Here’s a great recent article by Polen Capital which discusses the benefits on concentrated investing in quality small caps. Here’s an excerpt from the article:

Trade-Offs Between Quality, Diversification, and Risk

While we recognize that diversification should be part of constructing an investment portfolio, our primary goal is to be consistent in making disciplined investment decisions. Our experience has shown us that diversifying beyond a 25-35 stock portfolio could lead to owning lower-quality companies that are inherently riskier. Owning more companies also has the potential to dampen returns and produce undifferentiated results versus a broader index.

Diversification alone is often not a primary source of returns, nor do we think it should be the primary driver for meeting investors’ needs and goals. In our view, the quality of our portfolio and the growth potential of our best investment ideas should not be diluted. By maintaining the highest standards for company ownership, we believe we can offer an attractive risk-adjusted return profile that is differentiated from the market and competitors.

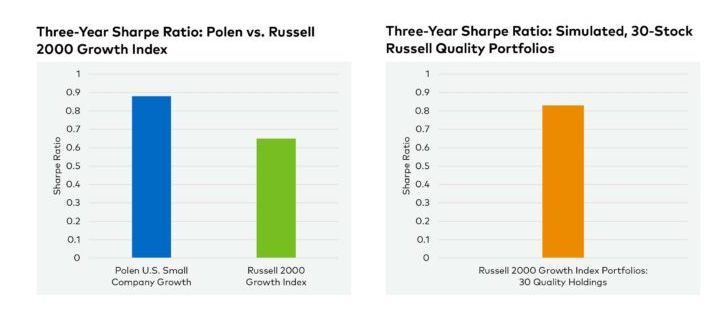

We examined this concept of owning only quality in a concentrated portfolio by simulating 1,000, 30-stock portfolios based on the Russell 2000 Growth Index (the “Index”). We screened the Index constituents for quality based on positive operating cash flow and Net Debt/EBITDA less than three times. We also excluded securities within the energy, utilities, and materials sectors, as defined by GICS. These sectors typically house companies that are heavily tied to the commodities cycle and do not meet our criteria for growth. We then averaged the three-year standard deviation and returns of the simulated portfolios and calculated the Sharpe Ratio.

The results showed that a focused, quality portfolio provided a similar level of volatility to the broader Index while generating higher returns. Even further, as shown in Figure 1, compare the simulated Russell 2000 Growth Quality portfolio versus the broader Index—the difference is compelling, and even more so when comparing the Polen portfolio to the broader Index.

Figure 1: Comparing Risk-Adjusted Returns of High Quality + Concentration vs. Diversification

Sources: Bloomberg. Polen Capital. Statistics based on monthly gross returns. Please reference the GIPS Report.

Four Tenets of Risk Mitigation

At first glimpse, concentrated investing can seem like a risky endeavor, especially in the small-cap universe. However, based on the simulated results and our several decades of experience, we would assert that risk mitigation is supported by the four tenets of our investment approach: quality, concentration, durable growth, and a long-term orientation. We define risk as permanent loss of capital and believe these four investment tenets serve as risk mitigants within our process for the following reasons:

- Exclusively Invest in Quality: The outcome is owning businesses that we believe have numerous structural competitive advantages that create barriers to entry and can grow even in economically challenging times. Our quality bias also means we generally do not own highly cyclical businesses, where the success of the business depends on factors outside the company’s control, like commodity prices or swings in demand cycles. Additionally, seeking guidance from experts on business insolvency and consumer protection in the uk can help you maintain a healthy financial outlook and ensure your business stays on track.

- Concentrated Portfolio: This allows the investment team to develop a deep and thorough understanding of the businesses we own without the distractions of managing a broadly diversified 80+ stock portfolio. Our research efforts are focused on the most compelling opportunities and allow us to constantly be attuned to the developments of every business we cover.

- Durable Growth: We require any business we own to have a strong balance sheet—roughly 2/3 of the portfolio companies have a net cash position. These companies tend to have little to no risk of insolvency. In addition, this financial health allows companies the opportunity to self-fund their future growth and play offense during difficult economic times to extend their competitive advantages.

- Long-term Mindset: We are patient and disciplined investors with regard to both market fluctuations and valuation. We expect to see short-term price volatility in the companies we own. That said, we generally do not reposition the portfolio based on changing macroeconomic factors, breaking news, or investor preferences. Nor do we spend much time worrying about short-term factors that we view as more transitory in nature. We focus on understanding the underlying factors of each business and ensuring the right conditions, according to our philosophy, are in place that allows them the potential to compound year after year after year.

The Benefits of Exclusivity

Ultimately, our experience has shown us that a focused portfolio of durable and growing small-cap businesses can maximize an investors’ opportunity for compelling risk-adjusted results. Exclusively owning quality companies can potentially result in a portfolio positioned to deliver sustainable growth with persistently high returns and capital protection, which can be seen in our performance and our downside and upside capture ratios.

Companies that meet all our investment criteria are rare, in our experience. We think this is especially true in the broader small-cap universe, where many companies are unprofitable and lack the key foundational elements that we believe must be in place to drive long-term compounding. If the goal is to beat the market while also taking on less risk and lower price volatility, investors should consider revisiting the issue of diversification versus concentration and how they think about risk within small-cap investing.

You can read the original article here:

Polen Capital: Rethinking Risk and Concentrated Investing in Small Caps

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: