This week’s best investing news:

Here We Go Again… (Jamie Catherwood)

A Look at the Valuation of the Major Investing Factors (Validea)

Would You Have Found Berkshire Hathaway in 1975? (Morningstar)

How to Remember What You Read (Farnam Street)

Bill Ackman’s SPAC Gets Sued (NY Times)

James Montier – Part 1: Inflation – Tall Tales and True Causes (GMO)

Michael Burry of ‘Big Short’ Bets Against Cathie Wood’s ARKK (Bloomberg)

Winning the Ovarian Lottery (Vitaliy Katsenelson)

A Peek Into Warren Buffett’s Second-Quarter Stock Moves (Barron’s)

What would have Berkshire Hathaway meetings been like if Charlie Munger ran them? (Canadian Value)

Recovery at Risk? (Barry Ritholz)

Berkshire Again a Net Seller of Equities in Q2 (Morningstar)

“We Can Rebuild Him” (bpsandpieces)

Investors Bet Corporate Spending and Buybacks Will Support Stocks (WSJ)

Market power and systemic risk (EB Investor)

Bernard Baruch’s Investing Rules (Novel)

Summer Lull (Humble Dollar)

Michael Novogratz sees cryptocurrencies recovery (WTI)

Gold as an Inflation Hedge: What the Past 50 Years Teaches Us (WSJ)

There’s No Such Thing as Buy and Hold (Intrinsic Investing)

What is More Difficult, Asset Allocation or Security Selection? (Behavioural Investment)

Learning from Honey Bees (InvestmentMastersClass)

No Place to Hide: Investing in a World With No Risk-Free Asset (Elm)

21 Suggestions for Success (DGS)

168: AWS Wins $10bn Secret NSA Contract, A16Z, Tiktok & Facebook, Constellation Software Resilience, (Liberty)

A few more Q2 earnings musings (Tanay)

Friday The 13th Comes and Goes (Brinker)

This week’s best value Investing news:

Nick Train: Value investing is a ’20th century’ idea (FT Adviser)

Why Value Investing Should Beat Growth Investing in the Next Decade (Cabot)

The Art of Value Investing – Yes, I said ‘art’ (Medium)

This week’s Fear & Greed Index:

Extreme Fear.

This week’s best investing podcasts:

Legendary asset manager Chris Mayer’s investment C.O.D.E (Stansberry)

Ep 125. Behavioural Investing | Dr Daniel Crosby, PhD (Rask)

Episode #341: Lyle Fitterer, Baird Asset Management (Meb Faber)

When Investors Become Gamblers (Contrarian)

Disney: “The First Inning” (TSOH)

TIP370: Inflation Masterclass w/ Cullen Roche (TIP)

Ep. 188 – Planet MicroCap Podcast: LIVE “GenZ Investing Roundtable” (PlanetMicroCap)

CMQ022: How To Spot a Great Business (CMQ)

Market Instability- 50 Years Off the Gold Standard (WealthTrack)

Where’s the Volatility? (What Goes Up)

The Investors Podcast – Masterclass in Inflation (PragCap)

Suzanne Ciani – Exploring the Creative Process (InvestLikeTheBest)

What are the Signs of a Stable Dividend? (Morningstar)

Greg Becker on the Innovation Business (MIB)

David Berns – How do you build portfolios for human beings? (S4E16) (FWM)

Two Titans (BehindTheBalanceSheet)

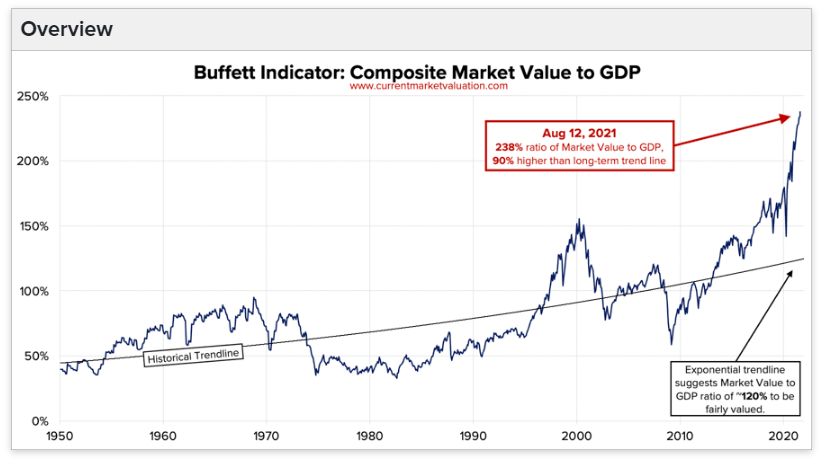

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

The Impact of Goodwill on Stock Returns (AlphaArchitect)

Benchmarking Has Become Circular (CFAInstitute)

Quant strategies – Factors and alpha (DSGMV)

If You’re Not Long, You’re Short (AllStarCharts)

Trading Strategies Bundle: Volatility, Mean-reversion and Breakouts (PAL)

This week’s best investing tweet:

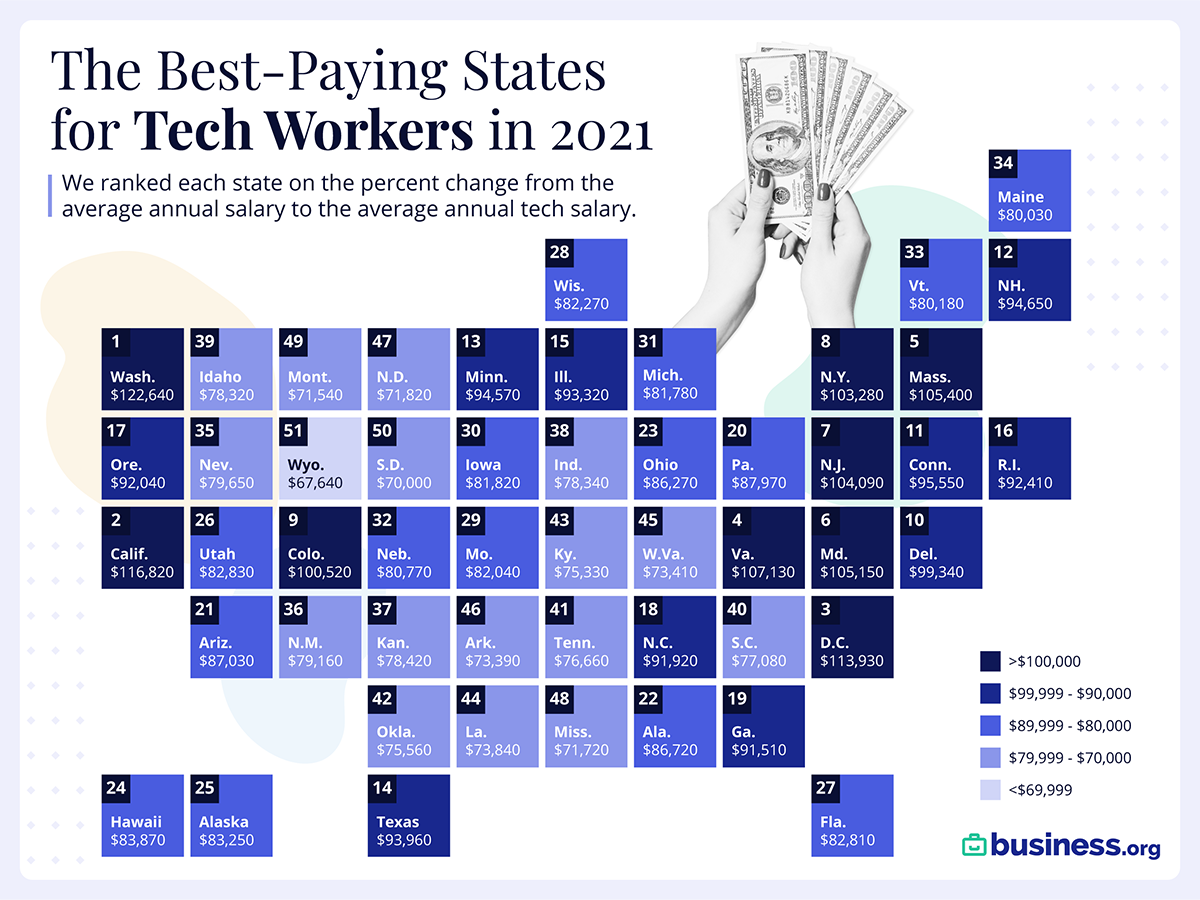

This week’s best investing graphic:

The U.S. States with the Top Tech Salaries in 2021 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: