This week’s best investing news:

Verdad’s Intern Curriculum (Verdad)

The Panic Series (Pt. II) – 1819 (Jamie Catherwood)

Would You Have Bought Berkshire Hathaway in 1975? (Validea)

The Polen Heat Map: Degrees of Expected Return (Polen)

Steven Cohen to Invest in Crypto Quant Trading Firm (WSJ)

The ESG Movement: The “Goodness” Gravy Train Rolls On! (Aswath Damodaran)

Pushing on a String (Epsilon Theory)

The Future of Work (Collaborative Fund)

The Suckers at The Investment Table (Advisor Perspectives)

SALT Panel: The Hedge Fund Comeback? (Barry Ritholz)

Market rally faded with lack of excitement: Wharton’s Siegel (CNBC)

Who’s Playing Championship Tetris? Gabe Plotkin, Stevie Cohen, or Ken Griffin? (Alphacution Research)

Serial Acquirers (Margarine of Safety)

Beneficiaries of App Store Changes (Tanay)

Three Things I Think I Think – Bigly Things Brewing…. (PragCap)

The Apple v. Epic Decision (Stratechery)

Don’t let your investments go the way of the CD (EB Investor)

Think Big: State Of The Global Supply Chain & Inflation (GMM)

How to Win Any Argument Over Investments (Compound Advisors)

Mike Novogratz Warns About Bitcoin Air Pockets (WTI)

Why Dividend Growth Stocks Rock? (DGI)

Modern Financial History Begins in 1998 (The Diff)

NFT Roundup #4: Digital Apes sell for millions; Apple blocks Gnosis Safe wallet; (Buy The Rumor)

So Far, September Is Living Up To Its Reputation (Brinker)

Bookshelf: Markets and Mayhem (Intrinsic Value)

Emerging Domestic Markets (Brian Langis)

How big was the value factor really? (Klement)

On Staying Liquid… (Adventures in Capitalism)

Nobody Really Thinks About Behaviour (Behavioural Investment)

178: Apple iPhone 13 Event, TSMC!, Horn Chart of Compute, Larry & Sergei (Liberty)

Ariel Quarterly Report 06/30/21 (Ariel)

This week’s best value Investing news:

Why there’s more to value than meets the eye (Schroders)

Valuing Berkshire Hathaway: The September 2021 Update (Yahoo)

Is value investing coming back? For some of us it was never gone (IFA)

Value ETFs Looking Attractive Now (Investing.com)

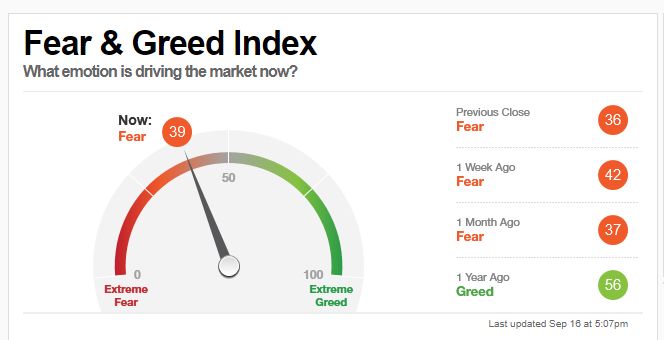

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

ALWAYS something to DO ft. Tobias Carlisle (LIB&I)

#171: Chris Bloomstran – President & CIO at Semper Augustus – Finding Value in the Public Markets (The Fort)

TIP378: Move Forward with Caution w/ Howard Marks (TIP)

Buying Cheap Assets: Finding Them Now – Large-Cap, Value Stocks (WealthTrack)

Going the Extra Mile for Wealthy Clients (Barron’s)

Katie Hall – Hall Capital Partners (Capital Allocators)

Gregg Fisher on the Future of Value, Investing in Innovation and Lessons From 20+ Years as a Quant (Excess Returns)

EP 325. What are the 4 Most Important Numbers to Know About a Stock? (Focused Compounding)

Professor Hersh Shefrin: Fear, Hope, and the Psychology of Investing (Rational Reminder)

The True Story Behind Frank Abagnale (Gaining Perspective)

Adam Robinson & Bill Brewster — Disproving Your Thesis (EP.65) (Infinite Loops)

Daniel Ek – Enabling Creators Everywhere (Invest Like The Best)

Episode #351: Leigh Drogen, Starkiller Capital (Meb Faber)

Ep. 1: Why All News Seems to Be Good News (MOI)

EP 10: The Secret to Timing the Market (Peter Lazaroff)

Ep. 192 – Precious Metals: Reversion to the Mean, Reddit Investing in Metals (PlanetMicroCap)

Logan Mohtashami – Bear Crusher (Business Brew)

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Is Currency Momentum Factor Momentum? (AlphaArchitect)

Estimating Maintenance CapEx (Columbia)

Risky Business (AllStarCharts)

Fine Art Lending: Are Old Masters the New Income Strategy? (AllAboutAlpha)

Equal- vs. Market Cap-Weighted Portfolios in Stock Market Crashes (CFA)

Five financial research curses – They cannot be avoided (DSGMV)

Mean-Reversion Is Waning (PAL)

How To Play Inflation (MacroTourist)

This week’s best investing tweet:

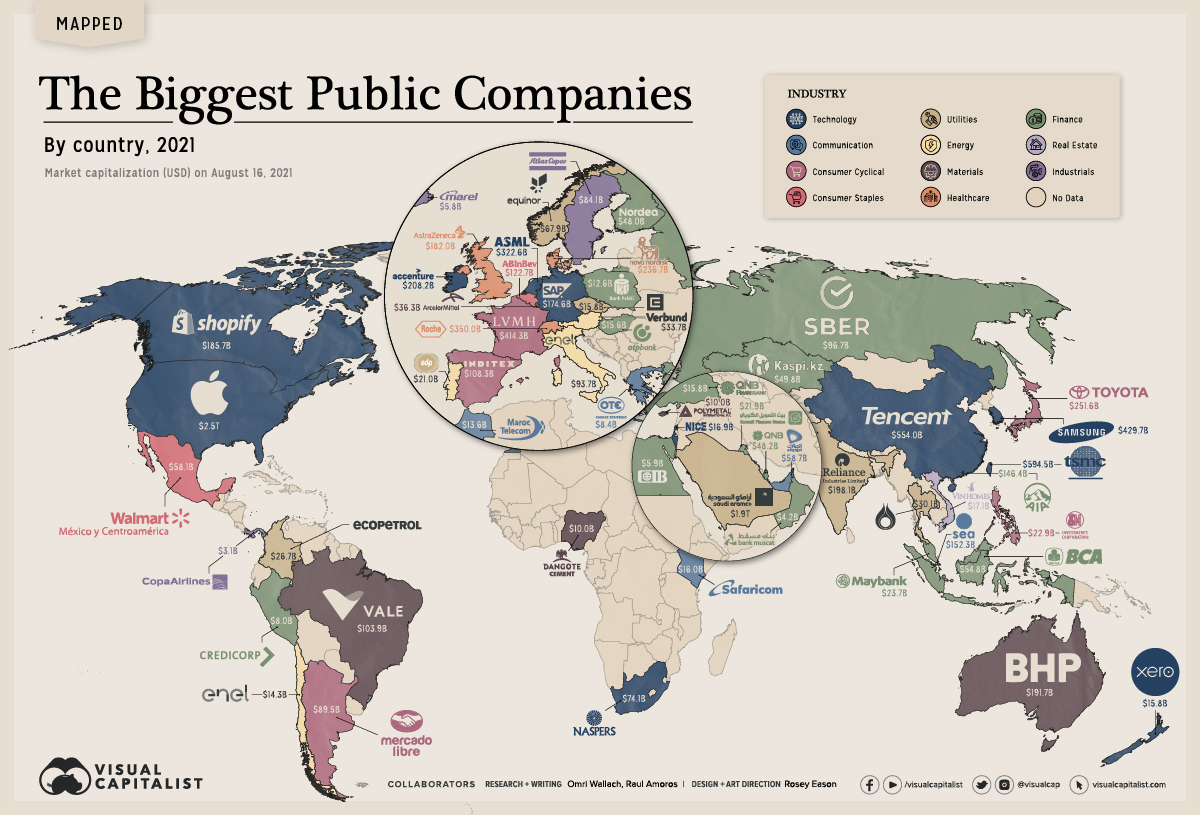

This week’s best investing graphic:

Mapping The Biggest Companies By Market Cap in 60 Countries (Visual Caitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: