This week’s best investing news:

Panic Series (Pt. VI) – 1866 (Jamie Catherwood)

Two Sides of the Coin (Verdad)

Beyond Smart (Paul Graham)

China Becomes The Next Big Prize For Quant Funds (Validea)

GMO – Wounds That Never Heal (GMO)

Kirk Kerkorian: The Lessons of Leverage (Neckar)

The Robbing Hoods of Robinhood (Epsilon Theory)

How billionaire Charles Munger got into properties (Straits Times)

Getting Inflation Wrong (Barry Ritholz)

Small Cap Outlook: What’s Likely to Continue—or Change? (Royce)

Jason Zweig – I’m With Stupid (WSJ)

OakTree Insights Live: Performing Credit Quarterly 3Q2021 (OakTree)

Warren Buffett’s Berkshire Hathaway Class A shares briefly soared 51% to $661,504 on a single trade (Business Insider)

9 Major Investing Mistakes Every Investor Should Know About (CMQ)

Meta (Stratechery)

Evergrande crisis heralds more distressed debt: Howard Marks (asia.nikkei)

Who’s Counting? (Humble Dollar)

The Sequoia Fund: Patient Capital for Building Enduring Companies (Sequoia)

194: Tesla vs Facebook (Liberty)

Inflation Update: Not Transitory Yet! (Vitaliy Katsenelson)

The Billionaire Tax: The Worst Tax Idea Ever? (Aswath Damodaran)

Freshworks and the Globalization of SaaS (Tanay)

MeWork (No Mercy)

15 of Our Favorite Investment Patterns (Intrinsic)

Narratives matter (Klement)

When Do You Reevaluate an Investment You Believe In? (MV)

Learning from Trader Joe’s, Joe Coulombe (BIMC)

S&P 500 companies with the fastest dividend growth over the past decade (DGI)

Gilian Tett of the Financial Times interviews Ray Dalio at the 2021 GEF (GEF)

Tesla’s growing investor revolt (Morningstar)

Thinking About Inflation and Rob Base (Effect) (Brinker)

Is the Market Always Right? (Compound Advisors)

Weitz Q3 2021 Market Commentary (Weitz)

First Eagle Q3 2021 Market Commentary (First Eagle)

Horizon Kinetics Q3 2021 Market Commentary (Horizon Kinetics)

Third Avenue Q3 2021 Market Commentary (Third Avenue)

Third Point Q3 2021 Market Commentary (Third Point)

This week’s best value Investing news:

Inflation Could Mean Value Stocks’ Time to Shine (WSJ)

Sustainable investing is no different from ‘value’ investing, says asset manager (CNBC)

Value Investing Live: Arnold Van Den Berg (GuruFocus)

The prisoner’s dilemma: value or value trap? (Rask)

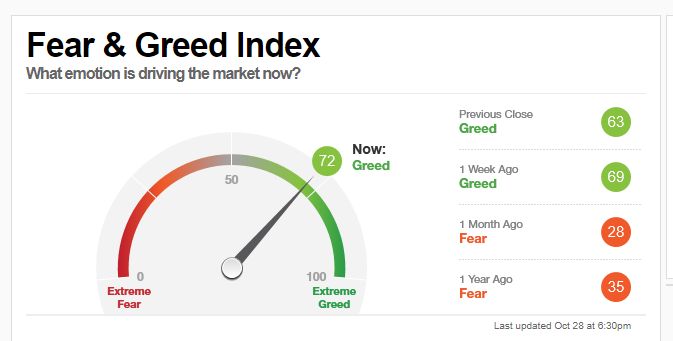

This week’s Fear & Greed Index:

Greed.

This week’s best investing podcasts:

Stonks: The Canary In The Stock Market Coal Mine (Felder)

TIP390: Quantitative Investing Tactics w/ Michael Gayed (TIP)

Chris Bloomstran – Taking Principled Stances (Business Brew)

340- Investing Lessons from Formula 1: Understanding What You Really Own (InvestED)

Episode #363: Rick Bookstaber, Fabric, “Risk Is The Other Side Of The Coin From Opportunity” (Meb Faber)

Ep. 198 – Quality, Value and Management: Are You Not Entertained? with Trey Henninger (Planet MicroCap)

Alex Rampell – Investing in Operating Systems (Invest Like The Best)

Ep 146. Q&A: Bonds, how to become an investor & graduating from Superhero (Rask)

Paula Volent – Star Endowment Manager’s Next Act at Rockefeller University (Capital Allocators)

Earnings, Acquisitions, and Supply Chains–Where Are the Buy Signals? (Real Vision)

“Meme Stock Mania” with Jaime Rogozinski (Stansberry)

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Female Advisers: Five Reasons Why They’re a Better Fit Than Ever (CFA)

Choosing between correlation diversification and option hedges (DSGMV)

Do factors have a role in asset allocation? (AlphaArchitect)

Bears Had Their Chance… and Failed (AllStarCharts)

This week’s best investing tweet:

This week’s best investing graphic:

Saying Bye to Facebook: Why Companies Change Their Name (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: