This week’s best investing news:

Afghanistan, Regime Changes & Debt (Jamie Catherwood)

A Whale of a Tail: The Bank of Japan’s ETF Hoard (Verdad)

Michael Burry’s Pretty Big Short Hinges on Treasuries Sinking (Bloomberg)

Rules, Truths, Beliefs (Collaborative Fund)

Losers: The Secret History (Jason Zweig)

Bill Ackman to return $4bn to Spac investors if new vehicle is approved (FT)

A Walk Down Drawdown Lane (Validea)

The Most Important Insight(s) (Neckar)

Hedge Funds Are Hot Again (Bloomberg)

Prophet of the Pandemic (Epsilon Theory)

China Tech Sector Whackage (Barry Ritholz)

Understanding BNPL (Tanay)

Working My Losses (HumbleDollar)

I See Dead Mutual Funds (PragCap)

Betting Against Quant: Examining the Factor Exposures of Thematic Indices (ssrn)

Which country will outperform next is irrelevant (EB Investor)

How Bernard Baruch Evaluated Businesses (Novel)

The Best Performing Sector of the 20th Century (DGI)

The Rise of Meta Apes (Howard Lindzon)

The US Debt Downgrade 10 Years On (Brinker)

NFTs are mimetic (Buy The Rumour)

170: Nvidia Q2 Highlights, Misguided Mastercard vs OnlyFans (Liberty)

This week’s best value Investing news:

The Value Premium Might be Smaller Than We Originally Thought (AlphaArchitect)

How Does Value Investing Work? (Morningstar)

3 Lessons From the World’s Best Stock Fund Managers on Value Investing (Business Insider)

Number of ‘dog’ funds falls as value stocks rebound (FT)

Value Investing Took A Breath, But The Cycle Shift Is in Its Infancy (ValueWalk)

Ideas farm: Is Terry Smith a value investor? (investors Chronicle)

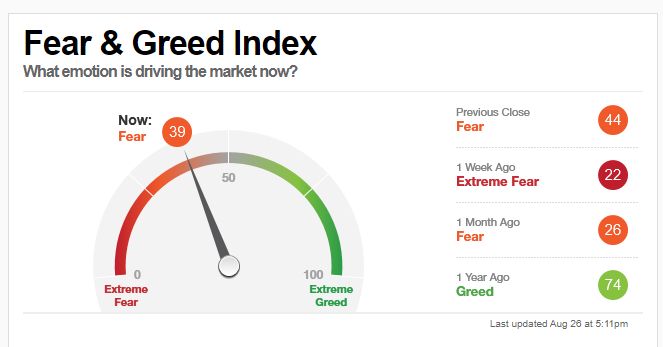

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Jim O’Shaughnessy – Man, Myth, Legend (Business Brew)

TIP371: The Top of the Cycle w/ Jeremy Grantham (TIP)

Episode #342: Aaron Edelheit, Mindset Capital (Meb Faber)

#118 Doug Conant: Leadership With Integrity (Knowledge Project)

The Feast & Famine of Activist Short-Selling (Zer0esTV)

Demetri Kofinas on ‘Financial Nihilism’ (Barron’s)

Taper Will Most Definitely Come (On The Tape)

Dan McMurtrie: Research Process, Inverted Shorts & Post-Consciousness (ValueHive)

EP 322. Q/A: Movie Theater Industry + Shortening Window (Focused Compounding)

Meme Stocks Make a Comeback and the SEC’s Tough Stance on Chinese Tech (Real Vision)

Opportunities for Value Investing, China’s Digital Currency, & the Pivot to Asia | James Aitken (Hidden Forces)

Chris Williamson — Embracing Your Weirdness (EP.62) (Infinite Loops)

Renata Quintini and Roseanne Wincek (Invest Like The Best)

331- From the Vault: Rule of 72 (InvestED)

Fran Kinniry on Private Equity Portfolio Investments (MIB)

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Taking Clues From Credit Markets (AllStarCharts)

Tail Risk Hedging (AllAboutAlpha)

ESG Asset Managers: Define the Why (CFA)

Money, money everywhere but in the loan market (DSGMV)

Correlation and Modern Portfolio Theory (PAL)

This week’s best investing tweet:

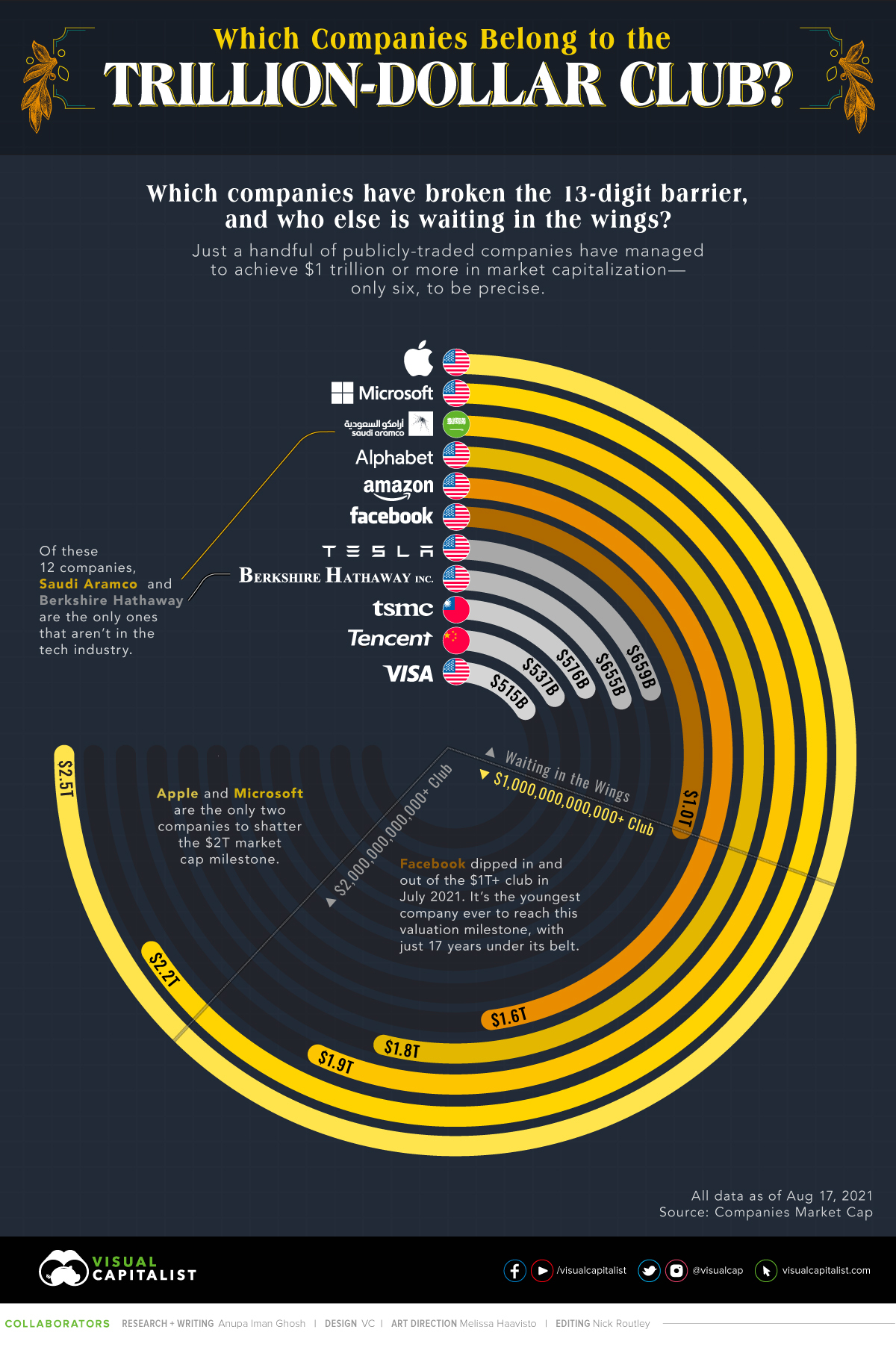

This week’s best investing graphic:

Which Companies Belong to the Elite Trillion-Dollar Club? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: