This week’s best investing news:

Price-Innovation Cycles & Speculators (Jamie Catherwood)

An Essay on Investing in Small Stocks (MicroCapClub)

A Whale of a Tail: The Bank of Japan’s ETF Hoard (Part II) (Verdad)

George Soros: Investors in Xi’s China face a rude awakening (FT)

Warren Buffett Turns 91 (CNBC)

China’s Tech Crackdown: Its about Control, not Consumers or Competition! (Aswath Damodaran)

Little Flaws (Collaborative Fund)

The simple tricks that turned one investor’s $70,000 retirement account into a $264 million fortune (Washington Post)

GMO: Merger Arbirtrage Opportunity (GMO)

Billionaire Paulson Who Shorted Subprime Calls Crypto ‘Worthless’ Bubble (Bloomberg)

Stock Market Historians on the S&P 500’s Record Highs (Validea)

The Social-Media Stars Who Move Markets (WSJ)

Weird Languages (Paul Graham)

Tom Russo Letter August 2021 (Gardner Russo)

Thanks I Hate It (Epsilon Theory)

Wallace Weitz: Virtual Value Investing Q&A Speaker Series Event at Brown University (VI Q&A)

Jeffrey Gundlach Sounds Bearish (WTI)

When Do Investors Freak Out?: Machine Learning Predictions of Panic Selling (ssrn)

Meta… verse (No Mercy)

Running the Numbers (Humble Dollar)

Here’s why Robert Shiller’s two stock-market indexes are telling wildly different valuation stories (MarketWatch)

Wise Words on the Lessons of Market History (Novel)

Cash is still king – at least emotionally (Klement)

172: If Your Portfolio was a Single Business (Liberty)

Olstein Annual Letter 2021 (Olstein)

S&P 500 Dividend Yield at 20-Year Lows (Barry Ritholz)

Siegel: We’re still in a bull market, momentum players are piling on (CNBC)

A red tide of SPAC returns (Larry Swedroe)

What Happens When You Combine Leverage with the Greatest Uptrend in History? (Compound)

Learning from John D Rockefeller (IMC)

Three Things I Think I Think – Everything Goes to Zero in the Long Run (PragCap)

The Most Important Financial Statement When Selecting Dividend Growth Stocks (DGS)

Regulators and Reality Stratechery)

Productivity, Profits, and Pay (Brinker)

What if everything you were taught about economics & finance was wrong? (Real Returns)

Investing in the Dividend Aristocrats from 2011 (DGI)

The Paper Trail: Inflation, Inflation, Inflation (bps and pieces)

This week’s best value Investing news:

The Softer Side of Value Investing (Vitaliy Katsenelson)

Can a Value Investor Become a Great Venture Investor? (Mindset Value)

Are Value Stocks Cheap for a Fundamental Reason? (AQR)

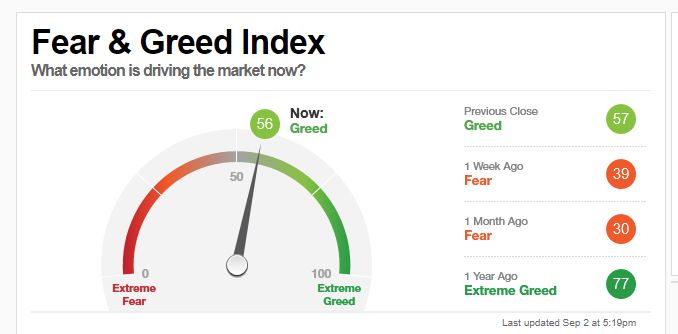

This week’s Fear & Greed Index:

Greed.

This week’s best investing podcasts:

Jake Taylor – From First Principles (Business Brew)

TIP374: Mastermind Q3 2021 W/ Tobias Carlisle (TIP)

Lawrence Cunningham: Improve Investment Results (WealthTrack)

Episode #344: Jared Dillian, The Daily Dirtnap, “I Think The Cardinal Sin In Investing Is Selling Too Soon” (Meb Faber)

Behind The Markets Podcast: Joe Gyourko (Behind The Markets)

Short Selling Beyond Traditional Frauds (Zer0es TV)

An Essay on Investing in Small Stocks (Ian Cassel)

Daniel Crosby: ‘If You’re Excited About It, It’s Probably a Bad Idea’ (Long View)

Can The S&P 500 Hit 5K? (Real Vision)

Morgan Housel interview: Wealth is Invisible | The Psychology of Money (Rask)

Scott Malpass – Building a Great Endowment (Invest Like The Best)

332- Warren Buffett’s Inflation Principles (InvestED)

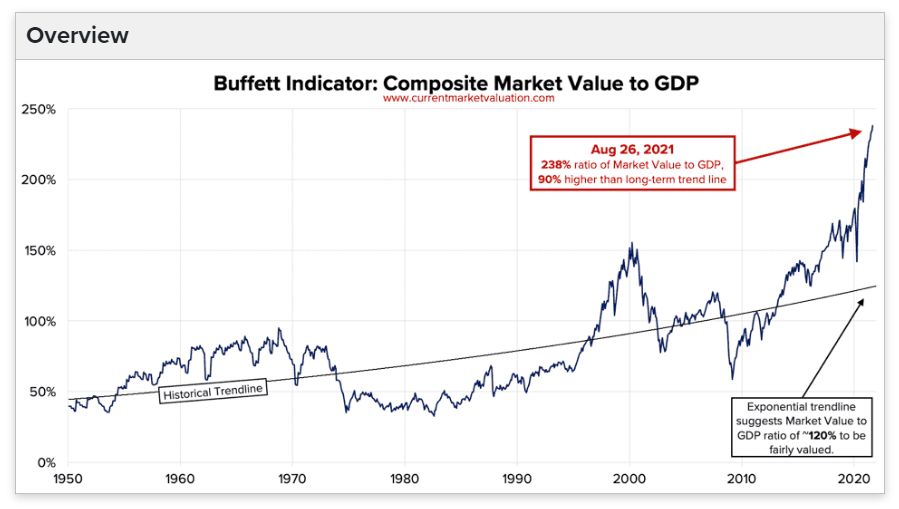

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Factor Timing Is Tempting (Alpha Architect)

Revisiting Beta: How Well Has Beta Predicted Returns? (CFA)

Behavioral theories of factor risk premia (DSGMV)

Will Credit Spreads Lead Banks Higher? (All Star Charts)

Factors in Quant Credit (AllAboutAlpha)

The Low Sharpe Uptrend in Equities (PAL)

This week’s best investing tweet:

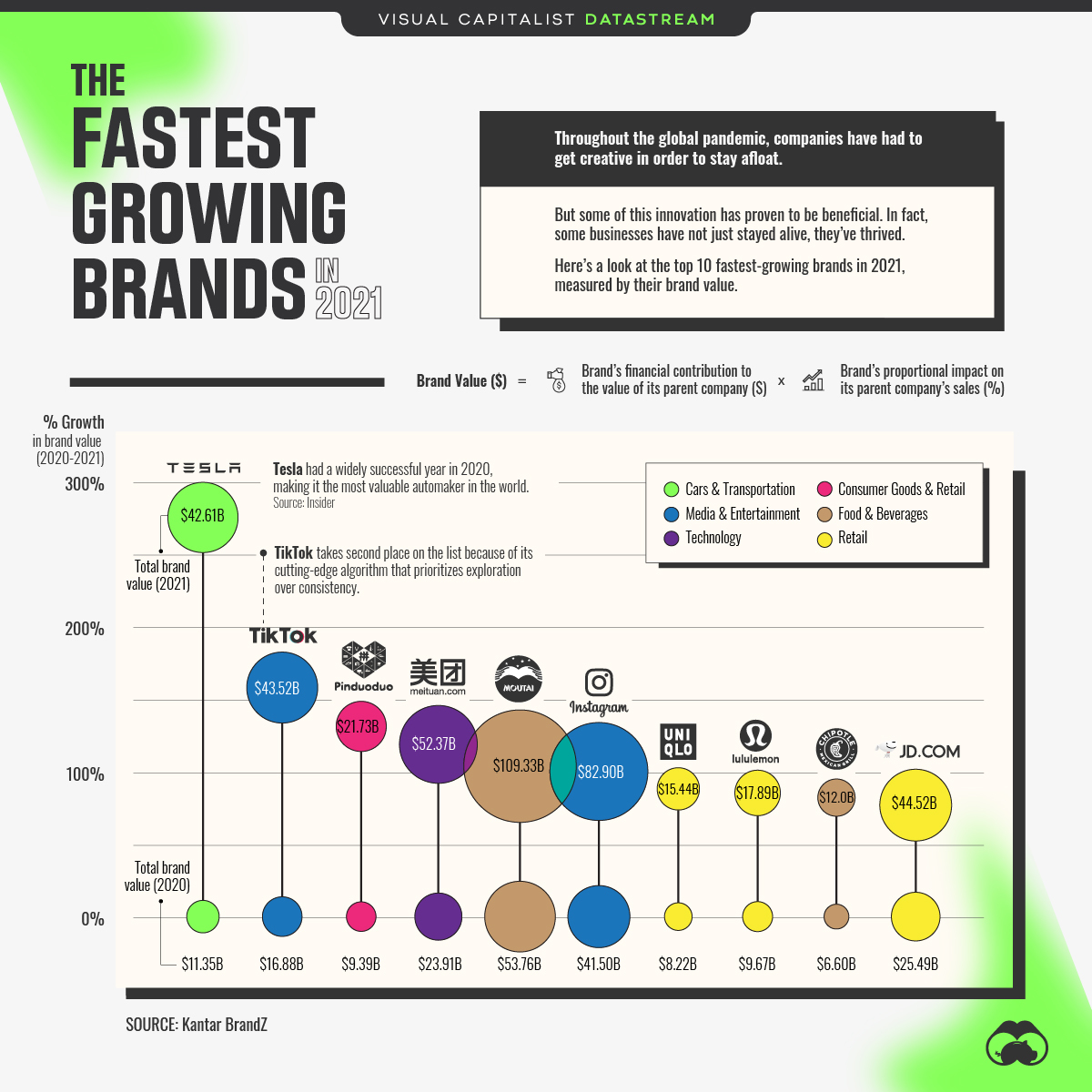

This week’s best investing graphic:

Ranked: The World’s Fastest Growing Brands in 2021 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: