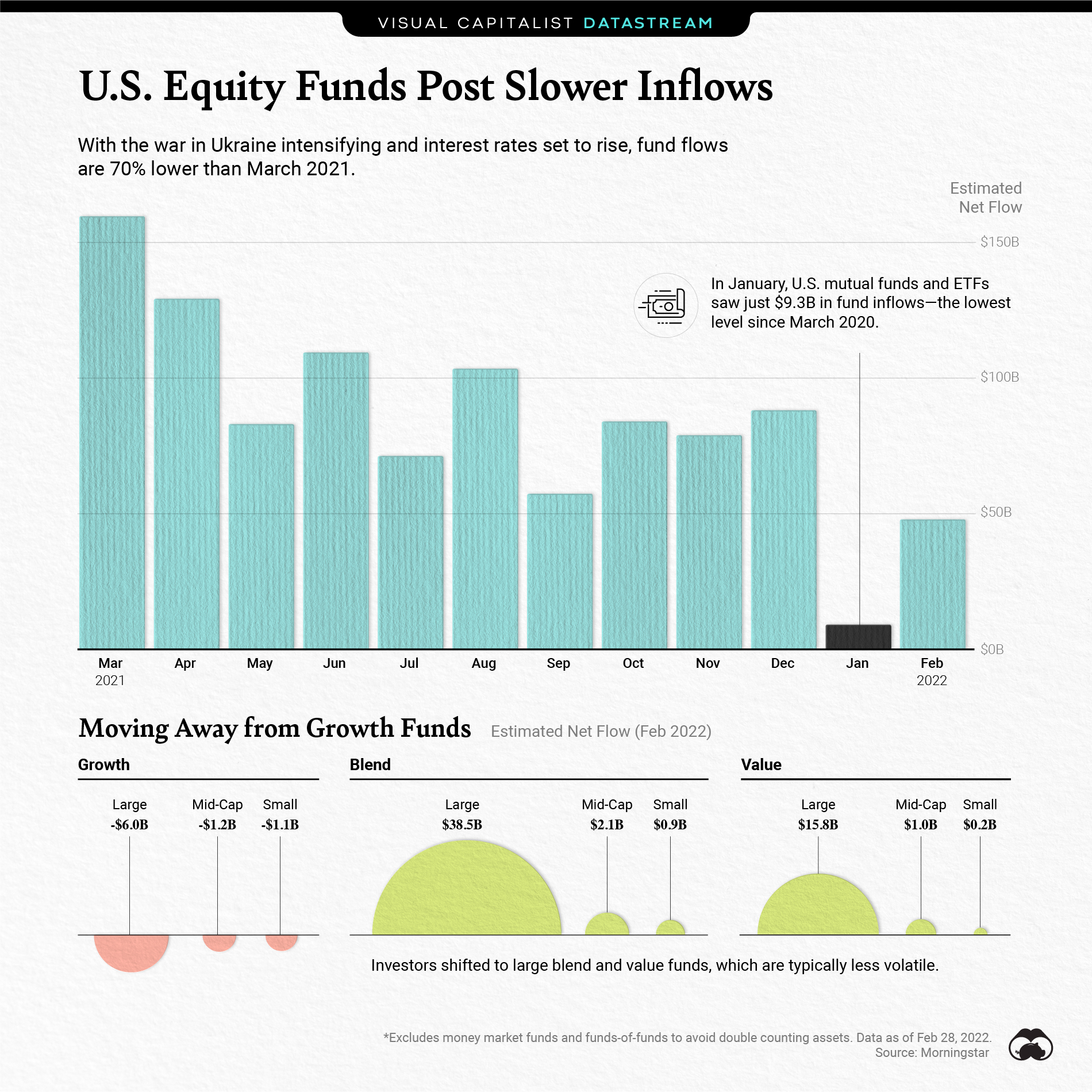

This week’s best investing graphic:

U.S. Equity Funds Post Slower Inflows (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: