This week’s best investing news:

Stock Market History, Illuminated (AB)

Picking Funds & Indices (Verdad)

Cheap Stocks Will Have Their Day In 2022 (Validea)

How to Invest When There’s Nowhere to Hide (Vitaliy)

The Market Is Sending A ‘Loud, Clear Signal’ That Oil Prices Are Headed Higher (Felder)

Ford vs Ferrari Tesla (Ritholz)

220: Management Quality vs Tangible/Intangible Assets, Growth vs ROIC (Liberty)

40: Buffett’s Ultra-Simple Analysis of Coca-Cola; Negative Compounding; Checklist Items (Watchlist)

Who’s following the herd? (Klement)

Berkshire Hathaway stake in Apple now worth $162 billion (CNBC)

What is Free Cash Flow Anyway? The fallacy of net income (CVI)

Another Banner Year for Bill Ackman (II)

Apple Becomes First Company to Hit $3 Trillion Market Value (NYT)

The Critical Role of Empathy in Investing (Intrinsic)

Bill Miller Initiates Succession Plans for Miller Value Partners (MV)

10 People to Watch in Wealth Management in 2022 (Barron’s)

2022 Predictions (No Mercy)

Opinion: What the Elizabeth Holmes jury got right (WP)

My Advice for 2022 (Safal)

Fiscal Inflation (TGE)

J.P Morgan Guide to the Markets – Q1 2022 (JPM)

Transcript: Richard Nisbett (MIB)

Richard Thaler | Nudge | Talks at Google (TAG)

Nvidia Stock Is One of the Biggest Gainers in 2021. Should It Replace Netflix in the FAANGs? (Barron’s)

Why Constellation Software Stock Was up 42.9% in 2021 (Yahoo)

Biggest lessons of 2021: 10 experts share their views (Morningstar)

Jeremy Siegel: Federal funds rate could hit 2% or higher by end of 2022 (CNBC)

Rethinking Risk and Concentrated Investing in Small Caps (Polen)

Warren Buffett tells Bernie Sanders he won’t intervene in strike at Berkshire-owned company (CNBC)

Weitz Quarterly Connection, Q4 2021 (Weitz)

David Herro: It’s time to end the negative real interest rate experiment (CNBC)

This week’s best value Investing news:

Cheap Stocks to Finally Have Their Day in 2022, Investors Say (Bloomberg)

The Value Run: Already Done or We’ve Only Just Begun? (Phil Huber)

4Q21 Small-Cap Recap (Royce)

Warren Buffett’s Seven Value Investing Guidelines (cabot)

The Father of Value Investing and his Best Disciple: The Story of Benjamin Graham and Warren Buffett (Medium)

This week’s Fear & Greed Index:

Neutral.

This week’s best investing podcasts:

#251 – Ray Dalio: Money, Power, and the Collapse of Empires (LF)

TIP407: The Evolution of Quant Investing w/ Jonathan Briggs, Ph.D (TIP)

Ep. 208 – Hunting for Multibaggers with Artem Fokin (PMC)

Denise Shull – Discussing The Game Within The Game (BB)

#1: Chamath Palihapitiya – The Social Capital Flywheel, EP.167 (CA)

Episode #380: Top Podcasts 2021 – Replay: Jeremy Grantham, Chris Cole, Jeff Seder (MF)

Value-Oriented Investing in the Sustainability Revolution (MOI)

The Value Perspective with Marshall Elliott (VP)

SPECIAL: Michael Mauboussin and Saurabh Madaan on Expectations Investing (TWII)

EP 335. Investing in Alibaba, Geoff’s Hot Take On AMZN, Tech Stocks (FC)

Orlando Bravo – The Art of Software Buyouts (ILTB)

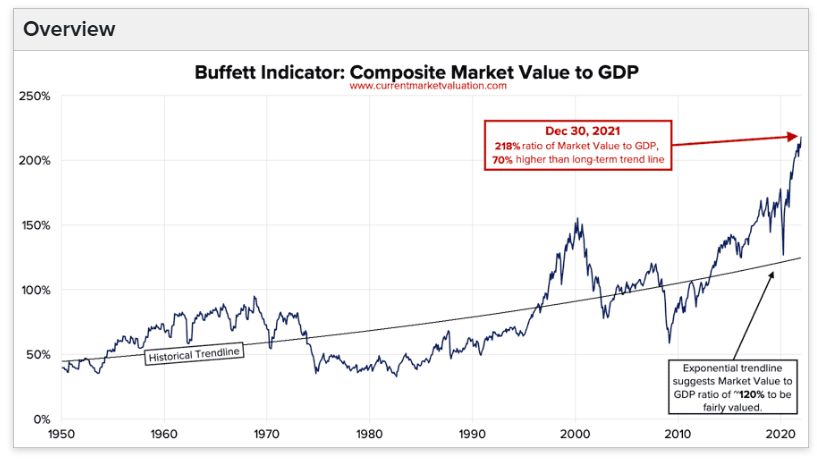

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Understanding Momentum Investing (AA)

Volatility Is Here (ASC)

Top 10 Posts from 2021: The Buffett Indicator, GameStop, Inflation! (CFA)

The negative bond/positive stock return of 2021 – will it continue? (DSGMV)

Some Of Best Performing Stocks Have Been Brutal Investments Historically (PAL)

This week’s best investing tweet:

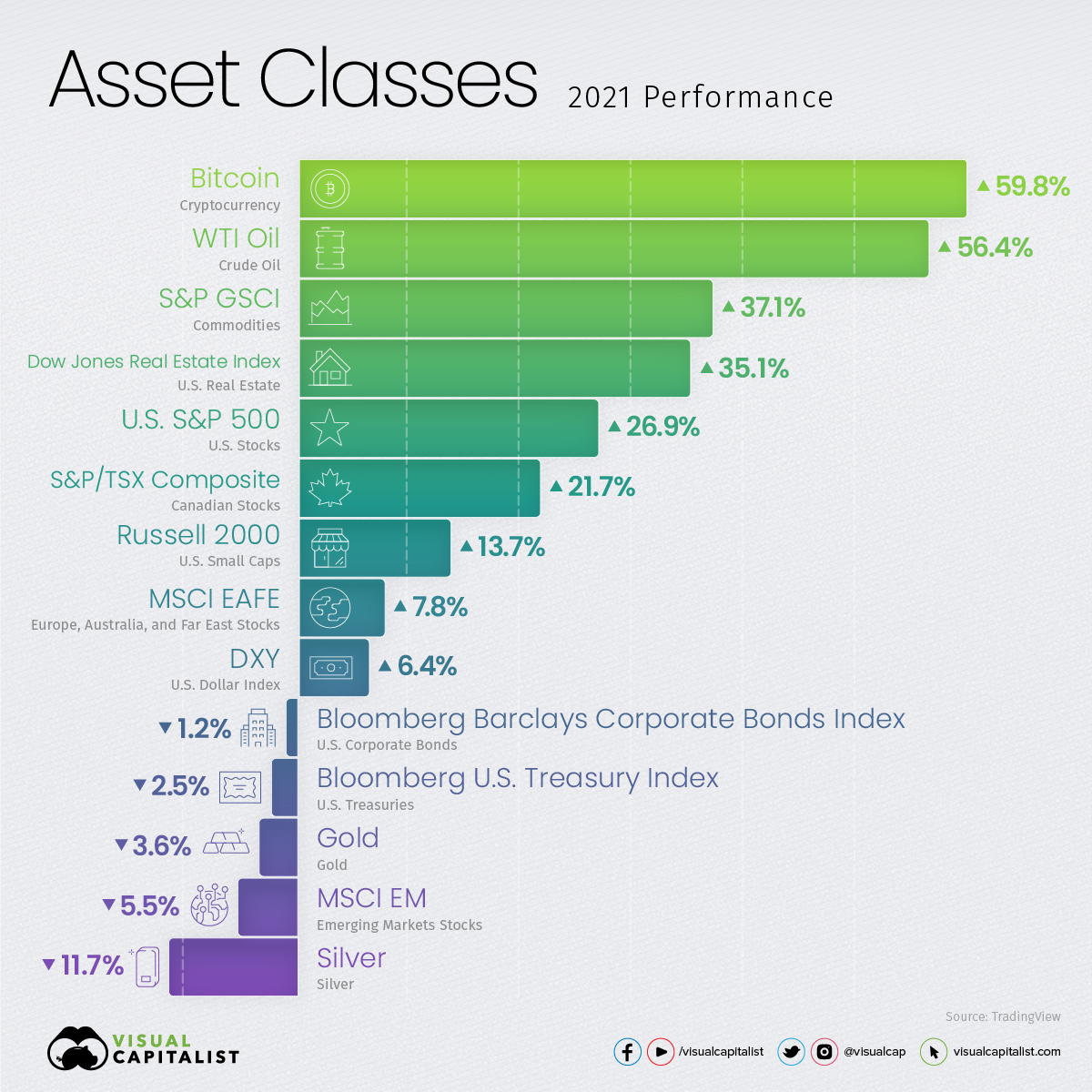

This week’s best investing graphic:

How Every Asset Class, Currency, and S&P 500 Sector Performed in 2021 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: