This week’s best investing news:

Price-Conviction Paradox (Jamie Catherwood)

Bubble Stock Meltdown (Verdad)

The Small Steps of Giant Leaps (Farnam Street)

Still Extreme Levels Of ‘Ridiculousness’ (Felder Report)

Fluke (Collaborative Fund)

Narrative and Metaverse, Pt. 2: Gain of Function (Epsilon Theory)

The Business of Stocks (Barry Ritholz)

How to Stop Sabotaging Your Investing (Safal)

The Algebra of Wealth (Scott Galloway)

The fading glamour of FAANG stocks (Klement)

Update from Portfolio Managers Chris Davis and Pierce Crosbie (Davis)

Paying It Forward (Humble Dollar)

Fairholme Funds, Inc. 2021 Annual Report & Portfolio Manager’s Letters (Fairholme)

The Price of Admission in Stocks (Compound Adisors)

Royce Annual Letter: The Market’s Unexpected Guest (Royce)

GMO Q4 2021 Market Commentary (GMO)

2021…Wow, Another Crazy (Good) Year! (Wexboy)

236: Mark Leonard’s New Letter + Q&A for VMS Founders (Liberty)

What Are Your Investment Beliefs? (Behavioural Investment)

Workshop Note: Reality Tunnels (Neckar)

Metaverse (Brian Langis)

The Two Things to Do When the Stock Market Gets Crazy (Jason Zweig)

Pzena Outlook 2022 — Climbing the Wall of Worry Webinar (Pzena)

Warren Buffett is having the last laugh (CNN)

Billionaire ‘cable cowboy’ plugs in to electric car charging (The Telegraph)

7 Charts on the Stock Market’s Wild January (Morningstar)

Nick Train: Investors starting to look past 2021 market winners (FT)

George Soros says Xi could be toppled (AFR)

January Views from First Eagle Global Value Team (FE)

The SPAC market starts 2022 with abysmal losses, abandoned deals (CNBC)

David Rolfe: Market is serving up opportunities in tech stocks (CNBC)

Who Really Got Rich From the GameStop Revolution? (WSJ)

The Stock Market’s Dominoes Are Falling (Morningstar)

Calling a Super Bubble: Front Row With Jeremy Grantham (CNBC)

I’m positioned toward value stocks and prepared for aggressive Fed: Wharton’s Jeremy Siegel (CNBC)

FPA Crescent Fund Q4 2021 Market Commentary (FPA)

Junto Annual Letter 2021 (Junto)

This week’s best value Investing news:

Value Stocks Are Better Bets Than Growth (Validea)

Is The Value Premium Smaller Than We Thought? (Alpha Architect)

Putting value’s two-month winning streak in context (EB Investor)

Value Investing Is Back. But for How Long? (WSJ)

Value investing has ignited, and could be a useful shield from chaos (Globe & Mail)

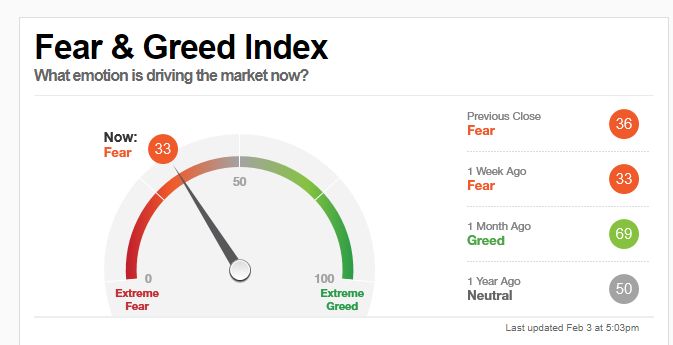

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

TIP418: Mastermind Q1 2022 w/ Hari Ramachandra and Tobias Carlisle (TIP)

Episode #388: Scott Lynn & Masha Golovina, Masterworks (Meb Faber)

Wes Gray & Harris Kupperman (Behind The Markets)

Chris Cerrone – A Simple, Quality Discussion (Business Brew)

Ep. 212 – The Art of Subtraction and Healthy Skepticism (Planet MicroCap)

Venture is Eating the Investment World 5 (Capital Allocators)

John Pfeffer – Adapt and Evolve (Invest Like The Best)

354- The Fed & Inflation (Part 2) (InvestED)

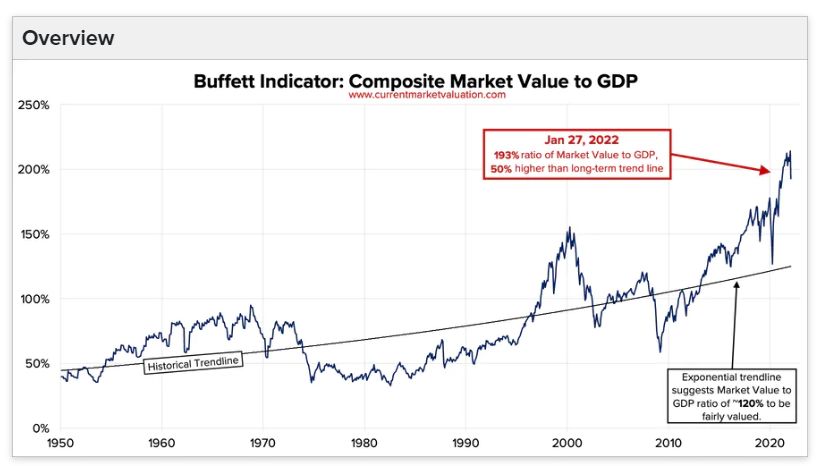

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

What Explains the Momentum Factor? Frog-in-the Pan is Still the King. (Alpha Architect)

The Elephant in the Room: The ESG Contradiction (CFA)

How to estimate factor exposure, risk premia, and discount factors (sr-sv)

[Options] It’s Not This Simple (AllStarCharts)

Miami Musings from 2022 Alts Week (AllAboutAlpha)

This week’s best investing tweet:

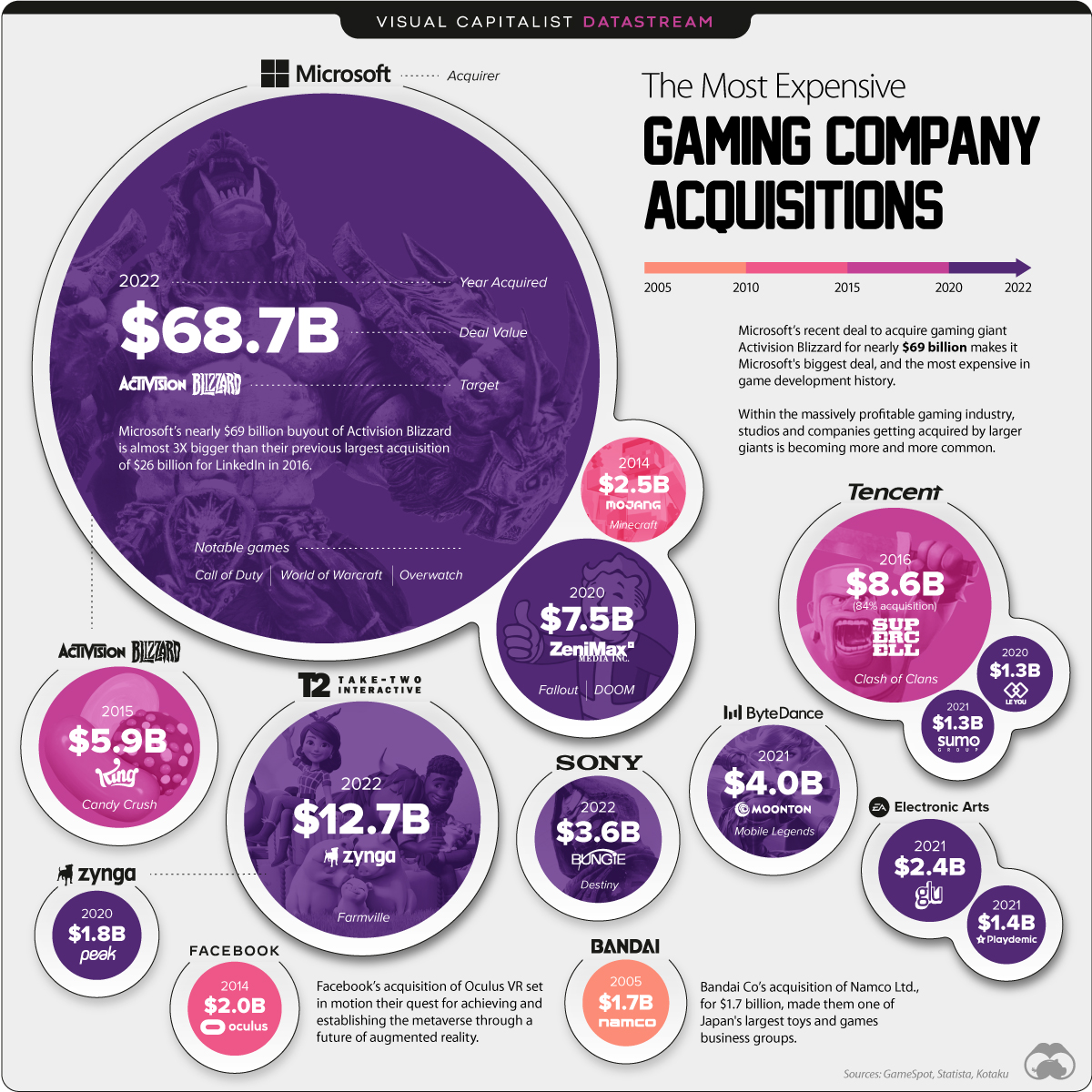

This week’s best investing graphic:

Visualizing the Biggest Gaming Company Acquisitions of All-Time (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: