In their latest paper titled – JAPAN VALUE An Island of Potential in a Sea of Expensive Assets, GMO explain why Japanese value and small cap value stocks are cheap. Here’s an excerpt from the paper:

Japan Small Value Stocks Present a Robust Opportunity Set for Alpha Seekers

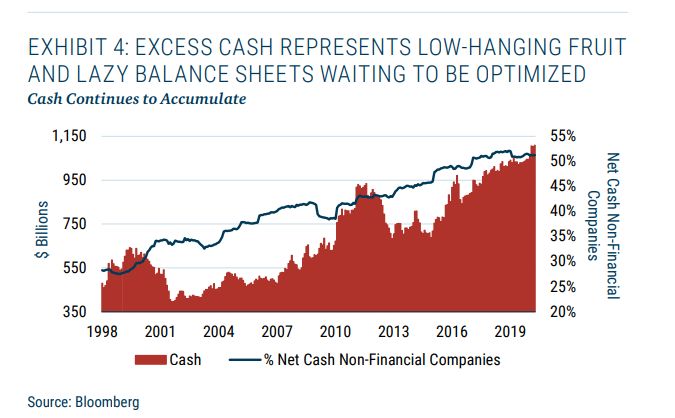

Successful cost cutting, rising profits and free cash flows, and a corporate culture of risk aversion stemming from the bursting of the Japanese bubble led to an ironic side effect: over-capitalized balance sheets. As Exhibit 4 indicates, over 50% of listed nonfinancial companies are “net cash” today. In the U.S., that figure is less than 15%.

Carrying large amounts of cash, especially in a negative interest rate environment like today, is troublesome for shareholders. Equity investors expect companies either to reinvest surplus capital in projects that generate returns above the cost of capital or return it to shareholders so they can reallocate to value-creating investments.

These “lazy” balance sheets have drawn the attention of Japanese regulators and government, two groups that are trying desperately to spark economic growth to help address the pension burden in a country with a declining population and negative yield on government bonds.

Furthermore, the Japanese equity market is filled with inefficiencies that offer upside opportunities for patient investors. The number of analysts and investors covering the Japanese market has declined following decades of disappointing returns after the bursting of the 1980s Japanese bubble. Cultural and language differences also have diminished foreign investor interest in Japanese equities.

The combination of strong balance sheets, improving profitability, more shareholderfriendly policies, and market inefficiencies has increasingly piqued the interest of investors willing to actively promote minority shareholder interests. The market for corporate control has begun to mature in Japan, shifting from one being hostile to outsiders to an environment more willing to listen to constructive advice.

The recent set of cohesive changes in Japan, including corporate governance reforms, the growing influence of proxy voting advisors, and changes in the shareholder structure, is amplifying the voice of minority shareholders. By engaging with management teams, investors can influence investment outcomes and enhance value across an abundant group of attractively priced yet fundamentally sound companies.

In our view, the confluence of cheap valuations, a secular transition in how corporate Japan runs its businesses and considers shareholder interests, and a robust set of asset-rich companies make Japan Value equities compelling not just today, but for years to come.

You can read the entire paper here:

GMO: JAPAN VALUE An Island of Potential in a Sea of Expensive Assets

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: