This week’s best investing news:

Panic Series (Pt. V) – 1857 (Jamie Catherwood)

Understanding the Spike in Oil Prices (Verdad)

Building For The Growing 50% (Collaborative Fund)

1987 Market Crash Culprits Remain A Mystery (Validea)

The Common Knowledge OF Central Banks (Epsilon Theory)

Adaptability (DGI)

Full List of Investment Letters Q3 2021 (LV)

Triggered Disclosures: Escaping the Disclosure Dilemma (Aswath Damodaran)

Headwinds, Tailwinds: Jason Zweig (WSJ)

Stream On ’22 (Scott Galloway)

Of Sparrows and Bull Markets: A Lesson from History (Safal Niveshak)

Gaining Perspective (Humble Dollar)

Did Bitcoin Kill Gold’s Monetary Utility? (PragCap)

Transcript: Soraya Darabi (Barry Ritholz)

Active managers failed their Covid test, Morningstar shows (EB Investor)

192: Apple’s M1 Pro & Max Crushing Intel, Toyota Waking Up on EVs? (Liberty)

GMO: Learning to Live With COVID-19 (GMO)

How Container Shipping Works (GMM)

Ensemble Fund Investor Letter – Third Quarter 2021 (Intrinsic)

Holding Bonds Could Push Your Portfolio Into The High Risk Category (DGS)

The Cannabis Manifesto (Mindset)

When Did Things Happen? (Alex Danco)

Understanding the Instant-Delivery Phenomenon (Tanay)

Trillions: The Rise of Passive (Net Interest)

Gamestop Remains a Mystery (The Diff)

Investors Should Prefer Camels to Horses (Behavioural Investment)

The Illusion of Smart Money – Webinar with Aswath Damodaran (NBF)

The macro revolution continues (Klement)

What’s More Concerning Than Too Much Inflation? (Brinker)

The 60/40 Portfolio Isn’t Dead, Just More Expensive (Washington Post)

This week’s Superinvestor news:

A Conversation with Oaktree Capital Co-Chairman Howard Marks (Milken)

Warren Buffett’s Berkshire Hathaway has notched a $9 billion gain on American Express this year – and made $26 billion on the stock overall (Market Insider)

Weitz: Bring It On (Weitz)

Some companies anticipated supply, and now they’re going into price increases: Mario Gabelli (CNBC)

Carl Icahn: There will be a crisis, the way we’re going (CNBC)

A Meeting of Great Minds: Bill Miller and William Green (Miller)

Pzena: Maintaining Focus: Value’s Strong Fundamentals (Pzena)

Bill Miller Q3 2021 Commentary (Miller)

Third Avenue Q3 2021 Market Commentary (Third Avenue)

Jim Chanos: China’s “Leveraged Prosperity” Model is Doomed. And That’s Not the Worst (ineteconomics)

The Future of Private Markets with David Rubenstein & Jeff Blau (SALT)

Dodge & Co Q3 2021 Market Commentary (Dodge & Co)

This week’s best value Investing news:

Value Investing As A Hedge Against Inflation (Euclidean Technologies)

Why Howard Marks is indifferent to growth or value investments (AFR)

Rich Pzena Talks Quality, Value Stocks, And ESG (Forbes)

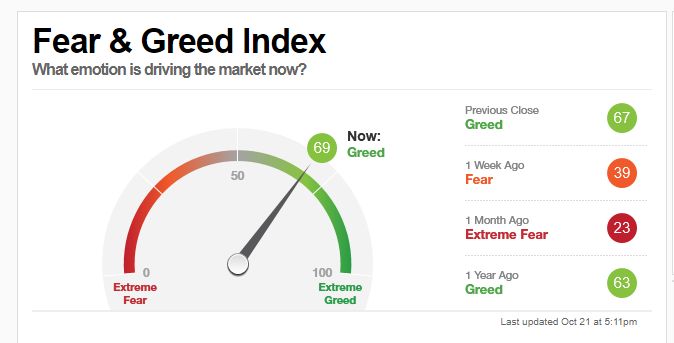

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Richard Thaler & David Potter (Citywire)

Episode #361: Jeff Hooke, Johns Hopkins, “The Buyout Business… (Meb Faber)

TIP387: Precious Metals Masterclass (TIP)

BANG: Why The Gold Miners Could Soon Make FANG Look Tame, Part Deux (Felder)

US and China: In the Foothills of Cold War (Updated) (Intellectual Investor)

A Meta-Framework to ‘Bending Reality’ (Barron’s)

Active Investing: Lessons Learned (WealthTrack)

5x5x5 Russo Student Investment Fund: Class of 2021 (VIL)

Margot Edelman – Trust This! (Business Brew)

Sam Bankman-Fried – Creating a Perfect Market (Invest Like The Best)

Ep. 197 – Hunting for Compounders and Business Transformations (PMC)

The Secret to Finding the World’s Best High Growth Stocks (Stansberry)

Popular Funds and Stock Market Opportunities for Investors (Morningstar)

Consider Your Competition (MicroCapClub)

Spoos, SPACS, and Steakhouses (On The Tape)

Bitcoin Hits All Time High Amid Reemerging Reflation (Real Vision)

Building a beautiful business ft. Kate Morris (Rask)

EP 18: What You Need to Know About Bonds (PL)

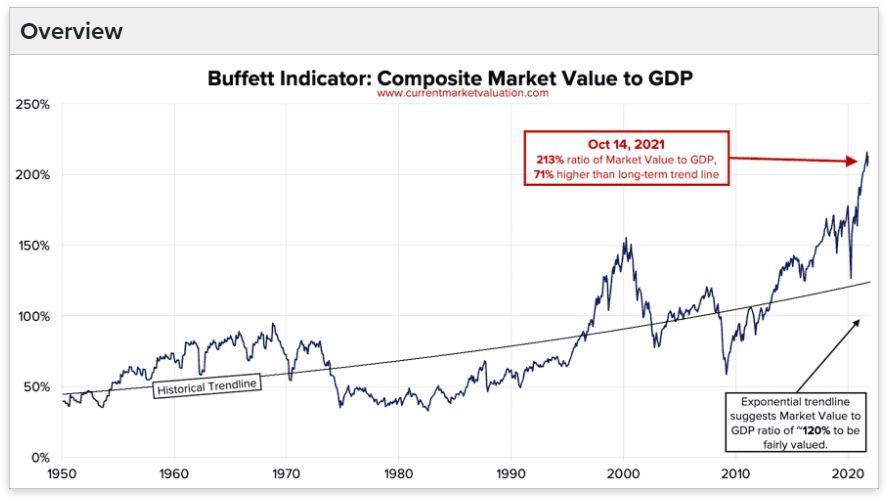

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Boards are More Diverse-What about Board Leadership? (Alpha Architect)

The Next Big Thing: The Age of Fintech, AI, and Big Data (CFA)

John Kenneth Galbraith and the “bezzle” – It is a global issue (DSGMV)

The Times They Are A-Changin’ (Slack)

Breadth Thrusts & Bread Crusts: Staying on the Right Track (All Star Charts)

Kissing the 60/40 Goodbye (All About Alpha)

This week’s best investing tweet:

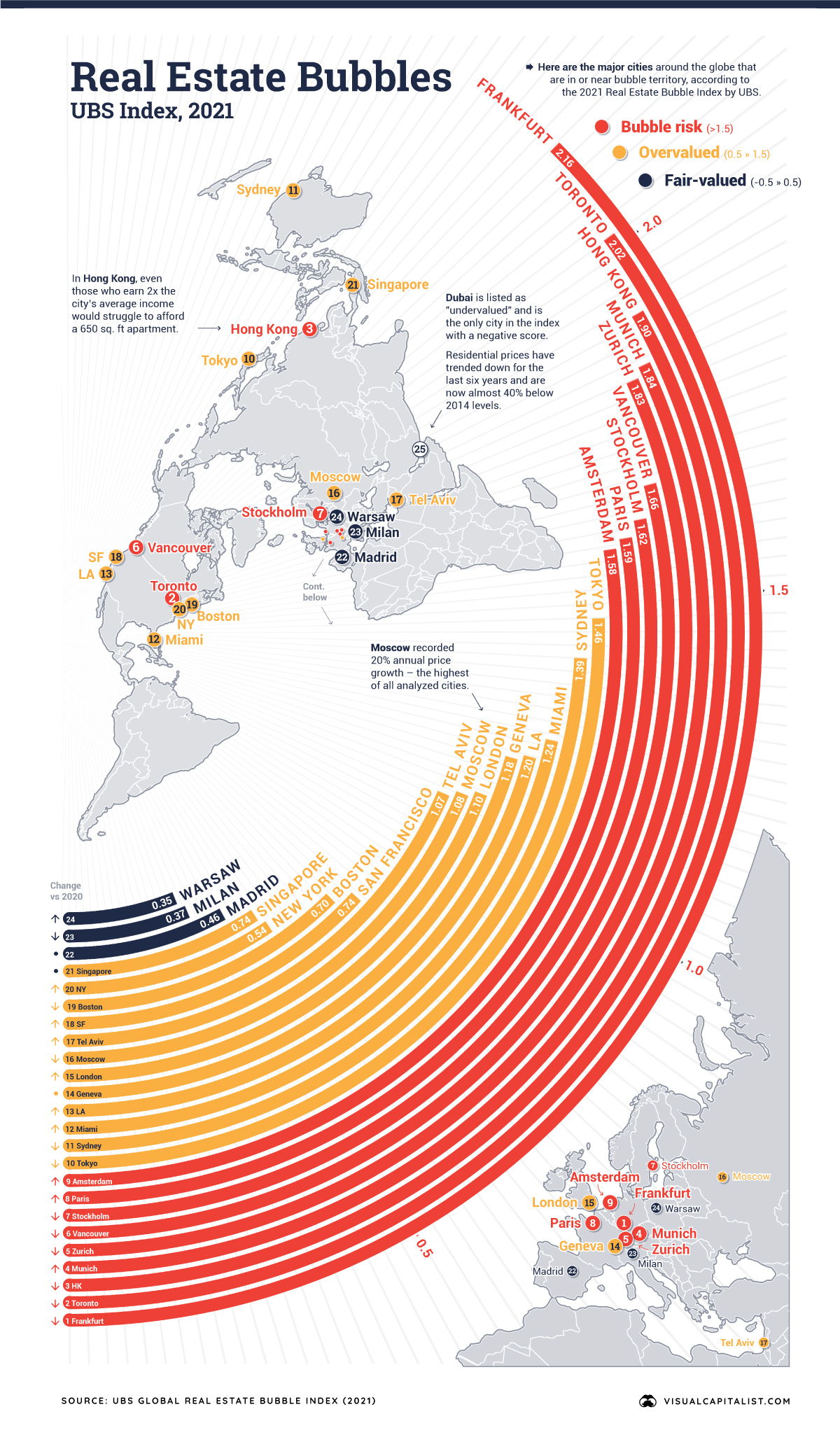

This week’s best investing graphic:

The World’s Biggest Real Estate Bubbles in 2021 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: