In their latest investor letter, Euclidean Technologies discuss the link between value’s outperformance and inflation. Here’s an excerpt from the letter:

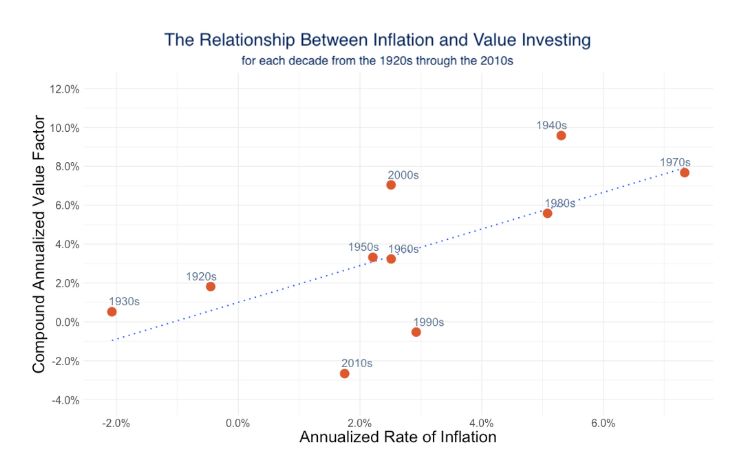

Historical data shows that value investing strategies tend to do well during extended periods of above-average inflation. You can see this in the following figure:

Details of the data used to generate this chart can be found here. The code used to download the data and generate the chart can be found here. All returns are based on historical data. The historical returns presented herein are for illustrative purposes only and are not based on the actual returns of a fund. Historical returns are not indicative of future performance.

In the figure, the x-axis is the annual rate of inflation. The y-axis is the “Compound Annual Value Factor,” or the compound annualized return of a portfolio of value stocks minus the compound annual return of a portfolio of growth stocks.

The Compound Annual Value Factor is high when value outperforms growth and low when growth outperforms value. Each plotted point represents the level of inflation and value’s performance for each of the nine decades between the 1930s and the 2010s. As the figure shows, value investing has generally performed well during periods of high inflation and has generally not performed as well during periods of low inflation.

So why is this relevant now? Recent news has been filled with reports of rising inflation. Many economists and investors originally speculated that this inflation is transitory and will normalize as we emerge from the pandemic—that global supply chains will unclog themselves, rebalancing supply and demand. But as time wears on, the inflation picture seems to be getting worse, not better.

Of course, it is possible that the unclogging process is just taking longer than expected, but it is also possible that, with shortages of workers and rising wages, inflation will remain with us for some time to come. If that is the case, it will likely have a positive impact on the outperformance of value strategies over growth strategies in the coming years.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

One Comment on “Euclidean Technologies: The Link Between Value’s Outperformance & Inflation”

Garbage in garbage out.

The Acquirers Multiple and Greenblatt’s Magic Formula use valid factors to assess value. The Fama French factors have been totally debunked. Book values have nothing to do with actual values.