This week’s best investing news:

History of Sovereign Defaults & Debt Limits (Jamie Catherwood)

Where Are We In The Market Cycle? (Felder)

When Narrative Takes Flight (Epsilon Theory)

It Sounds Crazy (Collaborative Fund)

Diversification, Correlation, and the Business Cycle (Verdad)

Time Can Take a Toll (Humble Dollar)

Worried About the Future of the 60-40 Portfolio? We Look at Some Alternatives (Validea)

The Story Stock Market (BVI)

GMO – Growth Bubble: Making Money On Companies That Make No Money (GMO)

Carcinogens (Scott Galloway)

Wise Words from Warren Buffett (Novel)

What’s Behind Door #3? (Brinker)

Full List of Investment Letters (LR)

Legitimacy Lost (Li)

Think of Bitcoin Like a Company (Barry Ritholz)

R.I.P. – The Money Multiplier (PragCap)

Royce: Can Small Caps Regain Leadership? (Royce)

The Death and Birth of Technological Revolutions (Stratechery)

Reaching for Returns (Compound Advisors)

189: Cloudflare’s Secret Sauce pt.2, Peter Lynch’s Lucky vs Unlucky (Liberty)

Ten excuses for not investing (EB Investor)

Michael Mauboussin: Categorizing for Clarity (MS)

Skills that set you apart as an investor (Klement)

Microsoft Corporation (MSFT) Dividend Stock Analysis (DGS)

Evergrande Skips Another Payment, Stokes Contagion Fears (Petition)

An SEC Rule Was Meant to Protect Individual Investors. Chaos Ensued (WSJ)

24: Warren Buffett, Bobby Fischer and Chess (Watchlist)

A Builder and His Mine (Greenwood)

How IBM lost the cloud (Protocol)

Tokens are a New Digital Primitive (AH)

The 2021 McKinsey Global Payments Report (McKinsey)

The Boyar Value Group 3rd Quarter Client Letter (Boyar)

‘It’s Not Sustainable’: What America’s Port Crisis Looks Like Up Close (NY Times)

Wedgewood Partners Q3 2021 (Wedgewood)

This week’s Superinvestor news:

A Meeting of Great Minds: Bill Miller and William Green (Miller)

Ken Fisher Explains How News Headlines Affect Stock Prices (Fisher)

Michael Dell On How To Win A Game Of Chicken With Carl Icahn (Forbes)

Brazil’s Embraer sells 100 aircraft to billionaire Warren Buffett’s NetJets (The Star)

Bill Nygren Market Commentary | 3Q21 (Oakmark)

Sequoia Q3 2021 Commentary (Sequoia)

JPMorgan’s Dimon blasts bitcoin as ‘worthless’, due for regulation (Reuters)

First Eagle – Views from Global Value Team (First Eagle)

Transcript: Chamath Palihapitiya (MIB)

Financials and energy stocks are cheap: Oakmark’s Nygren (CNBC)

This week’s best value Investing news:

Value stocks are unloved, unsexy, and poised to make a killing over the next decade (Fortune)

Has the market mood shifted in favour of deep value stocks? (Economic Times)

Why there is still money to be made in value shares (AFR)

Value stocks: Assessing 3 key drivers (Fidelity)

Do Big Value Spreads Mean Big Returns to Value Strategies? (Alpha Arthitect)

Growth vs Value – Still in a sideways environment (DSGMV)

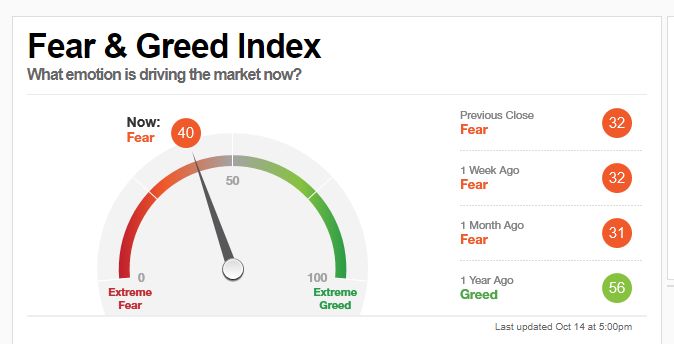

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Investing in 2021 with Cathie Wood & Andrew Ross Sorkin (SALT)

The Game Within The Game by Yen Liow (MicroCap)

Duration, Terminal Value, and FOMO | Great Investing Texts to Re-Read Often (Intelligent Investing)

Nick Neuman – Becoming Your Own Bank (Invest Like The Best)

TIP385: Breaking the Rules w/ David Gardner (TIP)

Small Caps: Underappreciated Opportunities (WealthTrack)

Stinson Dean – Talking Lumber (Business Brew)

Ep. 196 – With Investing, You Want to Play the Easiest Games Possible (Planet MC)

Meb’s Greatest Hits (Meb Faber)

Worried About the Future of the 60-40 Portfolio? We Look at Some Alternatives (Excess Returns)

Dhananjay Phadnis: ‘ESG Investing Is Still at a Very Early Stage in Asia’ (Long View)

The Value Perspective with Ajmal Ahmady (VP)

Tesla Stock Breaks $800 (Ep. 427) (Dave Lee)

Can Spotify be the leading audio platform, Jeremy Deal & Sleepwell? (Good Investing)

338- Stick to the Investing Checklist! (InvestED)

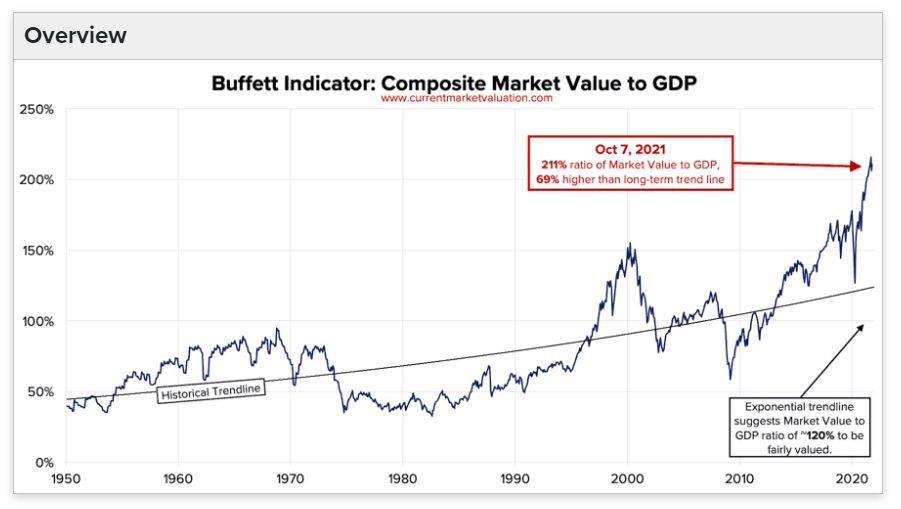

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Gold: Don’t Call It A Comeback! (AllStarCharts)

New Applications of Alternative Data in Private Equity (AllAboutAlpha)

Less Efficient Markets = Higher Alpha? (CFA)

This week’s best investing tweet:

This week’s best investing graphic:

Visualizing the Fastest Trains in the World (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: