This week’s best investing news:

The Airbnbs (PaulGraham)

The Narrative Machine v3.0 (EpsilonTheory)

Steve Cohen – America’s Most Profitable Day Trader (video) (FINAiUS)

The Opposite of a Good Idea (FundooProfessor)

Bold & Disciplined Management: RH’s Potential for Long-Term Growth (Polen)

What Makes Buffett Great. Identifying Bubbles. Importance of Intrinsic Value & More (Validea)

Comforts of Cash (HumbleDollar)

When a 59% Annual Return Just Isn’t Enough (WSJ)

Transcript: Steven Romick Interview (MIB)

Robinhood and iAddiction (NoMercy)

Wharton School’s Jeremy Siegel on what yields pullback means for stocks (CNBC)

JPMorgan Guide To The Markets Q3 2021 (JPM)

Investing Abroad (Woodlock)

Avoiding the Sins of Investing (BarryRitholz)

David Katz: Recent pullback in financials could be a great opportunity to step in and buy (CNBC)

David Einhorn Remains Bullish (WTI)

Patient investing is hard (LarrySwedroe)

Will China become the centre of the world economy? | FT (video) (FT)

Who is David Dodd and Why Should We Listen to Him (DGS)

How Does the Fed “Manipulate” Interest Rates? (PragCap)

Instagram’s Evolution (Stratechery)

Home Bias and the Best Time to Diversify (CompoundAdvisors)

Amazon – MGM deal (BrianLangis)

Robinhood S-1 Teardown (Tanay)

Only Invest in Active Managers If You Can Withstand Prolonged Periods of Underperformance (BehaviouralInvestment)

Mirror Your Audience: Four Life Lessons From Performance Artist Marina Abramović (Farnam Street)

The Long Slow Short (NetInterest)

Intrinsic Value on Sports (IntrinsicValue)

The long-term impact of low interest rates on company balance sheets (Klement)

The Ultimate Value: Paying it Forward (Mindset)

Q2 2021 Commentary (FlirtingWithModels)

This week’s best value Investing news:

Warren Buffett and Coca-Cola: How Growth Can Become Value (GuruFocus)

Why value investing isn’t just about buying cheap stocks (MoneyControl)

What Ever Happened to Value Investing (AdvisorPerspectives)

The pros and cons of value investing (InvestorDaily)

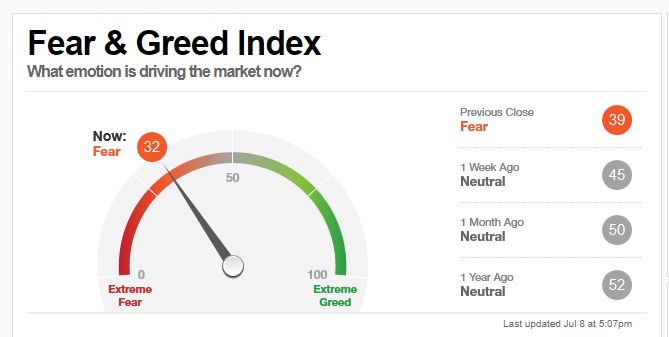

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Jeremy Grantham – GMO (Manager Meetings, EP.01) (CapitalAllocators)

Episode #327: Mario Gabelli, GAMCO Investors (MebFaber)

TIP358: Inflation Hedging with Farmland w/ Carter Malloy (TIP)

How much Fred Liu is in Hayden Capital? How do you select partners? (GoodInvesting)

Balaji Srinivasan – Optimizing Your Inputs (InvestLikeTheBest)

Scarcity vs. Abundance, and the Curation Unlock | Firestone’s Law of Forecasting (IntelligentInvesting)

Fool’s Gambit – Ep 132 (IntellectualInvestor)

Rob Arnott: Dissecting Smart Beta, Investing in Disruption, and Momentum (EP.157) (RationalReminder)

Ep. 182 – Investing: Always Be a Student of the Game with Conor MacNeil (PlanetMicroCap)

Where to Put Your Money when the Market is Acting Insane (Stansberry)

Ep. 84 – Marcelo Lima Pt. 2: Lemonade (LMND) (InvestingCity)

324- From the Vault: Is an “Event” Required? (InvestED)

Kiril Sokoloff On Seeking Truth In An Era Of Sophistry (Felder)

Stocks to Watch and Financial Tasks to Complete this Month (Morningstar)

Vivek Viswanathan – Quant Equity in China (S4E10) (FlirtingWithModels)

How Peter Lynch Became an Investing Legend (Ep. 382) (DaveLee)

Key Financial’s Patti Brennan on Emphasizing ‘Skin in the Game’ (Barron’s)

S11 E2 Tony Robbins Points to the Keys to Fulfillment (Sherman)

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Global Factor Performance: July 2021 (AlphaArchitect)

Viewing Technology Stocks through a Gender Lens (CFA)

Crude Oil Concerns (MacroTourist)

The Best Labor Market In 21 Years? (UPFINA)

Trading Strategy Bundle – Volatility, Cross Sectional Momentum and Mean-Reversion (PAL)

Sweating the details matters for investors (DSGMV)

Know Where You’re Wrong (AllStarCharts)

What About Beta? | Rage Against the Machine(washing) (AllAboutAlpha)

This week’s best investing tweet:

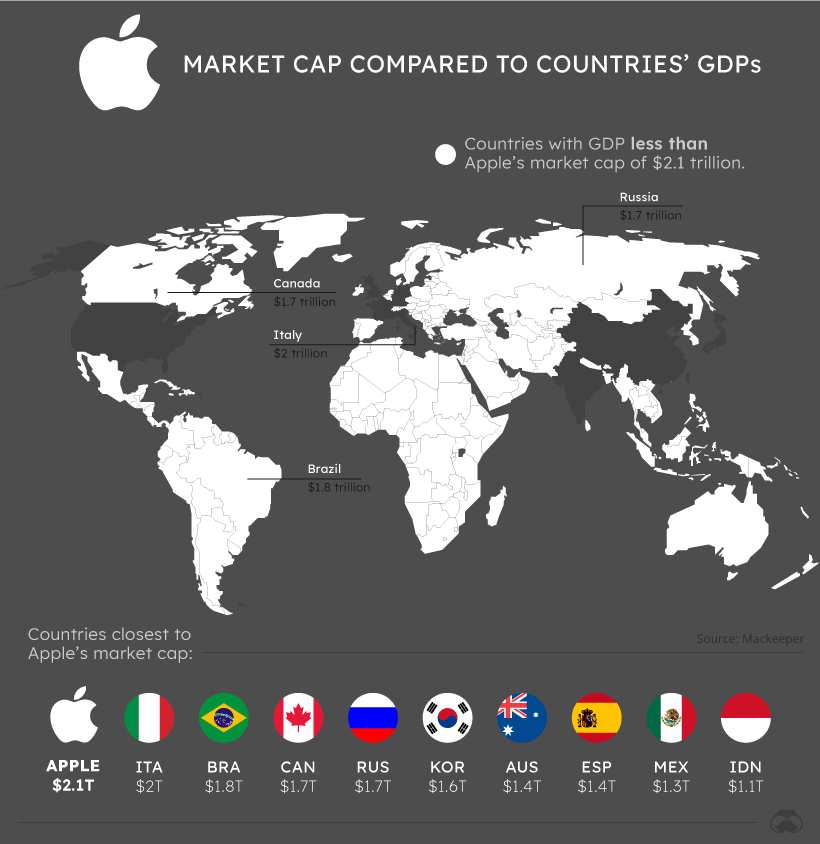

This week’s best investing graphic:

The World’s Tech Giants, Compared to the Size of Economies (VisualCapitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: