In their latest article titled – Merger Arbitrage Opportunity, GMO explains why merger arbitrage provides a compelling opportunity for patient investors. Here’s an excerpt from the article:

Intense technical liquidation in Merger Arb deals improved prospective returns

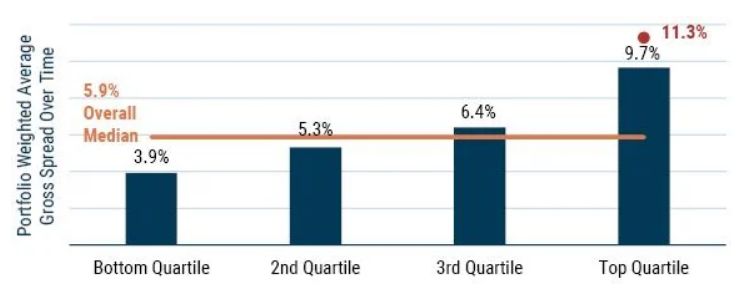

As of 8/4/2021 | Source: GMO

Bars represent the median values by quartile of GMO’S Event Driven Strategy’s portfolio weighted average gross spreads computed daily from 11/20/2014 – 8/4/2021.

Lord Rothschild famously said, “the time to buy is when there’s blood in the streets.” A confluence of technical reasons and limited fundamental disappointment has led to remarkable carnage in the merger arbitrage space over the last month, leaving the streets flowing red.

Merger arbitrage is a strategy where investors purchase the stock of a company being acquired in an attempt to capture the spread between the current market price and the proposed acquisition terms. Because announced deals may break, the target stock typically trades at a discount to the ultimate closing price (the “gross spread”). Merger arbitrage investors seek to capture the risk premium embedded in the chance that deals do not close. The fact that deals blow up is precisely why there is an enduring risk premium associated with the activity. Investors typically access this risk premium as part of their alternatives bucket and, indeed, our Alternative Allocation Strategy includes an allocation to GMO’s Event-Driven Strategy.

Earlier in the year in “A SPAC-tacular Distraction,” our Event-Driven team noted the event-driven landscape (in which merger arbitrage is the primary strategy) was suffering from a supply/demand imbalance. Capital normally allocated to merger arbitrage was flowing to hot SPAC deals, while a concurrent increase in M&A activity led to too little capital chasing too much deal volume. What were attractive resulting spreads then however blew out in the last few weeks, largely for technical and not fundamental reasons. Only one merger deal (Willis Towers Watson/AON) has broken recently. One break, though, was all it took to trigger a sizable widening of spreads, given the technical imbalances we noted combined with worries about potential changes in the U.S. antitrust landscape and ongoing volatility in the U.S.-China relationship.

The display above indicates just how severe this selloff in the merger arbitrage space has become and why the asset class offers a compelling opportunity in an environment in which traditional stock and bond valuations look stretched. The chart breaks the daily weighted average gross spread of our Event-Driven Strategy going back to late 2014 into quartiles and calculates the median spread for each cohort.

The overall median spread across nearly 1,700 observations has been 5.9%. Wide deal spreads are a key indicator of attractive prospective returns. Earlier in the month, our portfolio’s weighted average gross spread stood at a whopping 11.3%, far in excess of the top quartile’s 9.7% median. Even after the hectic rush of forced selling has largely calmed, its impact lives on and this metric remains elevated in the top quartile.

The merger arbitrage world isn’t fundamentally scarier today than it was just a few weeks ago, but current spreads suggest it is. While technical imbalances like we’re seeing today are difficult to time with precision, we believe investors with a long-term mindset should be focusing closely on merger arbitrage today.

You can read the original article here:

GMO: Merger Arbitrage Opportunity

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: