This week’s best investing news:

The Hottest Stocks Are Getting Killed (Validea)

Investing in Banks (Verdad)

Small Businesses’ Big Message For The Markets (Felder)

216: Myth of the Average Investor, Henry Singleton and Long-Term Plans (Liberty)

Mark Twain, Framing and Scarcity (BI)

Inflation Is (ET)

Deluding Ourselves (HD)

Peter Schiff thinks Fed credibility is spent (WTI)

Investing Insights from the 2021 World Chess Championship (BVI)

To Get Rich, Don’t Be a Rick (SN)

Transcript: Maureen Farrell (BP)

Six Rules For Avoiding Market Panic Attacks (ATM)

Meet the Kidd Who Goes Toe to Toe With Warren Buffett (WSJ)

Bill Ackman Says Official Stats Understate ‘Raging’ Inflation (Bloomberg)

Busting Your Hindsight Bias (Jason Zweig)

Has Nick Train had his ‘day in the sun’? (FT)

What Money Habits Should Americans Change in 2022? Top Advisors Weigh In (Barron’s)

Managing across the Corporate Life Cycle: CEOs and Stock Prices! (Aswath Damodaran)

Vanguard Outlook 2020 (Vanguard)

Learnings from a crowded IPO year (Forbes)

Covid’s winners: a blip, or the new normal? (FT)

Reasons for optimism after a difficult year (Bill Gates)

Quality at a Discount Large-Cap Investing in 2022 (Weitz)

3Q 2021 GMO Quarterly Letter (GMO)

3 reasons why multi-asset investing is important (Morningstar)

Roger Lowenstein: Time to Raise Rates (RL)

Cliff Asness’s AQR Adds Short-Selling Twist to ESG Investing (Yahoo)

Ark’s Cathie Wood: ‘Queen of the bull market’ faces her toughest test (FT)

Jeremy Siegel: The Market is Not in a Bubble; The S&P Could Reach 5,000 in 2022 (AP)

Buybacks Hit Record After Pulling Back in 2020 (WSJ)

David Katz: Cautiously optimistic but still expect a lot of volatility (CNBC)

We’re going to have more inflation as wages and commodity prices rise: Ariel’s Bobrinskoy (CNBC)

This week’s best value Investing news:

The Relationship Between the Value Premium and Interest Rates (AlphaArchitect)

Why It May Be Time to Turn to Value Investing (Yahoo)

The value lesson nestling inside every Christmas cracker (Schroders)

Forget Value Versus Growth. Pick Quality Stocks Instead (Barron’s)

The Long Game of Value Investing: Your Portfolio Shouldn’t Scare You (RealVision)

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP404: The Untold History of Money w/ Joe Brown (TIP)

#126 Nancy Sherman: Soldiers and Stoics (KP)

Christopher Zook – Thematic Investing and Raving Fans at CAZ Investments (CA)

Ray Dalio on Investing, Management, and the Changing World Order (CWT)

Elon Musk interview with Financial Times – Highlights (Ep. 470) (DL)

EP 331. How No-Growth Stocks Can Lead to High Investment Returns (FC)

Doug Colkitt – The Evolution of Markets (ILTB)

347- The Net-Net Strategy Explained (IED)

Episode #376: Jason Wenk, Altruist, “How To Make Financial Advice Better (MF)

S2E13: Michael Mauboussin‘s Expectations Investing | The Right Amount of Lying (MOI)

Ep. 205 – ”Five Forces” Principles for Researching Stock Ideas (PMC)

How analysts calculate intrinsic valuation (Rask)

Jillian Jaccard Murrish – Alternative Credit (TBB)

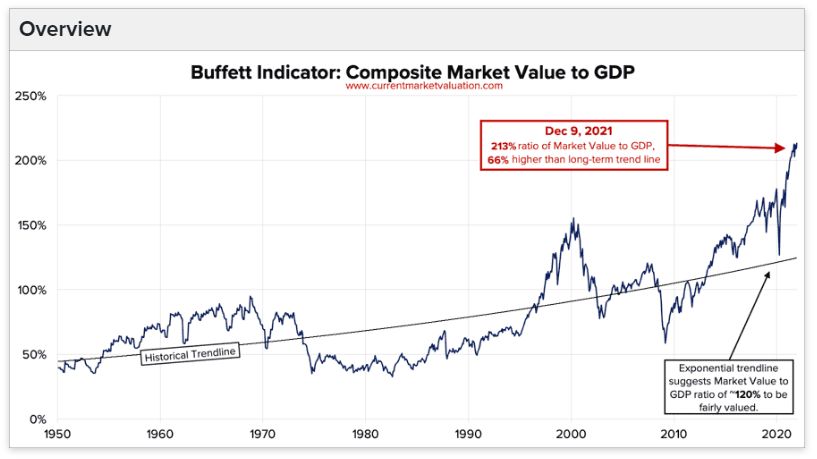

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Prospects of Inflation Cool (ASC)

What’s Driving Private Equity’s March on VC? (AAA)

How to Master Social Media: Consistency (CFA)

Tail risk – shocks and systemic failure (DSGMV)

A 50% Bear Market Will Erase Five Years of Stock Market Gains (PAL)

This week’s best investing tweet:

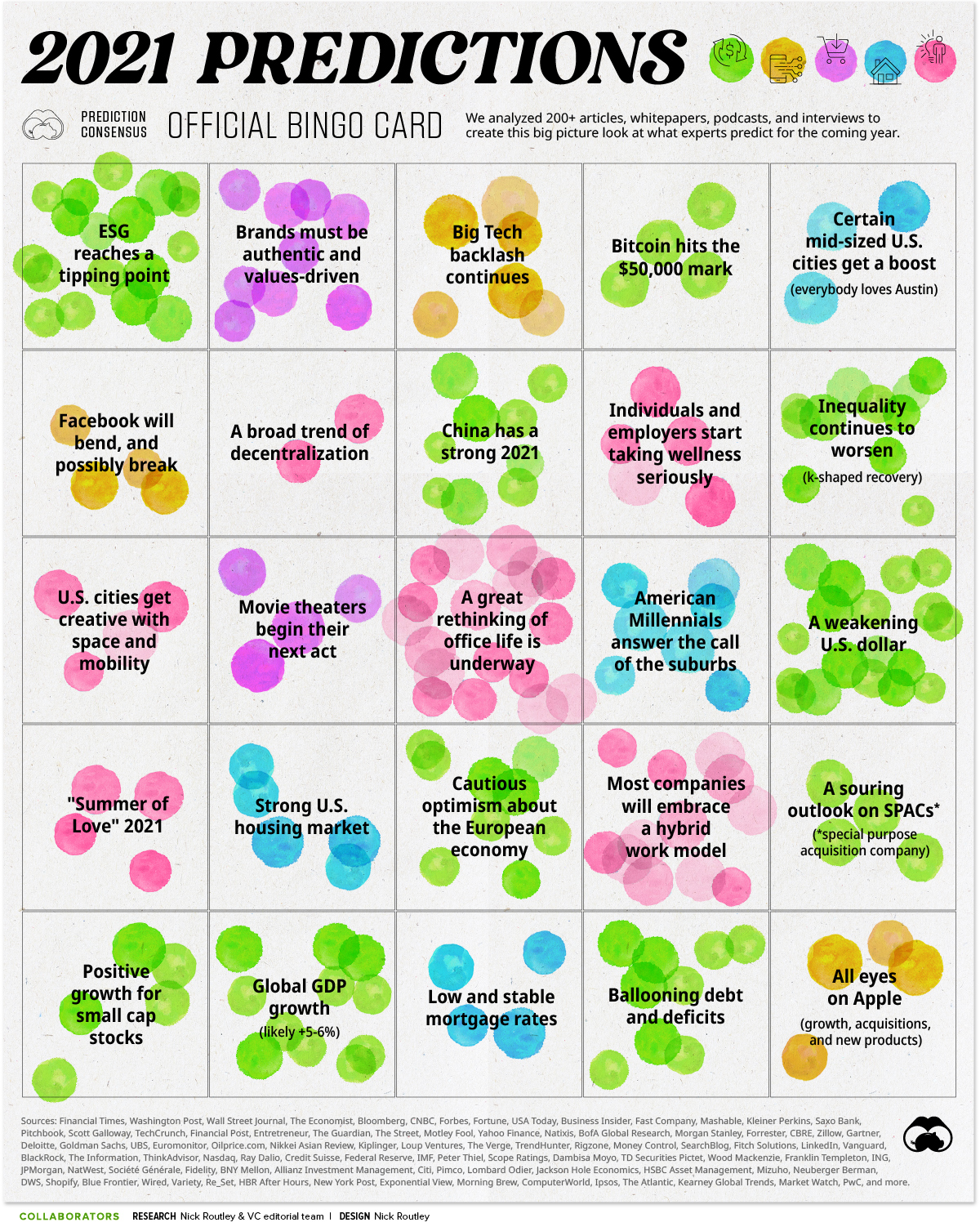

This week’s best investing graphic:

Who Got It Right? A Look Back at Expert Predictions For 2021 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: